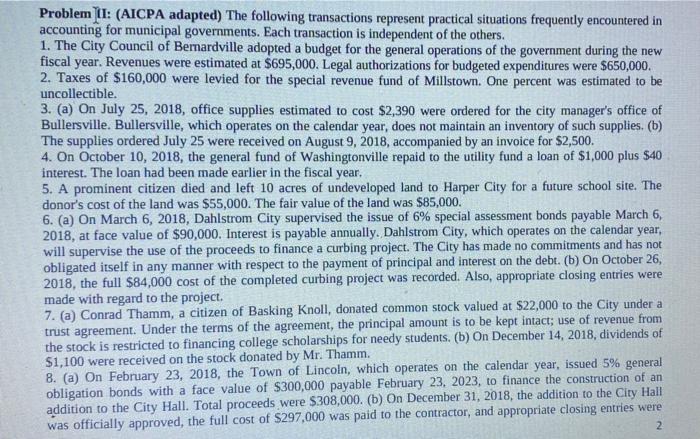

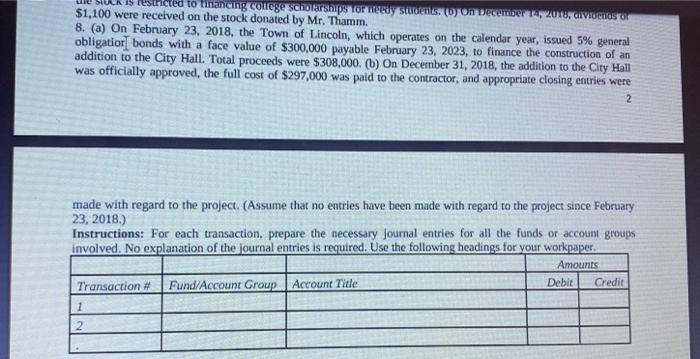

Problem II: (AICPA adapted) The following transactions represent practical situations frequently encountered in accounting for municipal governments. Each transaction is independent of the others. 1. The City Council of Bernardville adopted a budget for the general operations of the government during the new fiscal year. Revenues were estimated at $695,000. Legal authorizations for budgeted expenditures were $650,000. 2. Taxes of $160,000 were levied for the special revenue fund of Millstown. One percent was estimated to be uncollectible. 3. (a) On July 25, 2018, office supplies estimated to cost $2,390 were ordered for the city manager's office of Bullersville. Bullersville, which operates on the calendar year, does not maintain an inventory of such supplies. (b) The supplies ordered July 25 were received on August 9, 2018, accompanied by an invoice for $2,500. 4. On October 10, 2018, the general fund of Washingtonville repaid to the utility fund a loan of $1,000 plus $40 interest. The loan had been made earlier in the fiscal year. 5. A prominent citizen died and left 10 acres of undeveloped land to Harper City for a future school site. The donor's cost of the land was $55,000. The fair value of the land was $85,000. 6. (a) On March 6, 2018, Dahlstrom City supervised the issue of 6% special assessment bonds payable March 6, 2018, at face value of $90,000. Interest is payable annually. Dahlstrom City, which operates on the calendar year, will supervise the use of the proceeds to finance a curbing project. The City has made no commitments and has not obligated itself in any manner with respect to the payment of principal and interest on the debt. (b) On October 26, 2018, the full $84,000 cost of the completed curbing project was recorded. Also, appropriate closing entries were made with regard to the project. 7. (a) Conrad Thamm, a citizen of Basking Knoll, donated common stock valued at $22,000 to the City under a trust agreement. Under the terms of the agreement, the principal amount is to be kept intact; use of revenue from the stock is restricted to financing college scholarships for needy students. (b) On December 14, 2018, dividends of $1,100 were received on the stock donated by Mr. Thamm. 8. (a) On February 23, 2018, the Town of Lincoln, which operates on the calendar year, issued 5% general obligation bonds with a face value of $300,000 payable February 23, 2023, to finance the construction of an addition to the City Hall. Total proceeds were $308,000. (b) On December 31, 2018, the addition to the City Hall was officially approved, the full cost of $297,000 was paid to the contractor, and appropriate closing entries were 2 to financing college scholarships for needy students. Oon December 2018, ULVILHOSOS $1,100 were received on the stock donated by Mr. Thamm. 8. (a) On February 23, 2018, the Town of Lincoln, which operates on the calendar year, issued 5% general obligatior bonds with a face value of $300,000 payable February 23, 2023, to finance the construction of an addition to the City Hall. Total proceeds were $308,000. (b) On December 31, 2018, the addition to the City Hall was officially approved, the full cost of $297,000 was paid to the contractor, and appropriate closing entries were 2 made with regard to the project. (Assume that no entries have been made with regard to the project since February 23, 2018.) Instructions: For each transaction, prepare the necessary journal entries for all the funds or account groups involved. No explanation of the journal entries is required. Use the following headings for your workpaper. Amounts Transaction # Fund/Account Group Account Tide Debit Credit 1 2