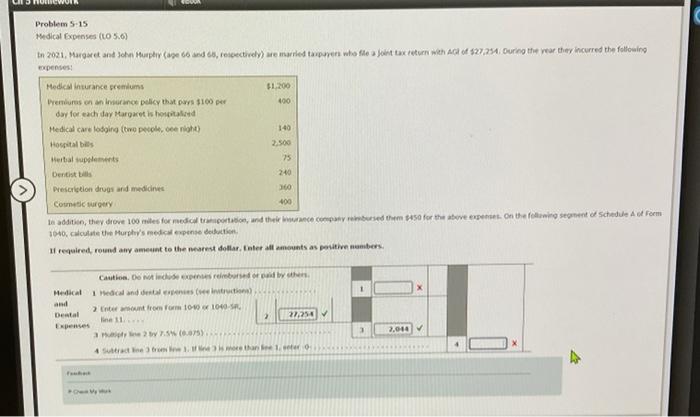

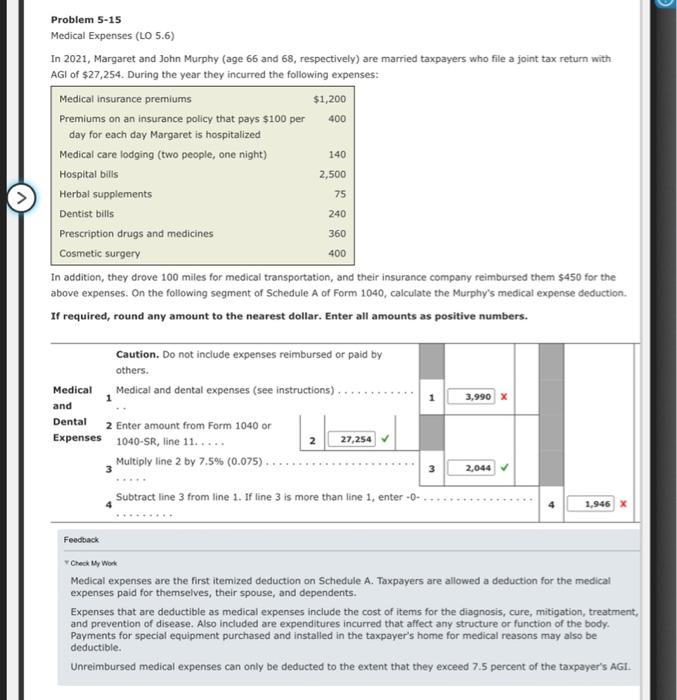

Problem S-15 Mrdical fxpenses (105.0) Fipenses: If required, round any aneant to the mesenst dollar, taler all ensounts as position nambers. Problem 5-15 Medical Expenses (LO 5.6) In 2021, Margaret and John Murphy (age 66 and 68, respectively) are married taxpayers who file a joint tax return with AGI of $27,254. During the year they incurred the following expenses: In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Feedback roteck Lry Wok Medical expenses are the first itemized deduction on Schedule A. Taxpayers are allowed a deduction for the medical expenses paid for themselves, their spouse, and dependents. Expenses that are deductible as medical expenses include the cost of items for the diagnosis, cure, mitigation, treatment, and prevention of disease. Also included are expenditures incurred that affect any structure or function of the body. Payments for special equipment purchased and installed in the taxpayer's home for medical reasons may also be deductible. Unreimbursed medical expenses can only be deducted to the extent that they exceed 7.5 percent of the taxpayer's AGl. Problem S-15 Mrdical fxpenses (105.0) Fipenses: If required, round any aneant to the mesenst dollar, taler all ensounts as position nambers. Problem 5-15 Medical Expenses (LO 5.6) In 2021, Margaret and John Murphy (age 66 and 68, respectively) are married taxpayers who file a joint tax return with AGI of $27,254. During the year they incurred the following expenses: In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Feedback roteck Lry Wok Medical expenses are the first itemized deduction on Schedule A. Taxpayers are allowed a deduction for the medical expenses paid for themselves, their spouse, and dependents. Expenses that are deductible as medical expenses include the cost of items for the diagnosis, cure, mitigation, treatment, and prevention of disease. Also included are expenditures incurred that affect any structure or function of the body. Payments for special equipment purchased and installed in the taxpayer's home for medical reasons may also be deductible. Unreimbursed medical expenses can only be deducted to the extent that they exceed 7.5 percent of the taxpayer's AGl