Answered step by step

Verified Expert Solution

Question

1 Approved Answer

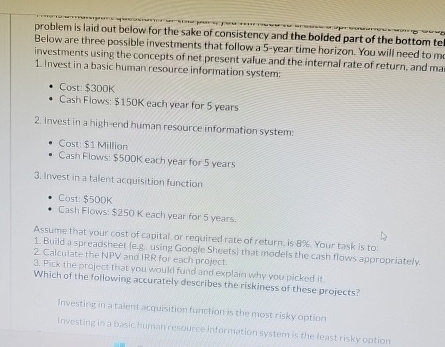

problem is laid out below for the sake of consistency and the boided part of the bottom te Below are three possible investments that follow

problem is laid out below for the sake of consistency and the boided part of the bottom te

Below are three possible investments that follow a year time horizon. You will need to mc

investments using the concepts of net present value and the internal rate of return. and ma

Invest in a basichuman resource information system:

Cost: $

Cash Flows: $ each year for years

Invest in a highend human resource information system:

Cost: $ Million

Cash Flows: $ each year for years

Invest in a talent acquisition function

Cost: $

Cash Flows: $ Keach year for years.

Assume that your cost of capital or required rate of return. is Your task is to:

Build a spreadsheel eg using Google Sheets that models the cash flows appropriately.

Calculat the NPV and IRR for each project.

Pick the project that you would fund and explain why you picked it

Which of the following accurately describes the riskiness of these projects?

Investing in a talent acquisition function is the most risky option

Investing in a basic human resourge information ystem is the leastrisky option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started