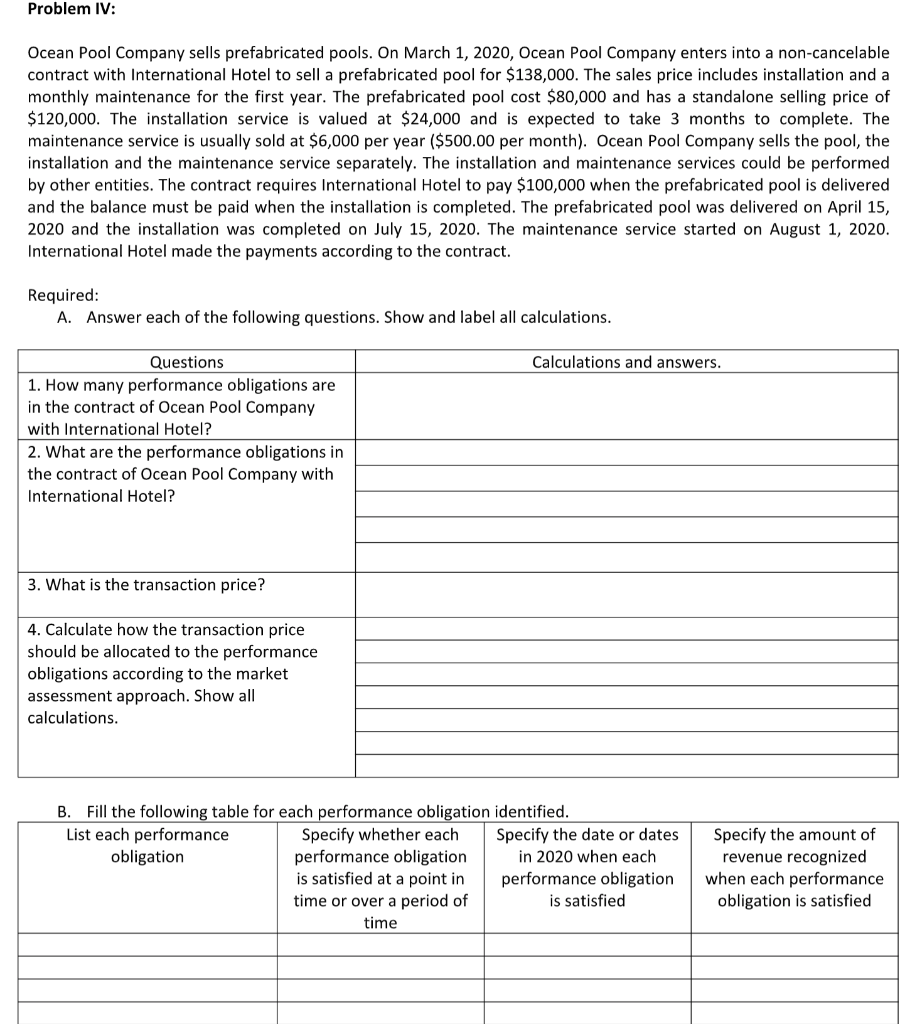

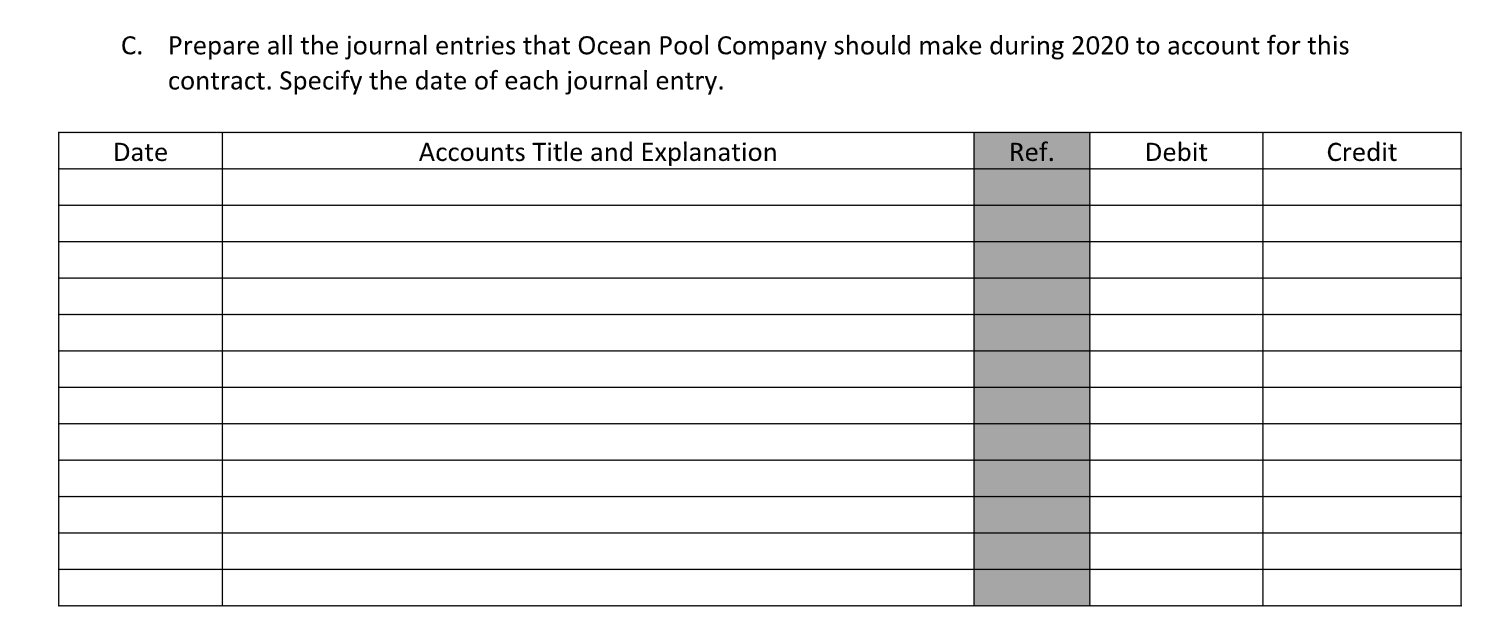

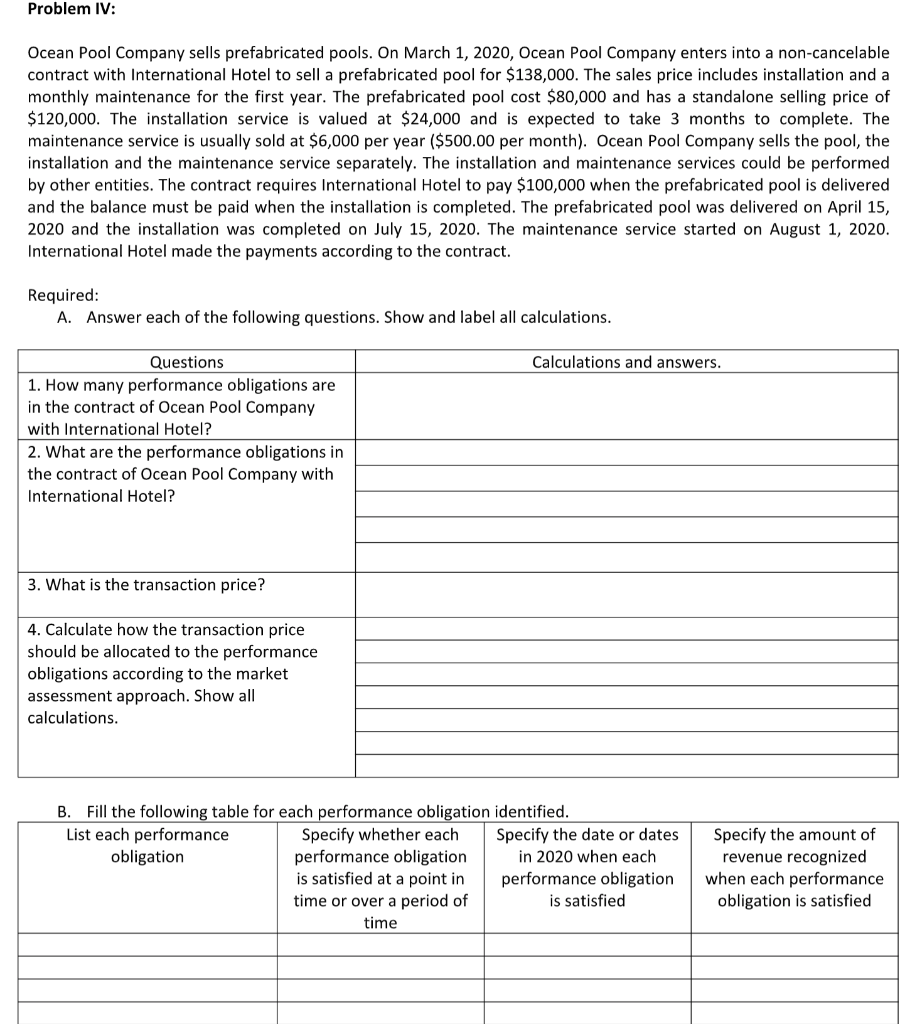

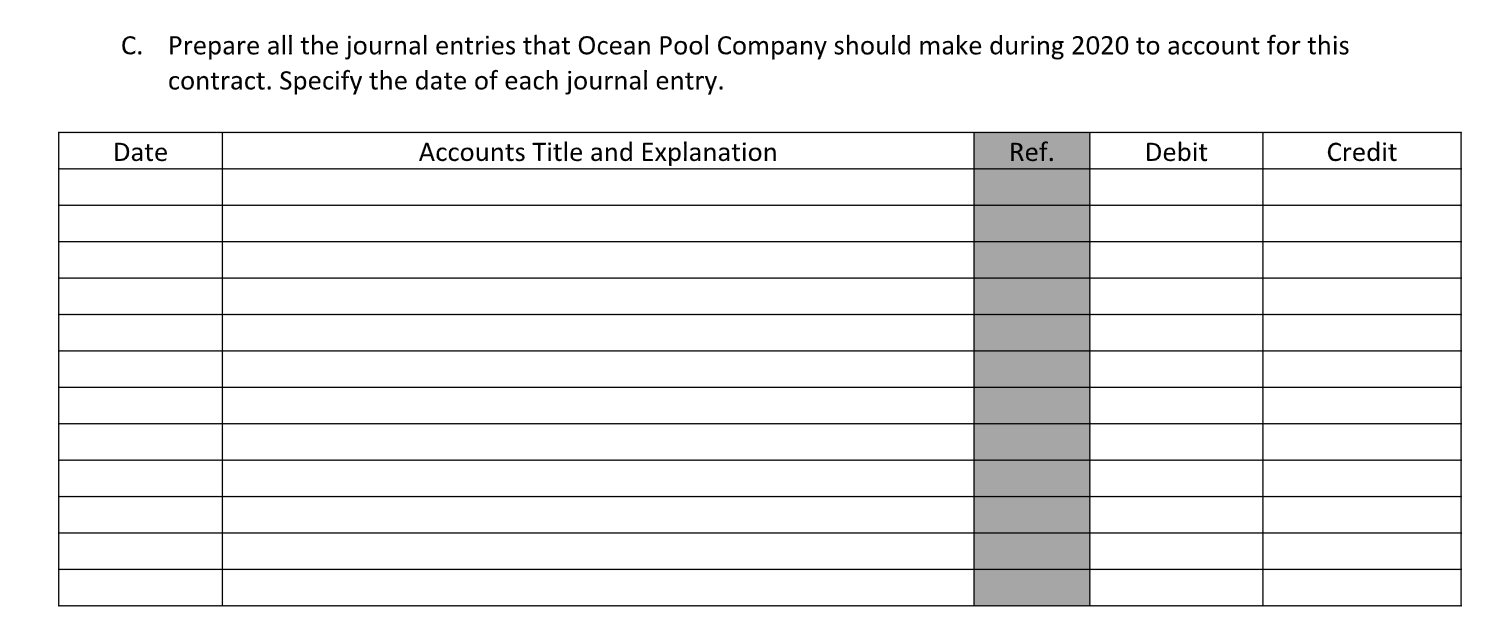

Problem IV: Ocean Pool Company sells prefabricated pools. On March 2020, Ocean Pool Company enters into a non-cancelable contract with International Hotel to sell a prefabricated pool for $138,000. The sales price includes installation and a monthly maintenance for the first year. The prefabricated pool cost $80,000 and has a standalone selling price of $120,000. The installation service is valued at $24,000 and is expected to take 3 months to complete. The maintenance service is usually sold at $6,000 per year ($500.00 per month). Ocean Pool Company sells the pool, the installation and the maintenance service separately. The installation and maintenance services could be performed by other entities. The contract requires International Hotel to pay $100,000 when the prefabricated pool is delivered and the balance must be paid when the installation is completed. The prefabricated pool was delivered on April 15, 2020 and the installation was completed on July 