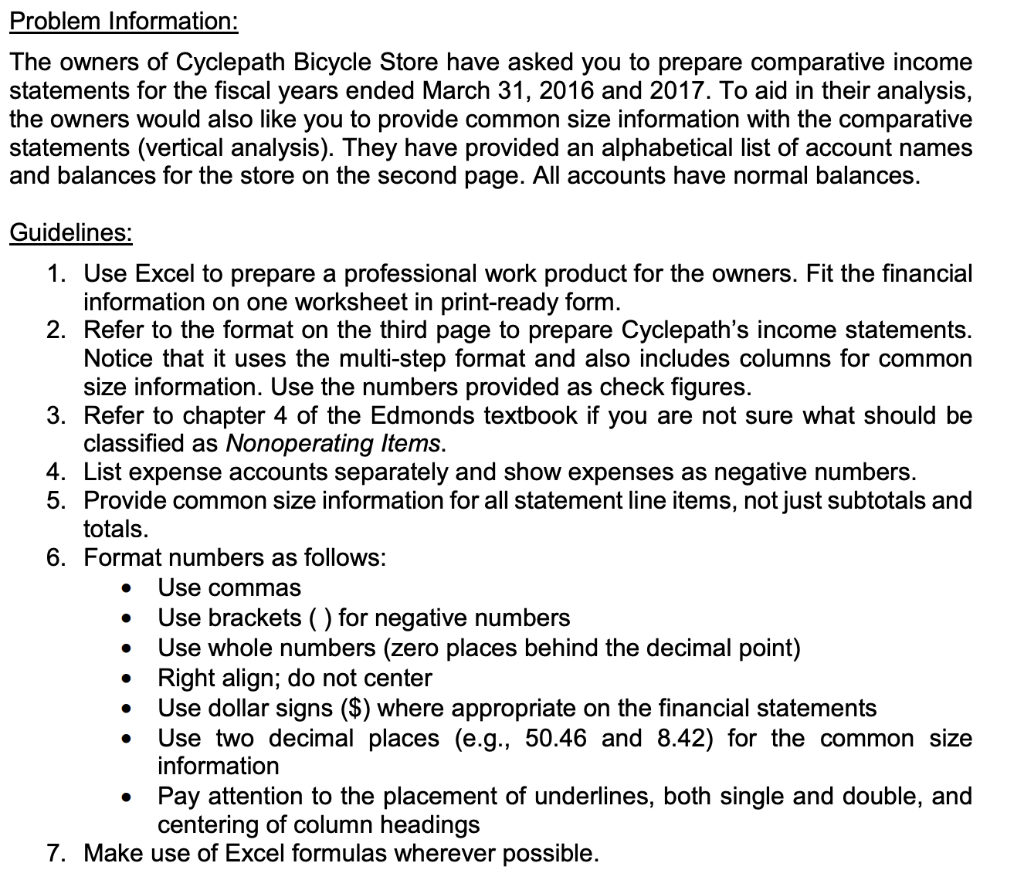

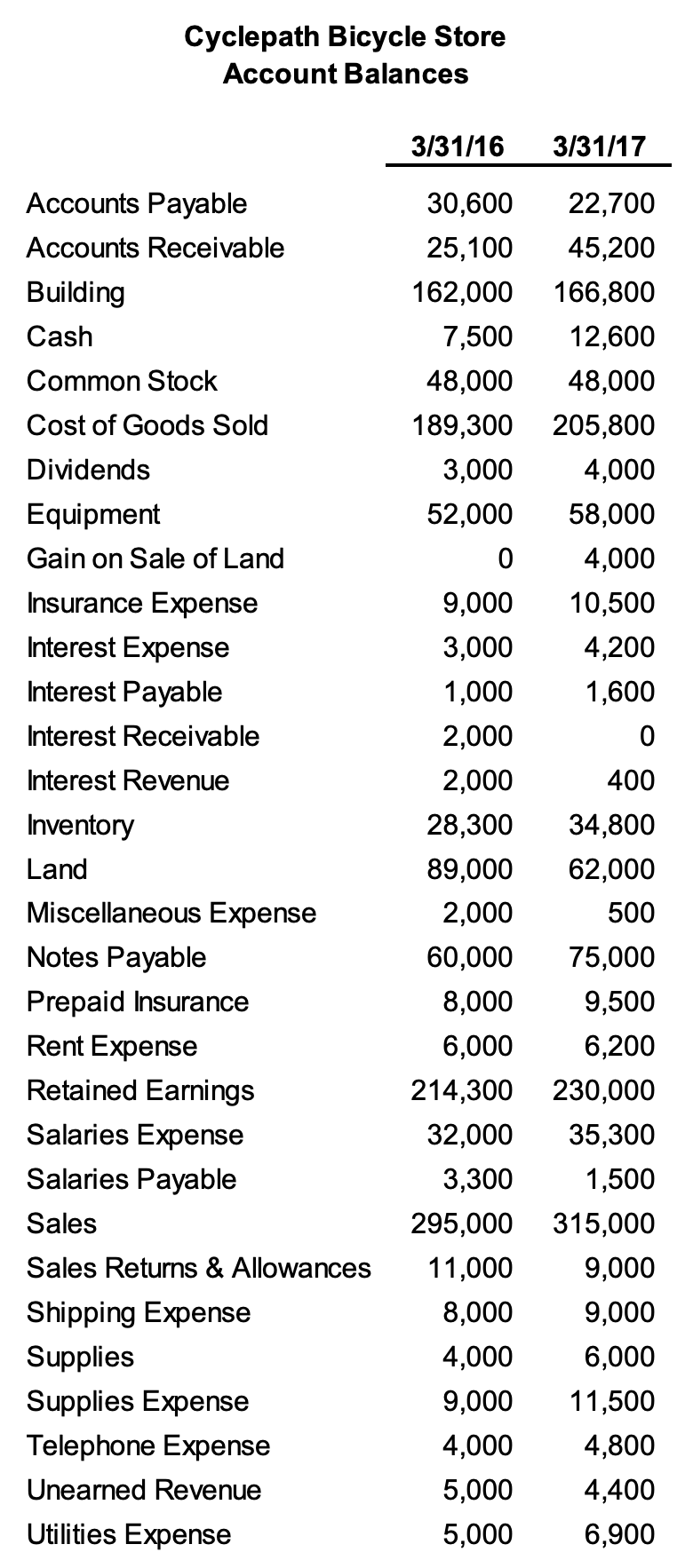

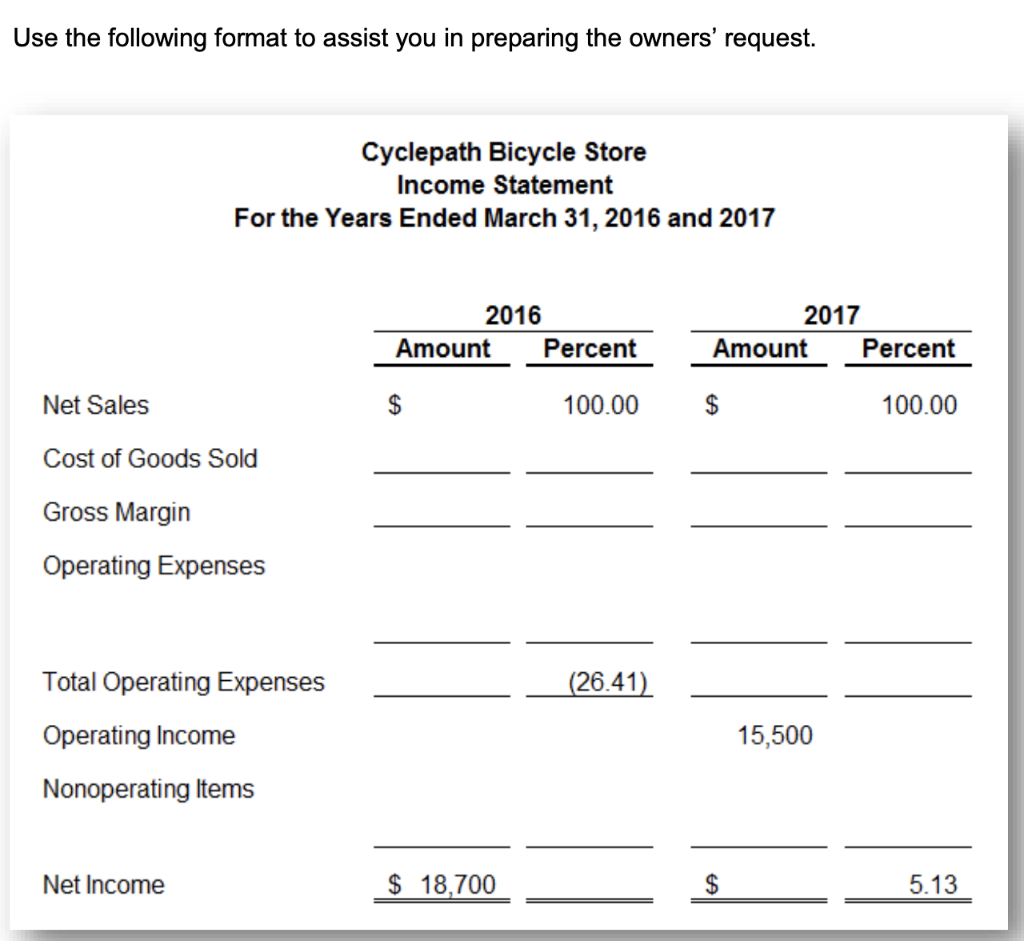

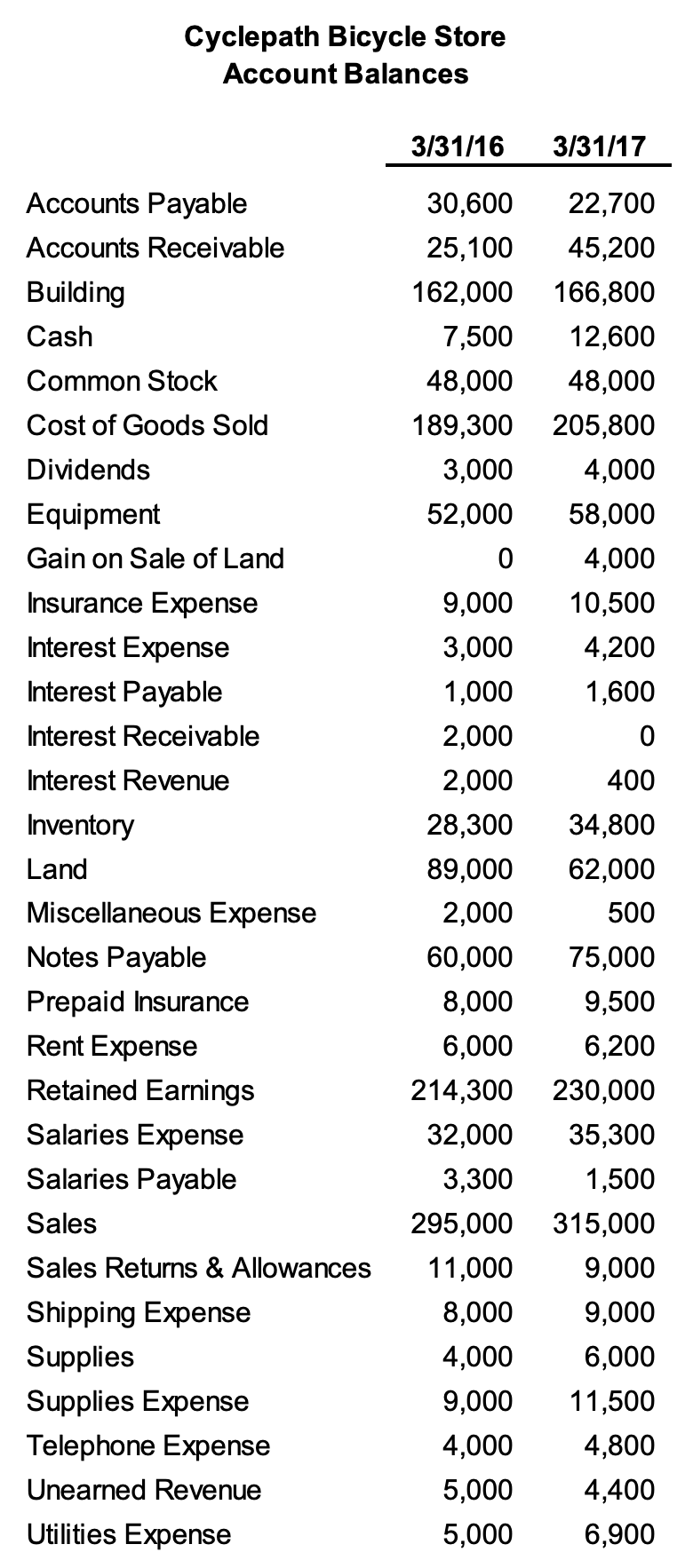

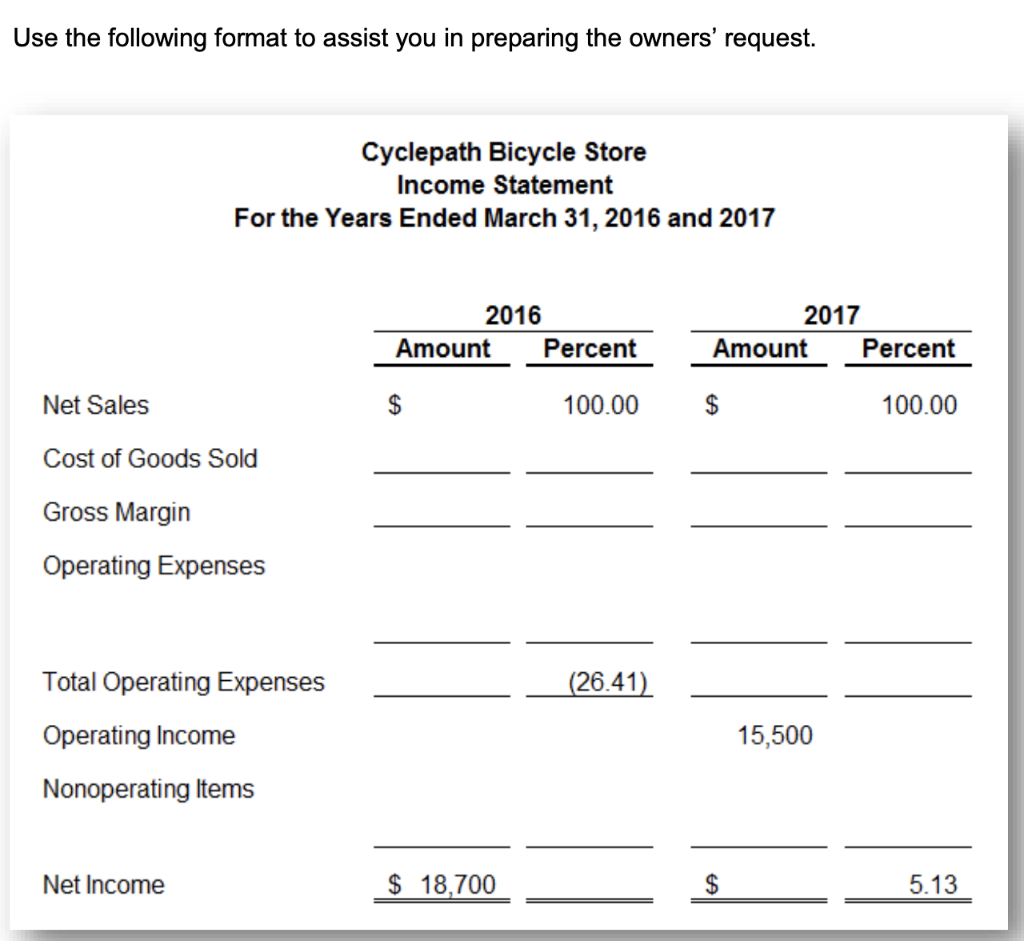

Problem Information: The owners of Cyclepath Bicycle Store have asked you to prepare comparative income statements for the fiscal years ended March 31, 2016 and 2017. To aid in their analysis, the owners would also like you to provide common size information with the comparative statements (vertical analysis). They have provided an alphabetical list of account names and balances for the store on the second page. All accounts have normal balances. Guidelines: 1. Use Excel to prepare a professional work product for the owners. Fit the financial