Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Set B For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. PROBLEM 15-1B On December 31

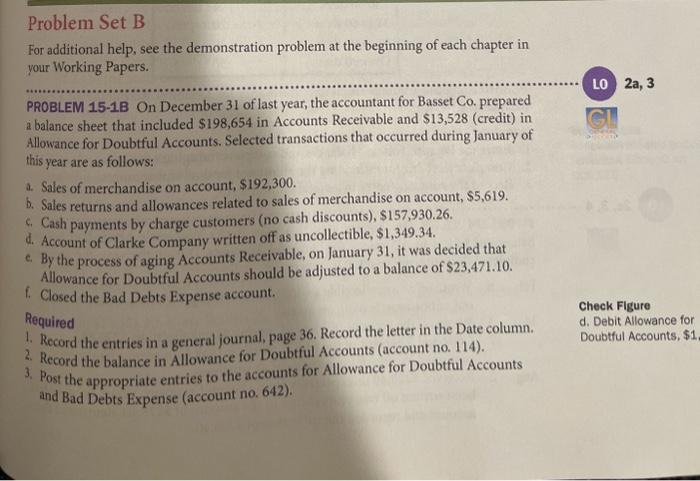

Problem Set B For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. PROBLEM 15-1B On December 31 of last year, the accountant for Basset Co. prepared a balance sheet that included $198,654 in Accounts Receivable and $13,528 (credit) in Allowance for Doubtful Accounts. Selected transactions that occurred during January of this year are as follows: a. Sales of merchandise on account, $192,300. b. Sales returns and allowances related to sales of merchandise on account, $5,619. C. Cash payments by charge customers (no cash discounts), $157,930.26. d. Account of Clarke Company written off as uncollectible, $1,349.34. e. By the process of aging Accounts Receivable, on January 31, it was decided that Allowance for Doubtful Accounts should be adjusted to a balance of $23,471.10. f. Closed the Bad Debts Expense account. Required 1. Record the entries in a general journal, page 36. Record the letter in the Date column. 2. Record the balance in Allowance for Doubtful Accounts (account no. 114). 3. Post the appropriate entries to the accounts for Allowance for Doubtful Accounts and Bad Debts Expense (account no. 642). LO 2a, 3 GL GENERAL LEDGER Check Figure d. Debit Allowance for Doubtful Accounts, $1,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started