Question

Problem set #08 project analysis Your job is to determine whether HP should produce a high-end smart phone. The project lasts 6 years. Investments $30

Problem set #08 project analysis

Your job is to determine whether HP should produce a high-end smart phone.

The project lasts 6 years. Investments $30 million in year 0 for machinery.

Assume straight-line depreciation over 6 years.

After 6 years, the book value of this machinery is zero.

Machinery will be sold for $2.5 million at the projects end.

NWC of $3 million to begin the project, which will increase at a 4% rate each year.

Revenue and cost estimates $50 million in year 1, growing at 10% yearly after Annual operating costs of (a) $30 million fixed, and (b) variable costs of 30% of annual revenues

Other information Tax rate = 30% Discount rate = 12%

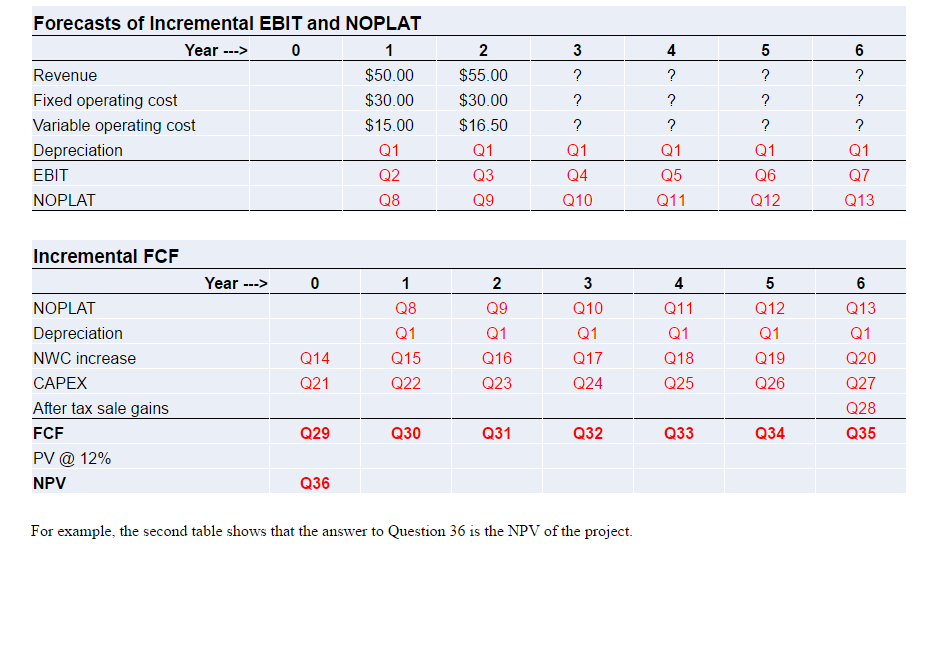

The following questions will help you calculate the NPV of this project. Enter all numbers in $ millions (e.g. in case of 30 million, simply enter 30.) Round off your answers to two decimal digits. I strongly recommend to use excel for this problem set. To help you understand the entire procedure, I provide the following two tables:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started