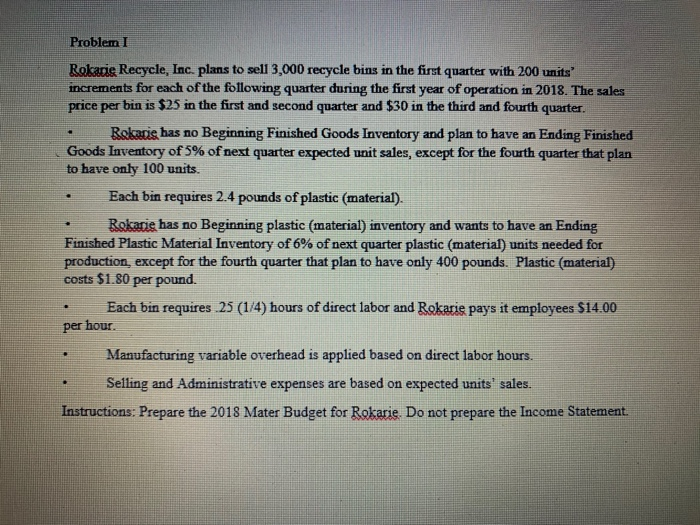

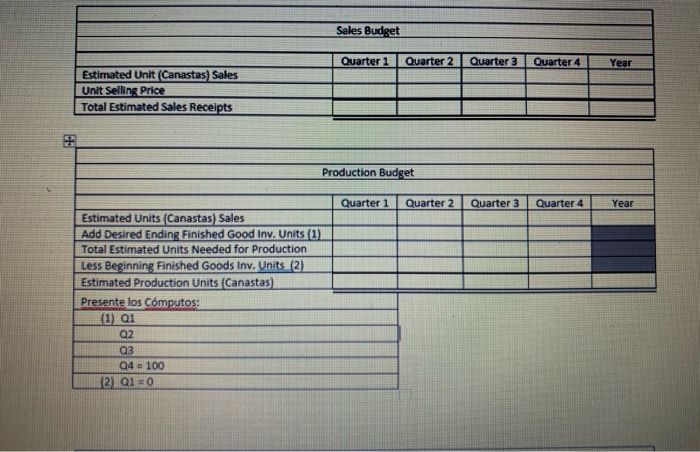

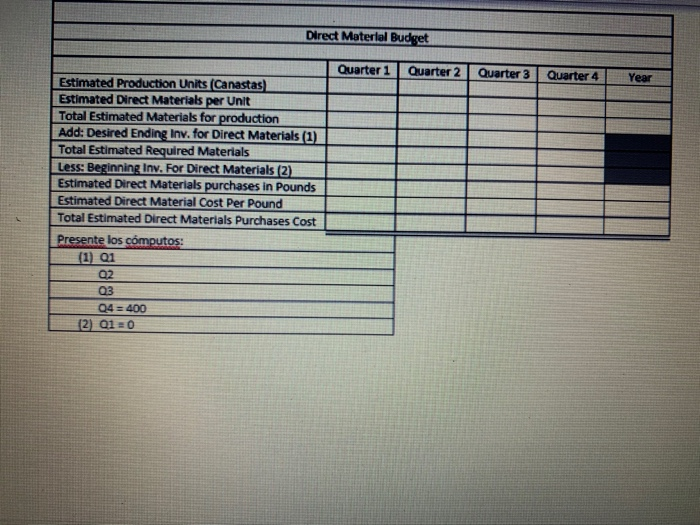

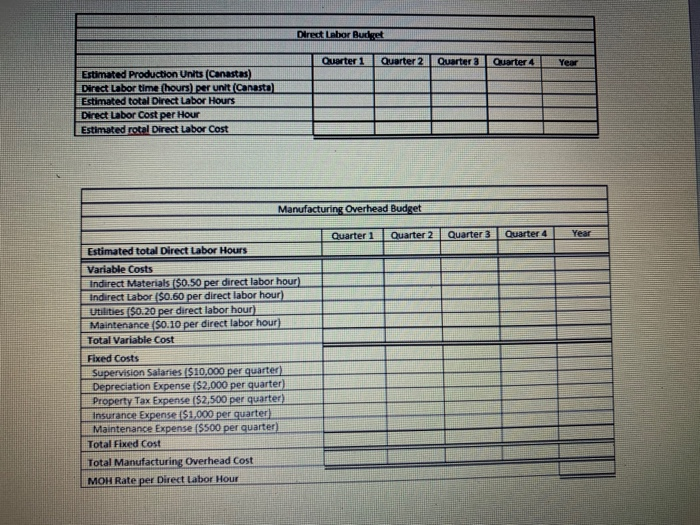

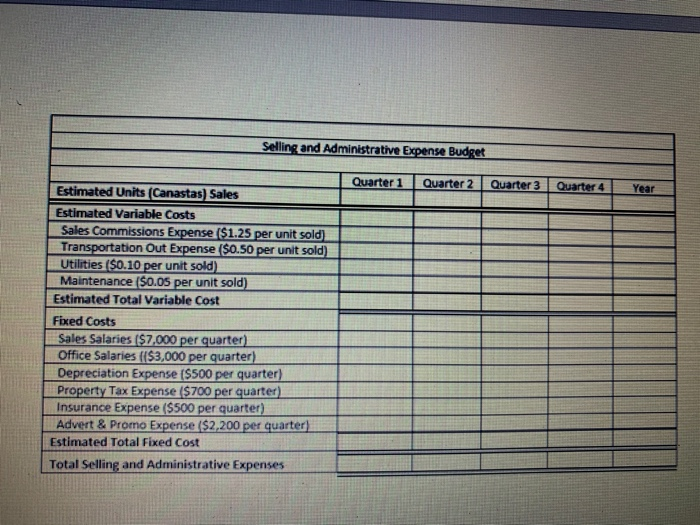

Problem I Rokarie Recycle, Inc. plans to sell 3,000 recycle bins in the first quarter with 200 units' increments for each of the following quarter during the first year of operation in 2018. The sales price per bin is $25 in the first and second quarter and $30 in the third and fourth quarter. Bakaris has no Beginning Finished Goods Inventory and plan to have an Ending Finished Goods Inventory of 5% of next quarter expected unit sales, except for the fourth quarter that plan to have only 100 units. Each bin requires 2.4 pounds of plastic (material). . Bokarie has no Beginning plastic material) inventory and wants to have an Ending Finished Plastic Material Inventory of 6% of next quarter plastic (material) units needed for production, except for the fourth quarter that plan to have only 400 pounds. Plastic (material) costs $1.80 per pound. Each bin requires 25 (1/4) hours of direct labor and Rokarie pays it employees $14.00 per hour. Manufacturing variable overhead is applied based on direct labor hours. Selling and Administrative expenses are based on expected units' sales. Instructions: Prepare the 2018 Mater Budget for Rokarie. Do not prepare the Income Statement. Sales Budget Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Estimated Unit (Canastas) Sales Unit Selling Price Total Estimated Sales Receipts Production Budget Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Estimated Units (Canastas) Sales Add Desired Ending Finished Good Inv. Units (1) Total Estimated Units Needed for Production Less Beginning Finished Goods Inv. Units (2) Estimated Production Units (Canastas) . Presente los Cmputos: (1) Q1 Q4 = 100 (2) 01=0 Direct Material Budget Quarter 1 Quarter 2 Quarter 3 Quarter Estimated Production