Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem: Module 7 Textbook Problem 2 Learning Objective: 7-4 Explain the flow-through of partnership items to the partners This year, Herb Partnership generated $780,000 ordinary

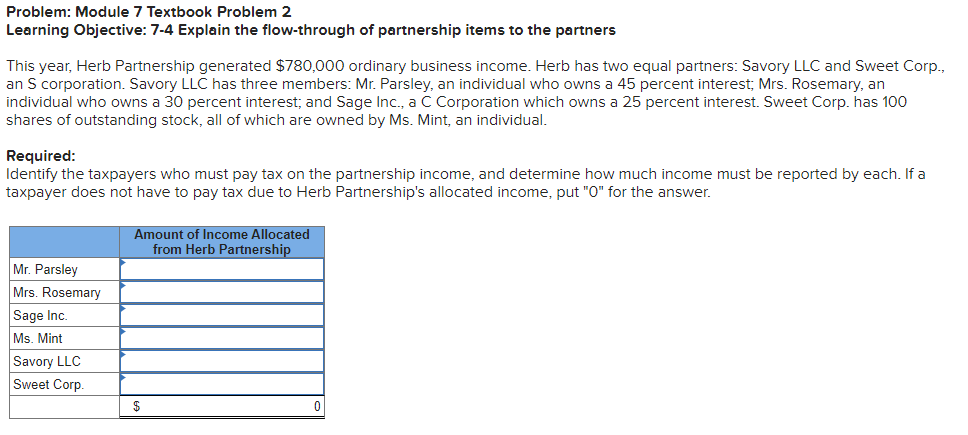

Problem: Module 7 Textbook Problem 2 Learning Objective: 7-4 Explain the flow-through of partnership items to the partners This year, Herb Partnership generated $780,000 ordinary business income. Herb has two equal partners: Savory LLC and Sweet Corp., an S corporation. Savory LLC has three members: Mr. Parsley, an individual who owns a 45 percent interest; Mrs. Rosemary, an individual who owns a 30 percent interest; and Sage Inc., a C Corporation which owns a 25 percent interest. Sweet Corp. has 100 shares of outstanding stock, all of which are owned by Ms. Mint, an individual. Required: Identify the taxpayers who must pay tax on the partnership income, and determine how much income must be reported by each. If a taxpayer does not have to pay tax due to Herb Partnership's allocated income, put "0" for the

Problem: Module 7 Textbook Problem 2 Learning Objective: 7-4 Explain the flow-through of partnership items to the partners This year, Herb Partnership generated $780,000 ordinary business income. Herb has two equal partners: Savory LLC and Sweet Corp., an S corporation. Savory LLC has three members: Mr. Parsley, an individual who owns a 45 percent interest; Mrs. Rosemary, an individual who owns a 30 percent interest; and Sage Inc., a C Corporation which owns a 25 percent interest. Sweet Corp. has 100 shares of outstanding stock, all of which are owned by Ms. Mint, an individual. Required: Identify the taxpayers who must pay tax on the partnership income, and determine how much income must be reported by each. If a taxpayer does not have to pay tax due to Herb Partnership's allocated income, put "0" for the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started