\Problem: So Far Have:

So Far Have:

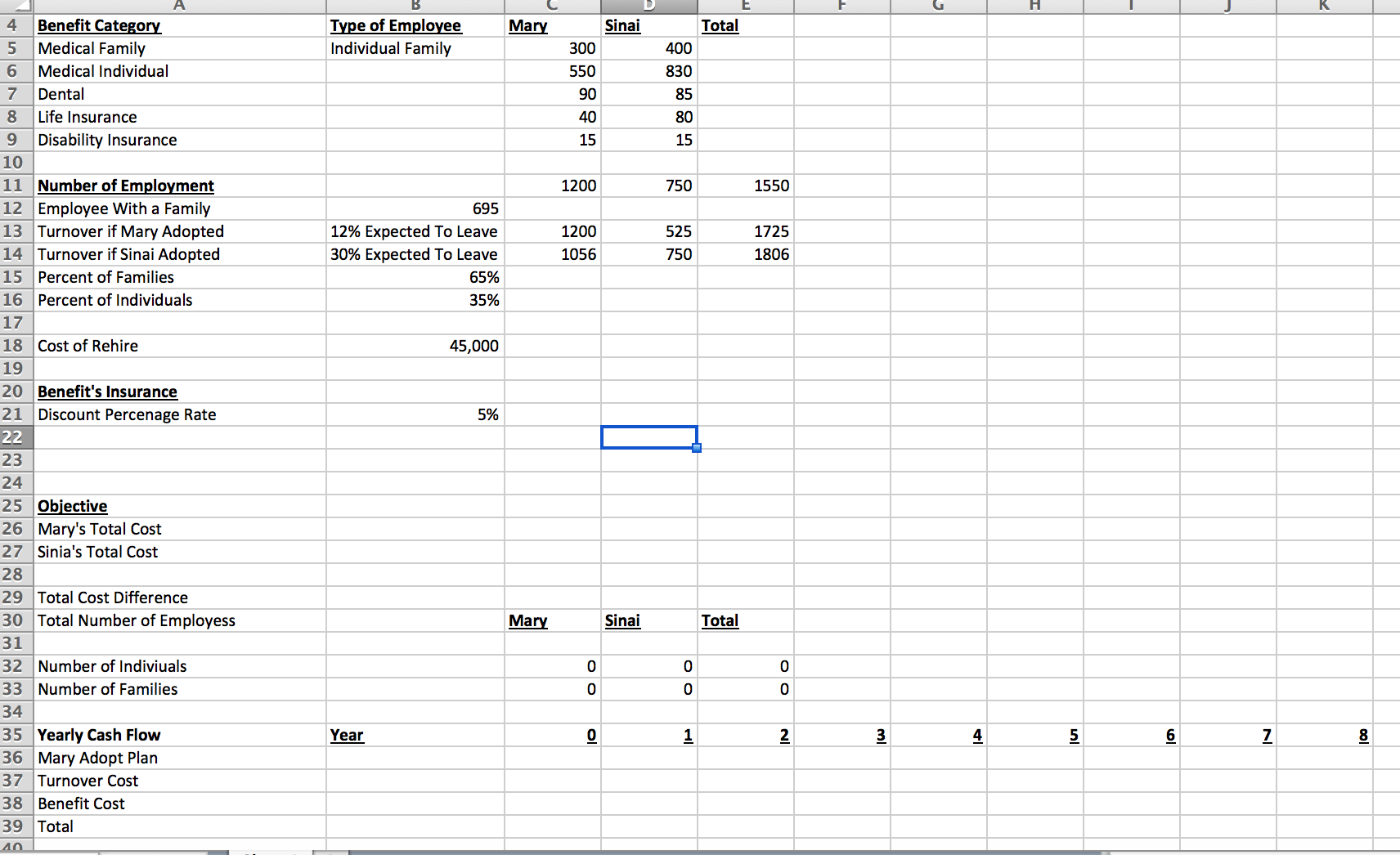

