Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem. Investment in TechnologyThe New Auto Parts Company, located on Boston's Route 1 2 8 , is considering installation of a new CIM technology which

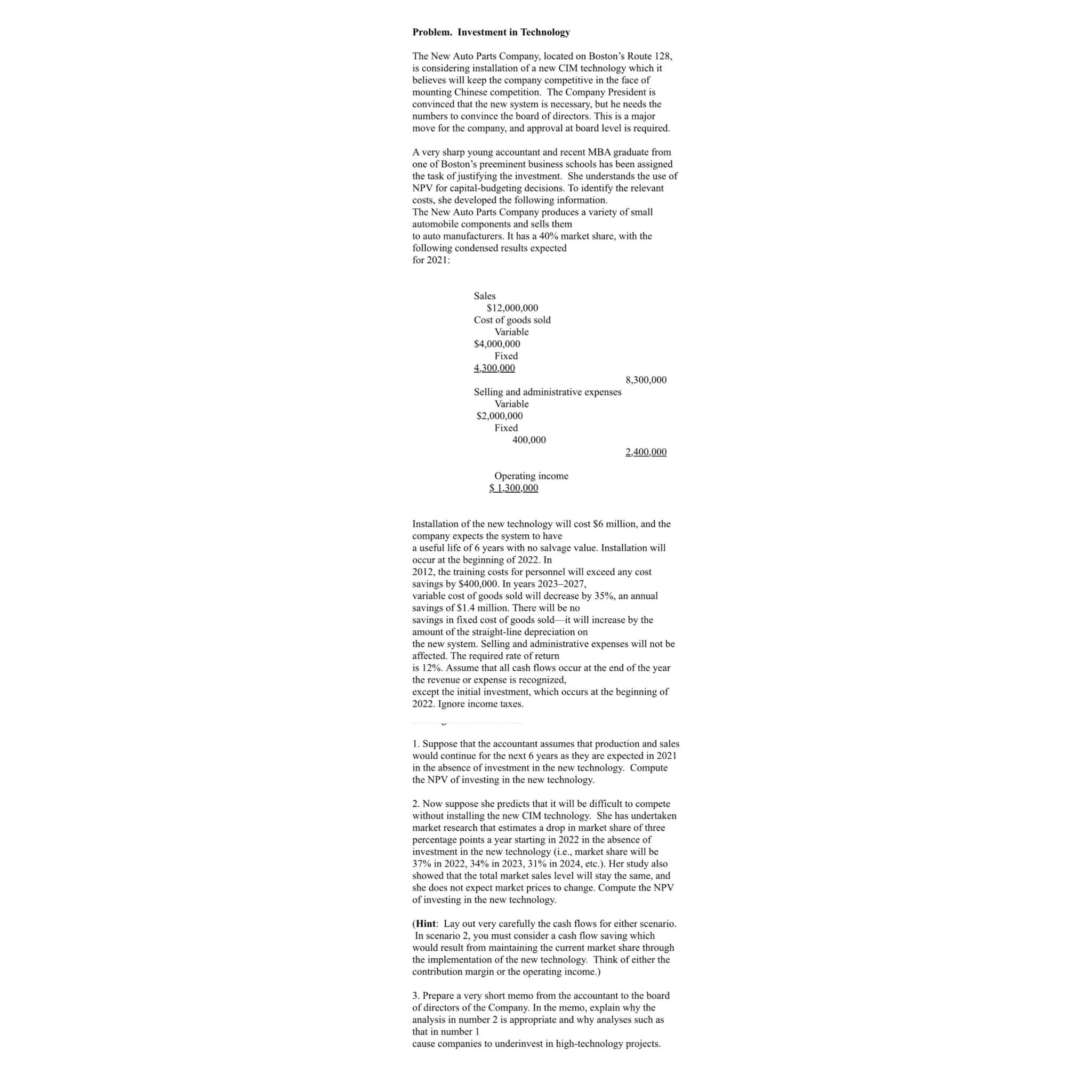

Problem. Investment in TechnologyThe New Auto Parts Company, located on Boston's Route is considering installation of a new CIM technology which itbelieves will keep the company competitive in the face ofmounting Chinese competition. The Company President isconvinced that the new system is necessary, but he needs thenumbers to convince the board of directors. This is a majormove for the company, and approval at board level is required.A very sharp young accountant and recent MBA graduate fromone of Boston's preeminent business schools has been assignedthe task of justifying the investment. She understands the use ofNPV for capitalbudgeting decisions. To identify the relevantcosts, she developed the following information.The New Auto Parts Company produces a variety of smallautomobile components and sells themto auto manufacturers. It has a market share, with thefollowing condensed results expectedfor :Sales$Cost of goods sold$Selling and administrative expenses$VariableFixedVariableFixedOperating incomeSInstallation of the new technology will cost $ million, and thecompany expects the system to havea useful life of years with no salvage value. Installation willoccur at the beginning of In the training costs for personnel will exceed any costsavings by $ In years variable cost of goods sold will decrease by an annualsavings of $ million. There will be nosavings in fixed cost of goods soldit will increase by theamount of the straightline depreciation onthe new system. Selling and administrative expenses will not beaffected. The required rate of returnis Assume that all cash flows Occur at the end of the yearthe revenue or expense is recognized,except the initial investment, which occurs at the beginning of Ignore income taxes Suppose that the accountant assumes that production and saleswould continue for the next years as they are expected in in the absence of investment in the new technology. Computethe NPV of investing in the new technology Now suppose she predicts that it will be difficult to competewithout installing the new CIM technology. She has undertakenmarket research that estimates a drop in market share of threepercentage points a year starting in in the absence ofinvestment in the new technology ie market share will be in in in etc. Her study alsoshowed that the total market sales level will stay the same, andshe does not expect market prices to change. Compute the NPVof investing in the new technology.Hint: Lay out very carefully the cash flows for either scenario.In scenario you must consider a cash flow saving whichwould result from maintaining the current market share throughthe implementation of the new technology. Think of either thecontribution margin or the operating income. Prepare a very short memo from the accountant to the boardof directors of the Company. In the memo, explain why theanalysis in number is appropriate and why analyses such asthat in number cause companies to underinvest in hightechnology projects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started