Answered step by step

Verified Expert Solution

Question

1 Approved Answer

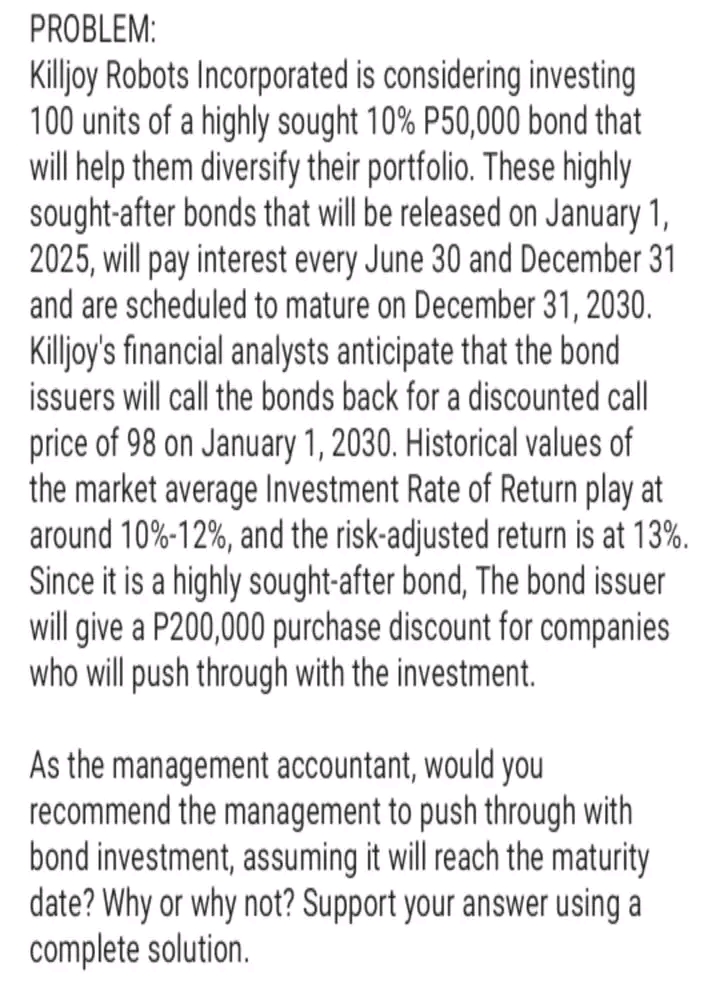

PROBLEM: Killjoy Robots Incorporated is considering investing 100 units of a highly sought 10% P50,000 bond that will help them diversify their portfolio. These

PROBLEM: Killjoy Robots Incorporated is considering investing 100 units of a highly sought 10% P50,000 bond that will help them diversify their portfolio. These highly sought-after bonds that will be released on January 1, 2025, will pay interest every June 30 and December 31 and are scheduled to mature on December 31, 2030. Killjoy's financial analysts anticipate that the bond issuers will call the bonds back for a discounted call price of 98 on January 1, 2030. Historical values of the market average Investment Rate of Return play at around 10%-12%, and the risk-adjusted return is at 13%. Since it is a highly sought-after bond, The bond issuer will give a P200,000 purchase discount for companies who will push through with the investment. As the management accountant, would you recommend the management to push through with bond investment, assuming it will reach the maturity date? Why or why not? Support your answer using a complete solution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started