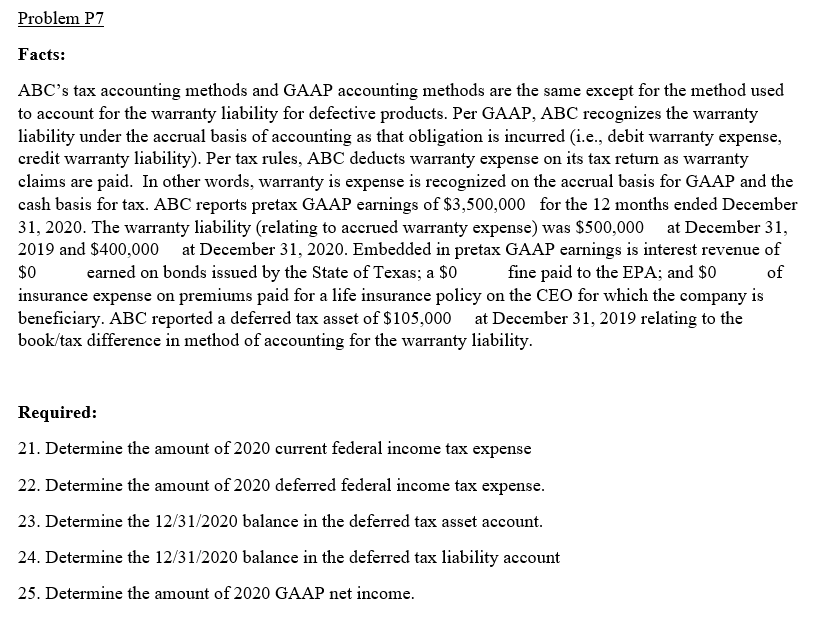

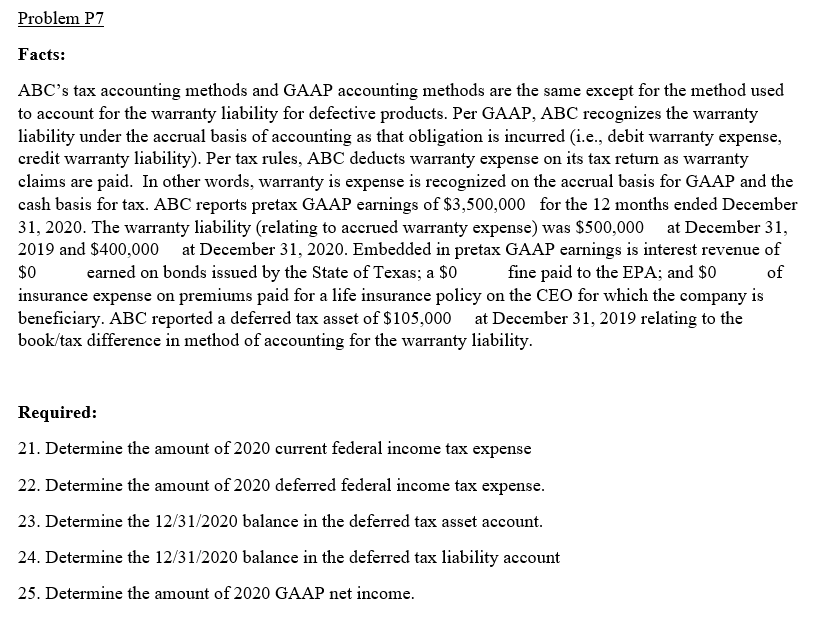

Problem P7 Facts: ABC's tax accounting methods and GAAP accounting methods are the same except for the method used to account for the warranty liability for defective products. Per GAAP, ABC recognizes the warranty liability under the accrual basis of accounting as that obligation is incurred (i.e., debit warranty expense, credit warranty liability). Per tax rules, ABC deducts warranty expense on its tax return as warranty claims are paid. In other words, warranty is expense is recognized on the accrual basis for GAAP and the cash basis for tax. ABC reports pretax GAAP earnings of $3,500,000 for the 12 months ended December 31, 2020. The warranty liability (relating to accrued warranty expense) was $500,000 at December 31, 2019 and $400,000 at December 31, 2020. Embedded in pretax GAAP earnings is interest revenue of $0 earned on bonds issued by the State of Texas; a $0 fine paid to the EPA; and $0 of insurance expense on premiums paid for a life insurance policy on the CEO for which the company is beneficiary. ABC reported a deferred tax asset of $105,000 at December 31, 2019 relating to the book/tax difference in method of accounting for the warranty liability. Required: 21. Determine the amount of 2020 current federal income tax expense 22. Determine the amount of 2020 deferred federal income tax expense. 23. Determine the 12/31/2020 balance in the deferred tax asset account. 24. Determine the 12/31/2020 balance in the deferred tax liability account 25. Determine the amount of 2020 GAAP net income. Problem P7 Facts: ABC's tax accounting methods and GAAP accounting methods are the same except for the method used to account for the warranty liability for defective products. Per GAAP, ABC recognizes the warranty liability under the accrual basis of accounting as that obligation is incurred (i.e., debit warranty expense, credit warranty liability). Per tax rules, ABC deducts warranty expense on its tax return as warranty claims are paid. In other words, warranty is expense is recognized on the accrual basis for GAAP and the cash basis for tax. ABC reports pretax GAAP earnings of $3,500,000 for the 12 months ended December 31, 2020. The warranty liability (relating to accrued warranty expense) was $500,000 at December 31, 2019 and $400,000 at December 31, 2020. Embedded in pretax GAAP earnings is interest revenue of $0 earned on bonds issued by the State of Texas; a $0 fine paid to the EPA; and $0 of insurance expense on premiums paid for a life insurance policy on the CEO for which the company is beneficiary. ABC reported a deferred tax asset of $105,000 at December 31, 2019 relating to the book/tax difference in method of accounting for the warranty liability. Required: 21. Determine the amount of 2020 current federal income tax expense 22. Determine the amount of 2020 deferred federal income tax expense. 23. Determine the 12/31/2020 balance in the deferred tax asset account. 24. Determine the 12/31/2020 balance in the deferred tax liability account 25. Determine the amount of 2020 GAAP net income