Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Set-1 1. Suppose a bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest

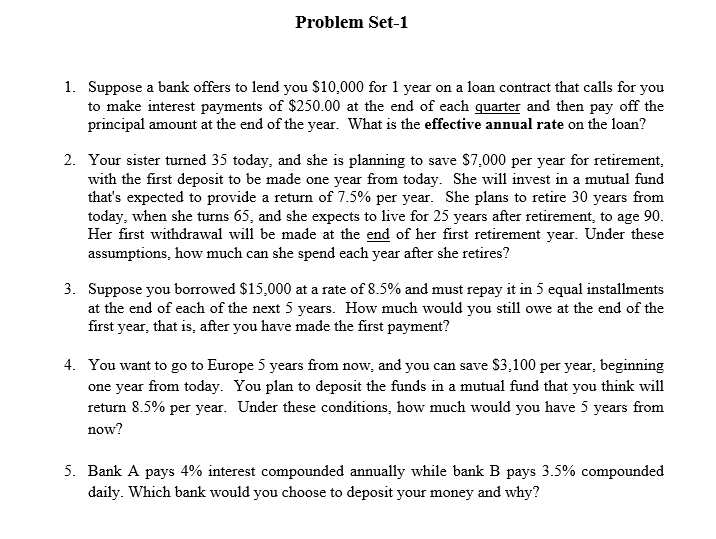

Problem Set-1 1. Suppose a bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest payments of $250.00 at the end of each quarter and then pay off the principal amount at the end of the year. What is the effective annual rate on the loan? 2. Your sister turned 35 today, and she is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. She will invest in a mutual fund that's expected to provide a return of 7.5% per year. She plans to retire 30 years from today, when she turns 65 , and she expects to live for 25 years after retirement, to age 90 . Her first withdrawal will be made at the end of her first retirement year. Under these assumptions, how much can she spend each year after she retires? 3. Suppose you borrowed $15,000 at a rate of 8.5% and must repay it in 5 equal installments at the end of each of the next 5 years. How much would you still owe at the end of the first year, that is, after you have made the first payment? 4. You want to go to Europe 5 years from now, and you can save $3,100 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have 5 years from now? 5. Bank A pays 4% interest compounded annually while bank B pays 3.5% compounded daily. Which bank would you choose to deposit your money and why

Problem Set-1 1. Suppose a bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest payments of $250.00 at the end of each quarter and then pay off the principal amount at the end of the year. What is the effective annual rate on the loan? 2. Your sister turned 35 today, and she is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. She will invest in a mutual fund that's expected to provide a return of 7.5% per year. She plans to retire 30 years from today, when she turns 65 , and she expects to live for 25 years after retirement, to age 90 . Her first withdrawal will be made at the end of her first retirement year. Under these assumptions, how much can she spend each year after she retires? 3. Suppose you borrowed $15,000 at a rate of 8.5% and must repay it in 5 equal installments at the end of each of the next 5 years. How much would you still owe at the end of the first year, that is, after you have made the first payment? 4. You want to go to Europe 5 years from now, and you can save $3,100 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have 5 years from now? 5. Bank A pays 4% interest compounded annually while bank B pays 3.5% compounded daily. Which bank would you choose to deposit your money and why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started