Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem: Module 9 Textbook Problem 7 Learning Objective: 9-5 Define constructive dividend Graham is the sole shareholder of Logan Corporation. For the past five years,

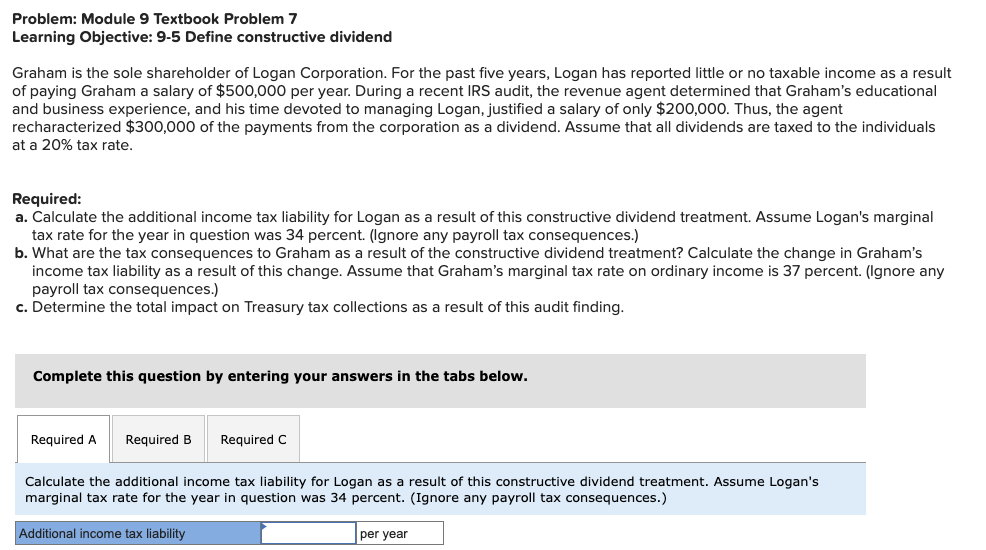

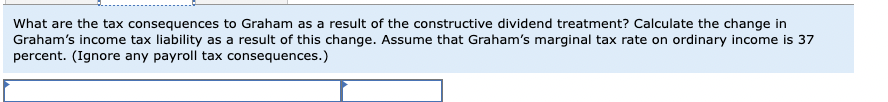

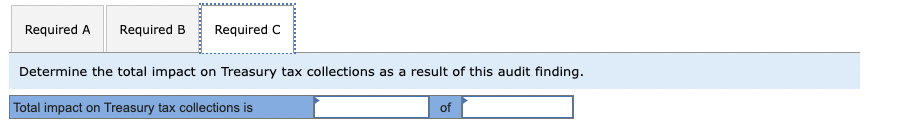

Problem: Module 9 Textbook Problem 7 Learning Objective: 9-5 Define constructive dividend Graham is the sole shareholder of Logan Corporation. For the past five years, Logan has reported little or no taxable income as a result of paying Graham a salary of $500,000 per year. During a recent IRS audit, the revenue agent determined that Graham's educational and business experience, and his time devoted to managing Logan, justified a salary of only $200,000. Thus, the agent recharacterized $300,000 of the payments from the corporation as a dividend. Assume that all dividends are taxed to the individuals at a 20% tax rate. Required: a. Calculate the additional income tax liability for Logan as a result of this constructive dividend treatment. Assume Logan's marginal tax rate for the year in question was 34 percent. (Ignore any payroll tax consequences.) b. What are the tax consequences to Graham as a result of the constructive dividend treatment? Calculate the change in Graham's income tax liability as a result of this change. Assume that Graham's marginal tax rate on ordinary income is 37 percent. (Ignore any payroll tax consequences.) c. Determine the total impact on Treasury tax collections as a result of this audit finding. Complete this question by entering your answers in the tabs below. Calculate the additional income tax liability for Logan as a result of this constructive dividend treatment. Assume Logan's marginal tax rate for the year in question was 34 percent. (Ignore any payroll tax consequences.) What are the tax consequences to Graham as a result of the constructive dividend treatment? Calculate the change in Graham's income tax liability as a result of this change. Assume that Graham's marginal tax rate on ordinary income is 37 percent. (Ignore any payroll tax consequences.) etermine the total impact on Treasury tax collections as a result of this audit finding

Problem: Module 9 Textbook Problem 7 Learning Objective: 9-5 Define constructive dividend Graham is the sole shareholder of Logan Corporation. For the past five years, Logan has reported little or no taxable income as a result of paying Graham a salary of $500,000 per year. During a recent IRS audit, the revenue agent determined that Graham's educational and business experience, and his time devoted to managing Logan, justified a salary of only $200,000. Thus, the agent recharacterized $300,000 of the payments from the corporation as a dividend. Assume that all dividends are taxed to the individuals at a 20% tax rate. Required: a. Calculate the additional income tax liability for Logan as a result of this constructive dividend treatment. Assume Logan's marginal tax rate for the year in question was 34 percent. (Ignore any payroll tax consequences.) b. What are the tax consequences to Graham as a result of the constructive dividend treatment? Calculate the change in Graham's income tax liability as a result of this change. Assume that Graham's marginal tax rate on ordinary income is 37 percent. (Ignore any payroll tax consequences.) c. Determine the total impact on Treasury tax collections as a result of this audit finding. Complete this question by entering your answers in the tabs below. Calculate the additional income tax liability for Logan as a result of this constructive dividend treatment. Assume Logan's marginal tax rate for the year in question was 34 percent. (Ignore any payroll tax consequences.) What are the tax consequences to Graham as a result of the constructive dividend treatment? Calculate the change in Graham's income tax liability as a result of this change. Assume that Graham's marginal tax rate on ordinary income is 37 percent. (Ignore any payroll tax consequences.) etermine the total impact on Treasury tax collections as a result of this audit finding Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started