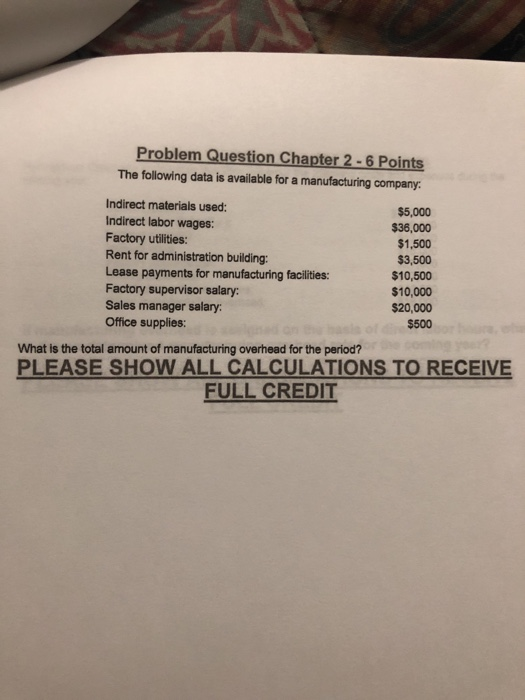

Question: Problem Question Chapter 2-6 Points The following data is available for a manufacturing company: Indirect materials used: Indirect labor wages: Factory utilities: Rent for administration

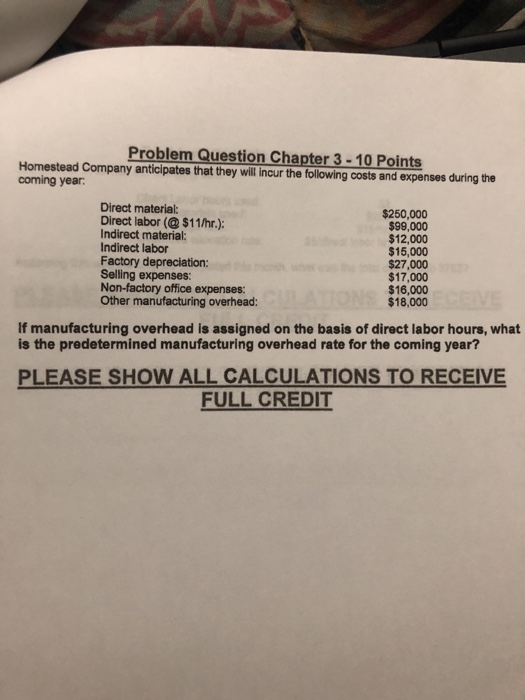

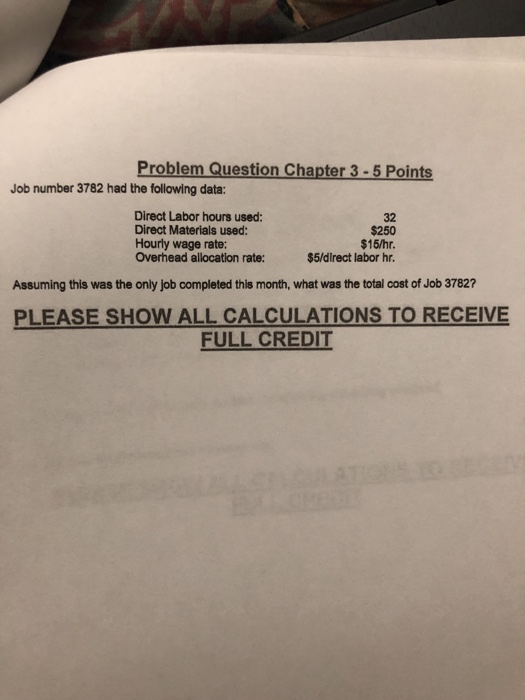

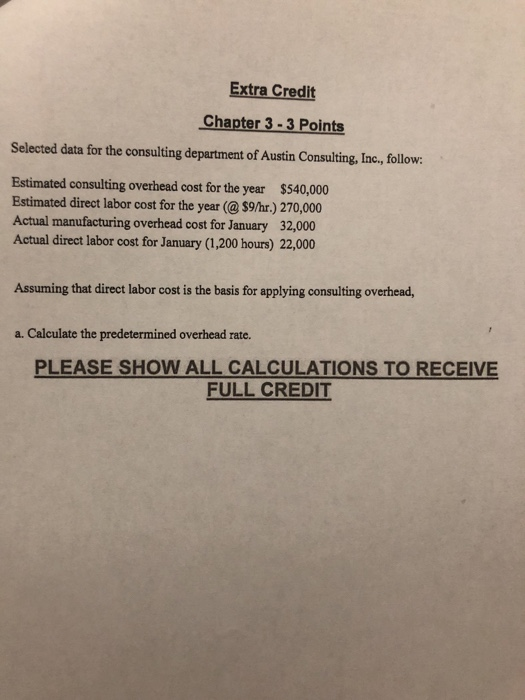

Problem Question Chapter 2-6 Points The following data is available for a manufacturing company: Indirect materials used: Indirect labor wages: Factory utilities: Rent for administration building: Lease payments for manufacturing facilities: Factory supervisor salary: Sales manager salary: Office supplies: $5,000 $36,000 $1,500 $3,500 $10,500 $10,000 $20,000 $500 What is the total amount of manufacturing overhead for the period? PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT Problem Question Chapter 3-10 Points Homestead Company anticipates that they will Incur the following costs and expenses during the coming year Direct material: Direct labor (@ $11/hr.): Indirect material: Indirect labor Factory depreciation: Selling expenses: Non-factory office expenses: Other manufacturing overhead: $250,000 $99,000 $12,000 $15,000 $27,000 $17,000 $16,000 $18,000 If manufacturing overhead is assigned on the basis of direct labor hours, what is the predetermined manufacturing overhead rate for the coming year? PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT Problem Question Chapter 3-5 Points Job number 3782 had the following data: Direct Labor hours used: Direct Materials used: Hourly wage rate: Overhead allocation rate: 32 $250 $15/hr. $5/direct labor hr. Assuming this was the only job completed this month, what was the total cost of Job 37827 PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT Extra Credit Chapter 3-3 Points Selected data for the consulting department of Austin Consulting, Inc., follow: Estimated consulting overhead cost for the year $540,000 Estimated direct labor cost for the year (@ $9/hr.) 270,000 Actual manufacturing overhead cost for January 32,000 Actual direct labor cost for January (1,200 hours) 22,000 Assuming that direct labor cost is the basis for applying consulting overhead, a. Calculate the predetermined overhead rate PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts