Answered step by step

Verified Expert Solution

Question

1 Approved Answer

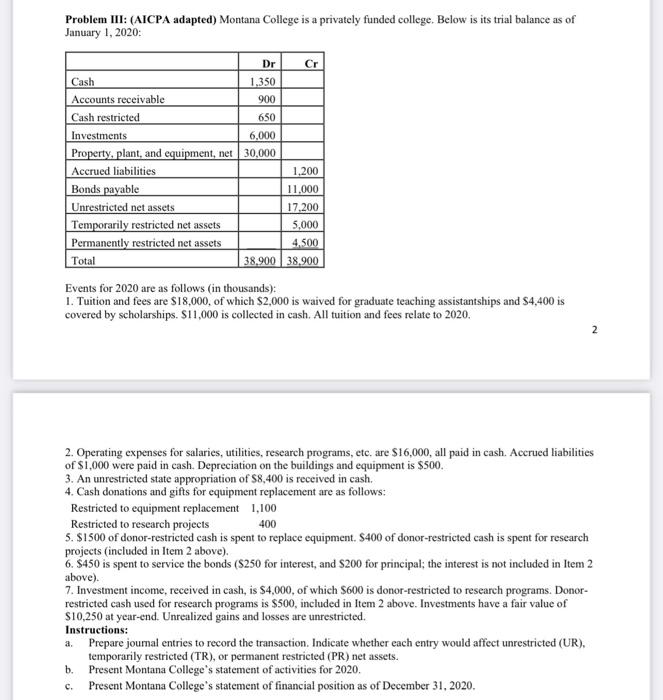

Problem III: (AICPA adapted) Montana College is a privately funded college. Below is its trial balance as of January 1, 2020: Cash Accounts receivable Cash

Problem III: (AICPA adapted) Montana College is a privately funded college. Below is its trial balance as of January 1, 2020: Cash Accounts receivable Cash restricted Dr 1,350 900 650 Investments 6,000 Property, plant, and equipment, net 30,000 Accrued liabilities Bonds payable Unrestricted net assets Temporarily restricted net assets Permanently restricted net assets Total Cr 1,200 11,000 17,200 5,000 4,500 38,900 38,900 Events for 2020 are as follows (in thousands): 1. Tuition and fees are $18,000, of which $2,000 is waived for graduate teaching assistantships and $4,400 is covered by scholarships. $11,000 is collected in cash. All tuition and fees relate to 2020. 2. Operating expenses for salaries, utilities, research programs, etc. are $16,000, all paid in cash. Accrued liabilities of $1,000 were paid in cash. Depreciation on the buildings and equipment is $500. 3. An unrestricted state appropriation of $8,400 is received in cash. 4. Cash donations and gifts for equipment replacement are as follows: 1,100 400 Restricted to equipment replacement Restricted to research projects 5. $1500 of donor-restricted cash is spent to replace equipment. $400 of donor-restricted cash is spent for research projects (included in Item 2 above). 6. $450 is spent to service the bonds ($250 for interest, and $200 for principal; the interest is not included in Item 2 above). 2 7. Investment income, received in cash, is $4,000, of which $600 is donor-restricted to research programs. Donor- restricted cash used for research programs is $500, included in Item 2 above. Investments have a fair value of $10,250 at year-end. Unrealized gains and losses are unrestricted. Instructions: a. Prepare journal entries to record the transaction. Indicate whether each entry would affect unrestricted (UR), temporarily restricted (TR), or permanent restricted (PR) net assets. b. Present Montana College's statement of activities for 2020. C. Present Montana College's statement of financial position as of December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started