Units (Canastas Estimated Direct Materials per Unit Total Estimated Materials for production Add: Desired Ending Inv. for Direct Materials (1) Total Estimated Required Materials less Beginning Inv. For Direct Materials (2) Estimated Direct Materials purchases in Pounds Estimated Direct Material Cost Per Pound Total Estimated Direct Materials Purchases Cost Presente los cmputos: (1) Q1 Q2 Q3 04 = 400 (2) Q10 Dret Labor Bucht Quarter 1 Quarter 2 Quarter al ter Yes Estimated Production Units (Canastas) Direct Labor time hours per unit (Canasto Estimated total Direct Labor Hours Direct Labor Cost per Hour Estimated rotal Direct Labor Cost T T Manufacturing Overhead Budget Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year T T T T IS Estimated total Direct Labor Hours Variable Costs Indirect Materials ($0.50 per direct labor hour) Indirect Labor 150.60 per direct labor hour) Utilities ($0.20 per direct labor hour) Maintenance (S0.10 per direct labor hour) Total Variable Costa d Fixed Costs Supervision Salaries ($10,000 per quarter) Depreciation Expense ($2,000 per quarter) Property Tax Expense ($2,500 per quarter) Insurance Expense ($1.000 per quarter) Maintenance Expense (5500 per quarter) Total Fixed Cost Total Manufacturing Overhead Cost MOH Rate per Direct Labor Hour s E T SET Selling and Administrative Expense Budget Quarter 1 Quarter 2 Quarter 3 Quarter 4 Estimated Units (Canastas) Sales Estimated Variable Costs Sales Commissions Expense ($1.25 per unit sold Transportation Out Expense ($0.50 per unit sold) Utilities ($0.10 per unit sold) Maintenance ($0.05 per unit sold) Estimated Total Variable Cost Fixed Costs Sales Salaries ($7,000 per quarter) Office Salaries ($3,000 per quarter) Depreciation Expense ($500 per quarter) Property Tax Expense ($700 per quarter) Insurance Expense ($500 per quarter) Advert & Promo Expense ($2,200 per quarter Estimated Total Fixed Cost Total Selling and Administrative Expenses