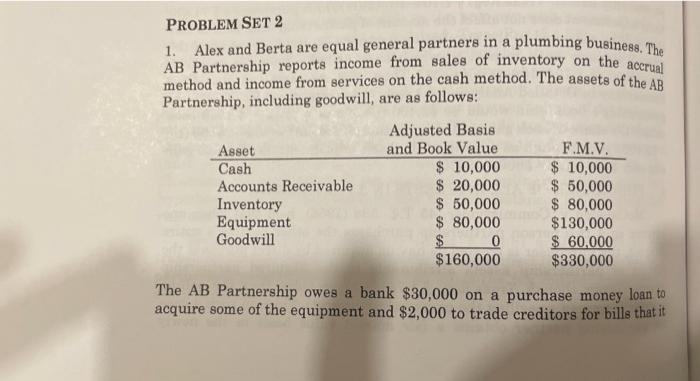

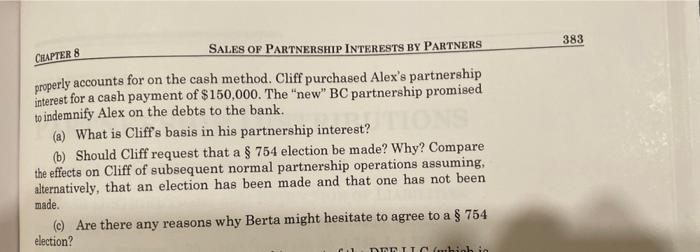

PROBLEM SET 2 1. Alex and Berta are equal general partners in a plumbing business. The AB Partnership reports income from sales of inventory on the accrual method and income from services on the cash method. The assets of the AB Partnership, including goodwill, are as follows: Adjusted Basis Asset and Book Value F.M.V. Cash $ 10,000 $ 10,000 Accounts Receivable $ 20,000 $ 50,000 Inventory $ 50,000 $ 80,000 Equipment $ 80,000 $130,000 Goodwill $ 0 $ 60,000 $160,000 $330,000 The AB Partnership owes a bank $30,000 on a purchase money loan to acquire some of the equipment and $2,000 to trade creditors for bills that it 383 CHEAPTER 8 SALES OF PARTNERSHIP INTERESTS BY PARTNERS properly accounts for on the cash method. Cliff purchased Alex's partnership interest for a cash payment of $150,000. The "new" BC partnership promised to indemnify Alex on the debts to the bank. (A) What is Cliff's basis in his partnership interest? (b) Should Cliff request that a $ 754 election be made? Why? Compare the effects on Cliff of subsequent normal partnership operations assuming, alternatively, that an election has been made and that one has not been made. (c) Are there any reasons why Berta might hesitate to agree to a $ 754 election? (uhinh in PROBLEM SET 2 1. Alex and Berta are equal general partners in a plumbing business. The AB Partnership reports income from sales of inventory on the accrual method and income from services on the cash method. The assets of the AB Partnership, including goodwill, are as follows: Adjusted Basis Asset and Book Value F.M.V. Cash $ 10,000 $ 10,000 Accounts Receivable $ 20,000 $ 50,000 Inventory $ 50,000 $ 80,000 Equipment $ 80,000 $130,000 Goodwill $ 0 $ 60,000 $160,000 $330,000 The AB Partnership owes a bank $30,000 on a purchase money loan to acquire some of the equipment and $2,000 to trade creditors for bills that it 383 CHEAPTER 8 SALES OF PARTNERSHIP INTERESTS BY PARTNERS properly accounts for on the cash method. Cliff purchased Alex's partnership interest for a cash payment of $150,000. The "new" BC partnership promised to indemnify Alex on the debts to the bank. (A) What is Cliff's basis in his partnership interest? (b) Should Cliff request that a $ 754 election be made? Why? Compare the effects on Cliff of subsequent normal partnership operations assuming, alternatively, that an election has been made and that one has not been made. (c) Are there any reasons why Berta might hesitate to agree to a $ 754 election? (uhinh in