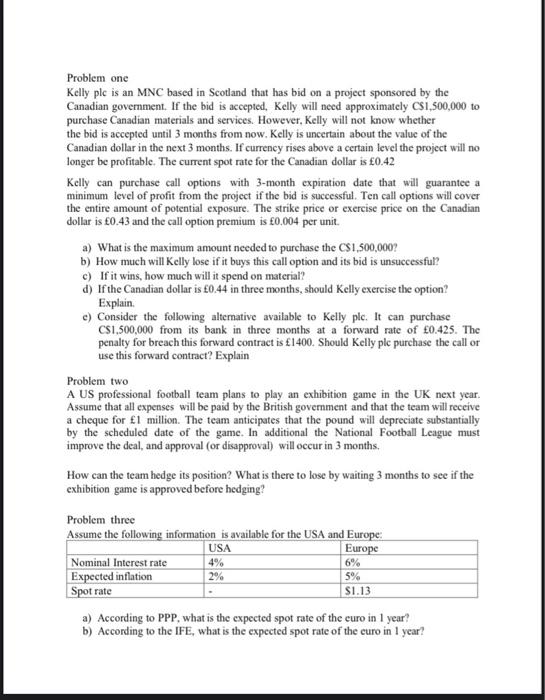

Problem one Kelly plc is an MNC based in Scotland that has bid on a project sponsored by the Canadian government. If the bid is accepted, Kelly will need approximately CS1,500,000 to purchase Canadian materials and services. However, Kelly will not know whether the bid is accepted until 3 months from now. Kelly is uncertain about the value of the Canadian dollar in the next 3 months. If currency rises above a certain level the project will no longer be profitable. The current spot rate for the Canadian dollar is 0.42 Kelly can purchase call options with 3-month expiration date that will guarantee a minimum level of profit from the project if the bid is successful. Ten call options will cover the entire amount of potential exposure. The strike price or exercise price on the Canadian dollar is 0.43 and the call option premium is 0,004 per unit. a) What is the maximum amount needed to purchase the CS 1,500,000? b) How much will Kelly lose if it buys this call option and its bid is unsuccessful? c) If it wins, how much will it spend on material? d) If the Canadian dollar is 0.44 in three months, should Kelly exercise the option? Explain. c) Consider the following alternative available to Kelly ple. It can purchase CS1,500,000 from its bank in three months at a forward rate of 0.425. The penalty for breach this forward contract is 1400. Should Kelly ple purchase the call or use this forward contract? Explain Problem two A US professional football team plans to play an exhibition game in the UK next year. Assume that all expenses will be paid by the British government and that the team will receive a cheque for 1 million. The team anticipates that the pound will depreciate substantially by the scheduled date of the game. In additional the National Football League must improve the deal, and approval (or disapproval) will occur in 3 months How can the team hedge its position? What is there to lose by waiting 3 months to see if the exhibition game is approved before hedging? Problem three Assume the following information is available for the USA and Europe: USA Europe Nominal Interest rate 4% 6% Expected inflation 2% 5% Spot rate S1.13 a) According to PPP, what is the expected spot rate of the euro in 1 year? b) According to the IFE, what is the expected spot rate of the curo in 1 year