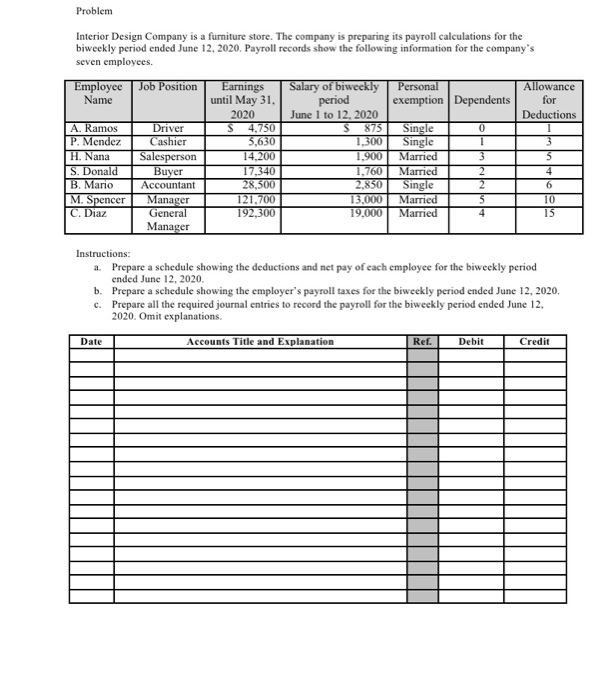

Problem Interior Design Company is a furniture store. The company is preparing its payroll calculations for the biweekly period ended June 12, 2020. Payroll records show the following information for the company's seven employees. Job Position Employee Name Personal exemption Dependents Allowance for Deductions 0 A. Ramos P. Mendez H. Nana S. Donald B. Mario Earnings until May 31, 2020 $ 4,750 5,630 14.200 17, 340 28,500 121.700 192,300 Salary of biweekly period June 1 to 12. 2020 S 875 1,300 1.900 1 ,760 2,850 13.000 19,000 Driver Cashier Salesperson Buyer Accountant Manager General Manager Single Single Married Married Single Married Married 1 3 2 3 5 4 2 5 10 M. Spencer C. Diaz Instructions: a. Prepare a schedule showing the deductions and net pay of each employee for the biweekly period ended June 12, 2020. b. Prepare a schedule showing the employer's payroll taxes for the biweekly period ended June 12, 2020, c. Prepare all the required journal entries to record the payroll for the biweekly period ended June 12, 2020. Omit explanations. Date Accounts Title and Explanation Ref. Debit Credit Problem Interior Design Company is a furniture store. The company is preparing its payroll calculations for the biweekly period ended June 12, 2020. Payroll records show the following information for the company's seven employees. Job Position Employee Name Personal exemption Dependents Allowance for Deductions 0 A. Ramos P. Mendez H. Nana S. Donald B. Mario Earnings until May 31, 2020 $ 4,750 5,630 14.200 17, 340 28,500 121.700 192,300 Salary of biweekly period June 1 to 12. 2020 S 875 1,300 1.900 1 ,760 2,850 13.000 19,000 Driver Cashier Salesperson Buyer Accountant Manager General Manager Single Single Married Married Single Married Married 1 3 2 3 5 4 2 5 10 M. Spencer C. Diaz Instructions: a. Prepare a schedule showing the deductions and net pay of each employee for the biweekly period ended June 12, 2020. b. Prepare a schedule showing the employer's payroll taxes for the biweekly period ended June 12, 2020, c. Prepare all the required journal entries to record the payroll for the biweekly period ended June 12, 2020. Omit explanations. Date Accounts Title and Explanation Ref. Debit Credit