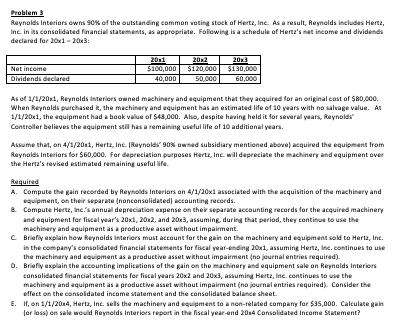

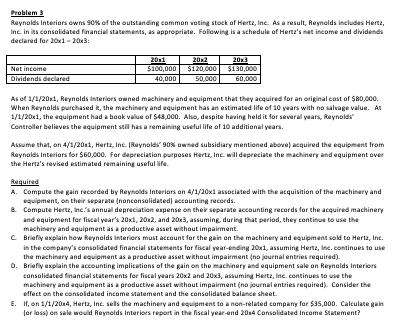

Problem Reynolds interiors owns of the outstanding common voting stock of Herta, Ing. As a result, Reynolds includes Herta Inc. in its consolidated financial statements, as appropriate. Following is a schedule of Her's income and dividends declared for 21-03: Dividends declared As of 1/1/201, Reynolds interior owned machinery and equipment that they acquired for an original cost of $80.000 When Reynolds purchased the machinery and equipment has an estimated life of 10 years with no salvage value. At 1/1/20x1, the equipment had a book value of $48,000. Ale, despite having held it for several years, Reynolds Controller believes the equipment still has a remaining life of 10 additional years Asume that, on 4/1/2001, Hertz, Inc. Reynolds 90% owned subsidiary mentioned above)quired the equipment from Reynolds interiors for $60,000. For depreciation purposes Harta, Inc. willdepreciate the machinery and equipment over the Horia's roved estimated remaining useful life. Required A Compute the gain recorded by Reynolds interiors on 4/1/20x associated with the acquisition of the machinery and ipment on their separate (nonconsolidated accounting records. Compute Herta, inc.'s annual depreciation expense on their separate accounting records for the acquired machinery and equipment for fiscal year's 20x, 2012, and 2043, assuming during that period, they continue to use the machinery and equipment as a productive asset without impairment. Briefly explain how Reynolds interiors must account for the gain on the machinery and equipment sold to Horta, Int. in the company's consolidated financial statements for fiscal year-ending 2001, assuming Herta, in continues to use the machinery and equipment as a productive asset without impairment ne journal entries required) D. Briefly explain the accounting implications of the gain on the machinery and equipment sale on Reynolds Interiors consolidated financial statements for fiscal years 20x2 and 20, assuming Herte, in continues to the machinery and equipment as a productive asset without impairment (no ournalentries required). Consider the effect on the consolidated income statement and the censelidated balance sheet on 1/1/2014, Hart, in the machinery and equipment team- rated company for $1.000 Calatega Lor o n sale wod y dis interior report in the fiscal year and 2014 Consolidated income Statement