Question

PROBLEM NO. 1 You were hired by SCAM Corporation to examine their accounts for the year ended December 31, 2023 and the following are

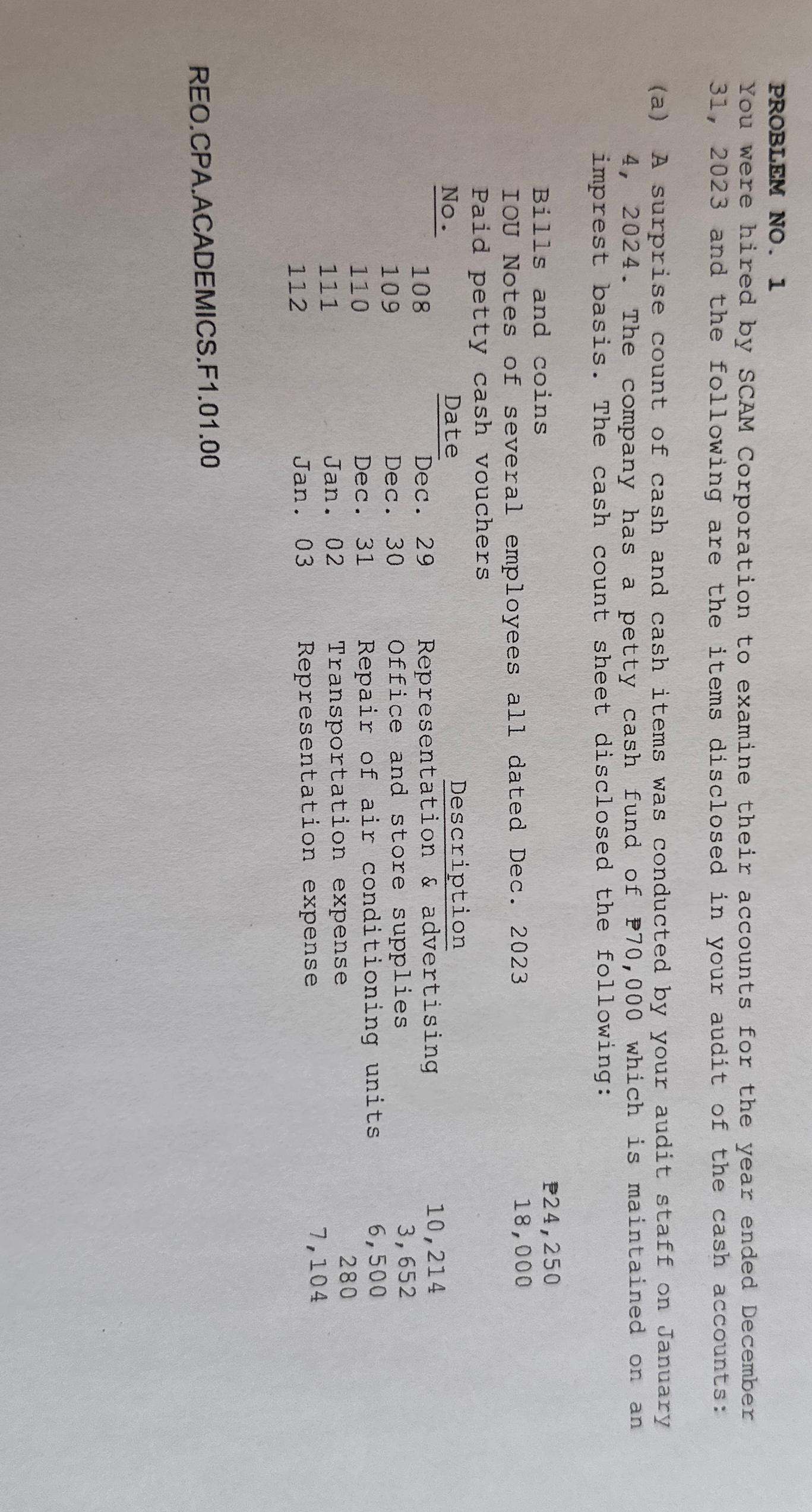

PROBLEM NO. 1 You were hired by SCAM Corporation to examine their accounts for the year ended December 31, 2023 and the following are the items disclosed in your audit of the cash accounts: (a) A surprise count of cash and cash items was conducted by your audit staff on January 4, 2024. The company has a petty cash fund of 70,000 which is maintained on an imprest basis. The cash count sheet disclosed the following: Bills and coins IOU Notes of several employees all dated Dec. 2023 Paid petty cash vouchers Description Representation & advertising Office and store supplies P24,250 18,000 No. Date 108 Dec. 29 10,214 109 Dec. 30 3,652 110 Dec. 31 111 Jan. 02 Repair of air conditioning units Transportation expense 6,500 280 112 Jan. 03 Representation expense 7,104 REO.CPA.ACADEMICS.F1.01.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield.

9th Canadian Edition, Volume 2

470964731, 978-0470964736, 978-0470161012

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App