15, 2020. The maintenance service started on August 1, 2020. International Hotel made the payments according to the contract. Required: A. Answer each of the following questions. Show and label all calculations. Calculations and answers. Questions 1. How many performance obligations are in the contract of Ocean Pool Company with International Hotel? 2. What are the performance obligations in the contract of Ocean Pool Company with International Hotel? 3. What is the transaction price? 4. Calculate how the transaction price should be allocated to the performance obligations according to the market assessment approach. Show all calculations. B. Fill the following table for each performance obligation identified. List each performance Specify whether each Specify the date or dates obligation performance obligation in 2020 when each is satisfied at a point in performance obligation time or over a period of is satisfied time Specify the amount of revenue recognized when each performance obligation is satisfied C. Prepare all the journal entries that Ocean Pool Company should make during 2020 to account for this contract. Specify the date of each journal entry. Date Accounts Title and Explanation Ref. Debit Credit Problem IV: Ocean Pool Company sells prefabricated pools. On March 2020, Ocean Pool Company enters into a non-cancelable contract with International Hotel to sell a prefabricated pool for $138,000. The sales price includes installation and a monthly maintenance for the first year. The prefabricated pool cost $80,000 and has a standalone selling price of $120,000. The installation service is valued at $24,000 and is expected to take 3 months to complete. The maintenance service is usually sold at $6,000 per year ($500.00 per month). Ocean Pool Company sells the pool, the installation and the maintenance service separately. The installation and maintenance services could be performed by other entities. The contract requires International Hotel to pay $100,000 when the prefabricated pool is delivered and the balance must be paid when the installation is completed. The prefabricated pool was delivered on April 15, 2020 and the installation was completed on July 15, 2020. The maintenance service started on August 1, 2020. International Hotel made the payments according to the contract. Required: A. Answer each of the following questions. Show and label all calculations. Calculations and answers. Questions 1. How many performance obligations are in the contract of Ocean Pool Company with International Hotel? 2. What are the performance obligations in the contract of Ocean Pool Company with International Hotel? 3. What is the transaction price? 4. Calculate how the transaction price should be allocated to the performance obligations according to the market assessment approach. Show all calculations. B. Fill the following table for each performance obligation identified. List each performance Specify whether each Specify the date or dates obligation performance obligation in 2020 when each is satisfied at a point in performance obligation time or over a period of is satisfied time Specify the amount of revenue recognized when each performance obligation is satisfied C. Prepare all the journal entries that Ocean Pool Company should make during 2020 to account for this contract. Specify the date of each journal entry. Date Accounts Title and Explanation Ref. Debit Credit