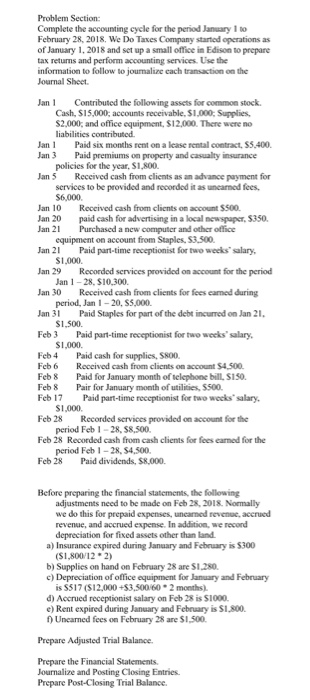

Problem Section: Complete the accounting cycle for the period January 1 to February 28, 2018, We Do Taxes Company started operations as of January 1, 2018 and set up a small office in Edison to prepare tax returns and perform accounting services. Use the information to follow to journalize each transaction on the Journal Sheet Jan Contributed the following assets for common stock. Cash, $15.000; accounts receivable. $1,000: Supplies S2,000, and office equipment, $12,000. There were no liabilities contributed Jan Paid six months rent on a lease rental contract, S5,400. Jan 3 Paid premiums on property and casualty insurance policies for the year. $1,800. Jan 5 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees. $6,000 Jan 10 Received cash from clients on account $500 Jan 20 paid cash for advertising in a local newspaper, $350. Jan 21 Purchased a new computer and other office equipment on account from Staples, S3,500. Jan 21 Paid part-time receptionist for two weeks' salary. S1.000. Jan 29 Recorded services provided on account for the period Jan 1-28. SI0.300. Jan 30 Received cash from clients for fees camed during period, Jan - 20. $5.000. Jan 31 Paid Staples for part of the debt incurred on Jan 21. SI 500 Feb 3 Paid part-time receptionist for two weeks' salary, S1.000. Feb 4 Paid cash for supplies, S800. Feb 6 Received cash from clients on account $4.500. Feb 8 Paid for January month of sclephone bill SISO. Feb 8 Pair for January month of utilities, 5500 Feb 17 Paid part-time receptionist for two weeks' salary. $1,000. Feb 28 Recorded services provided on account for the period Feb 1-28S8,500. Feb 28 Recorded cash from cash clients for fees earned for the period Feb 1-28, S4,500 Feb 28 Paid dividends. $8.000. Before preparing the financial statements, the following adjustments need to be made on Feb 28, 2018. Normally we do this for prepaid expenses, uneared revenue, accrued revenue, and accrued expense. In addition, we record depreciation for fixed assets other than land a) Insurance expired during January and February is $300 (S1,800/12*2) b) Supplies on hand on February 28 are $1.280 c) Depreciation of office equipment for January and February is S517 (S12,000+$3,500/60 * 2 months) d) Accrued receptionist salary on Feb 28 is $1000 e) Rent expired during January and February is S1.800 f) Uncamed fees on February 28 are $1.500 Prepare Adjusted Trial Balance. Prepare the Financial Statements Journalize and Posting Closing Entries. Prepare Post-Closing Trial Balance