Question

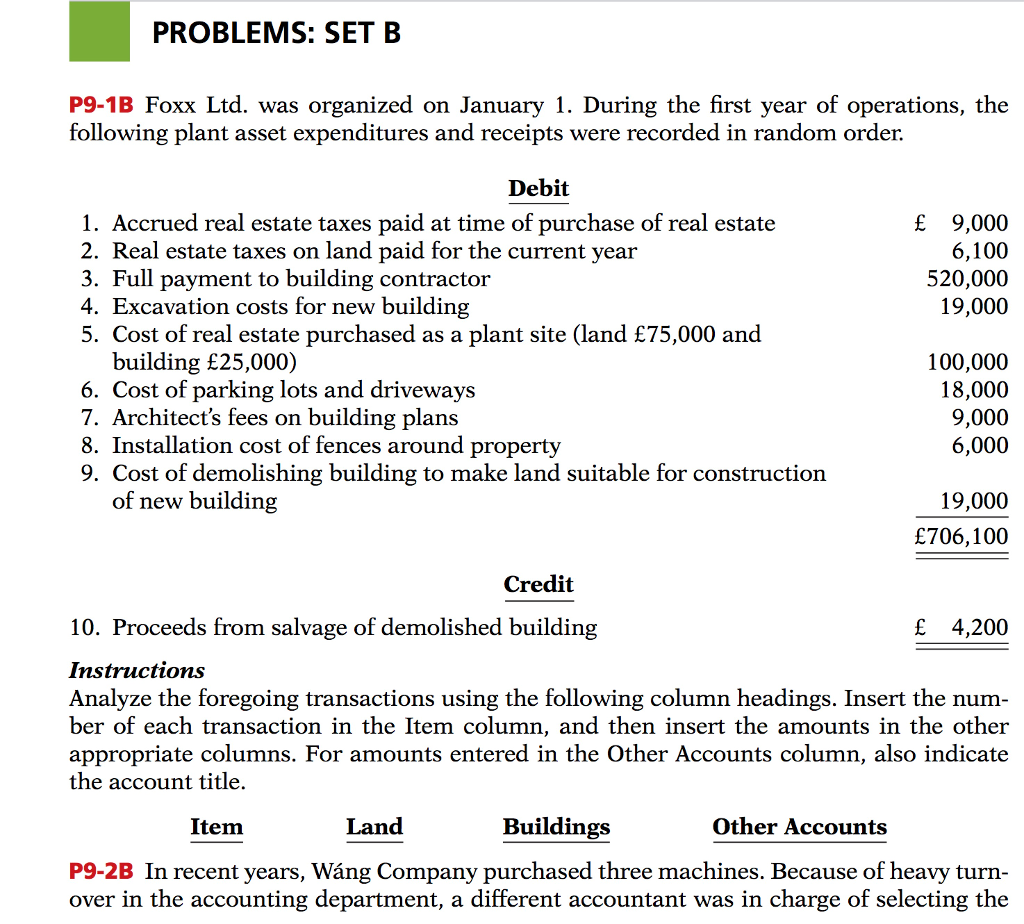

Problem One: Problem 9-1B on page 469, ignoring GST. Assume the fencing in #8 is permanent. In addition to the textbook instructions, answer the following:

Problem One:

Problem 9-1B on page 469, ignoring GST. Assume the fencing in #8 is permanent. In addition to the textbook instructions, answer the following:

1) How would your answer change for #8 if the fencing were erected prior to the demolition mentioned in #9, and were removed after the building was constructed? Assume that the $6,000 is material but that the removal costs were insignificant.

2) Suppose that Foxx Ltd. borrowed enough money not only to make the purchase but also to fund all of the other expenditures mentioned in the problem. Interest was incurred from the date of borrowing, which was two months before construction expenditures commenced, until six months after construction of the building was completed. Discuss the proper accounting treatment for the interest charges, i.e., are they all expensed, all capitalized, or some expensed and some capitalized? Provide reasons for your conclusion.

| Item |

| Land | Buildings | Other Accounts |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started