information on one worksheet in print-ready form. 2. Refer to the format on the third page to prepare Cyclepath's income statements. Notice that it uses the multi-step format and also includes columns for common size information. Use the numbers provided as check figures. 3. Refer to chapter 4 of the Edmonds textbook if you are not sure what should be classified as Nonoperating Items. 4. List expense accounts separately and show expenses as negative numbers. 5. Provide common size information for all statement line items, not just subtotals and totals. 6. Format numbers as follows: Use commas Use brackets () for negative numbers Use whole numbers (zero places behind the decimal point) Right align; do not center Use dollar signs ($) where appropriate on the financial statements Use two decimal places (e.g., 50.46 and 8.42) for the common size information Pay attention to the placement of underlines, both single and double, and centering of column headings 7. Make use of Excel formulas wherever possible. . 0 O . Cyclepath Bicycle Store Account Balances 3/31/16 3/31/17 30,600 25,100 162,000 7,500 48,000 189,300 3,000 52,000 0 22,700 45,200 166,800 12,600 48,000 205,800 4,000 58,000 4,000 10,500 4,200 1,600 0 400 Accounts Payable Accounts Receivable Building Cash Common Stock Cost of Goods Sold Dividends Equipment Gain on Sale of Land Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Miscellaneous Expense Notes Payable Prepaid Insurance Rent Expense Retained Earnings Salaries Expense Salaries Payable Sales Sales Returns & Allowances Shipping Expense Supplies Supplies Expense Telephone Expense Unearned Revenue Utilities Expense 9,000 3,000 1,000 2,000 2,000 28,300 89,000 2,000 60,000 8,000 6,000 214,300 32,000 3,300 295,000 11,000 8,000 4,000 9,000 4,000 5,000 5,000 34,800 62,000 500 75,000 9,500 6,200 230,000 35,300 1,500 315,000 9,000 9,000 6,000 11,500 4,800 4,400 6,900 Use the following format to assist you in preparing the owners' request. Cyclepath Bicycle Store Income Statement For the Years Ended March 31, 2016 and 2017 2016 Amount Percent 2017 Amount Percent Net Sales $ 100.00 $ 100.00 Cost of Goods Sold Gross Margin Operating Expenses (26.41). Total Operating Expenses Operating Income Nonoperating Items 15,500 Net Income $ 18,700 $ 5.13