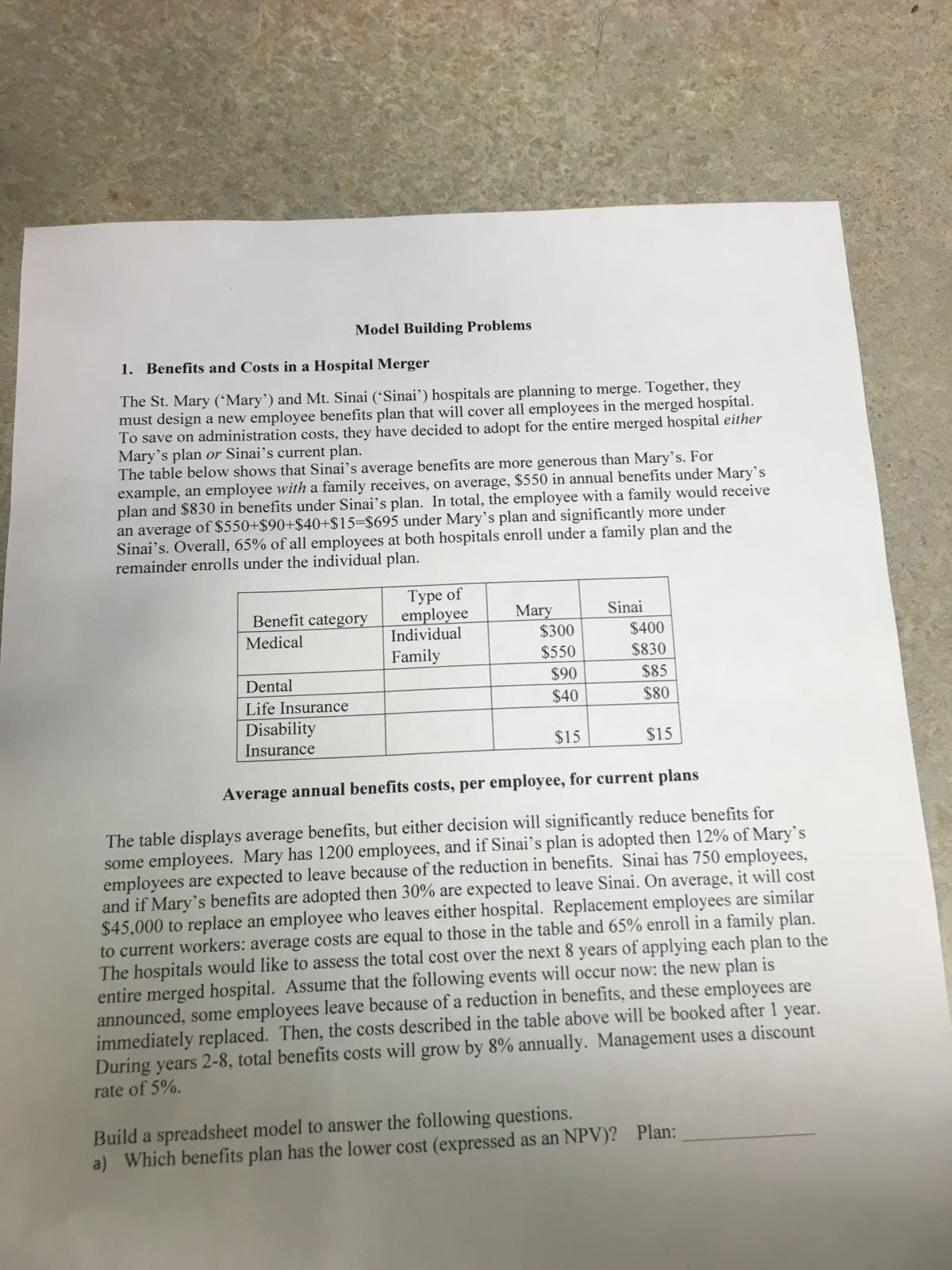

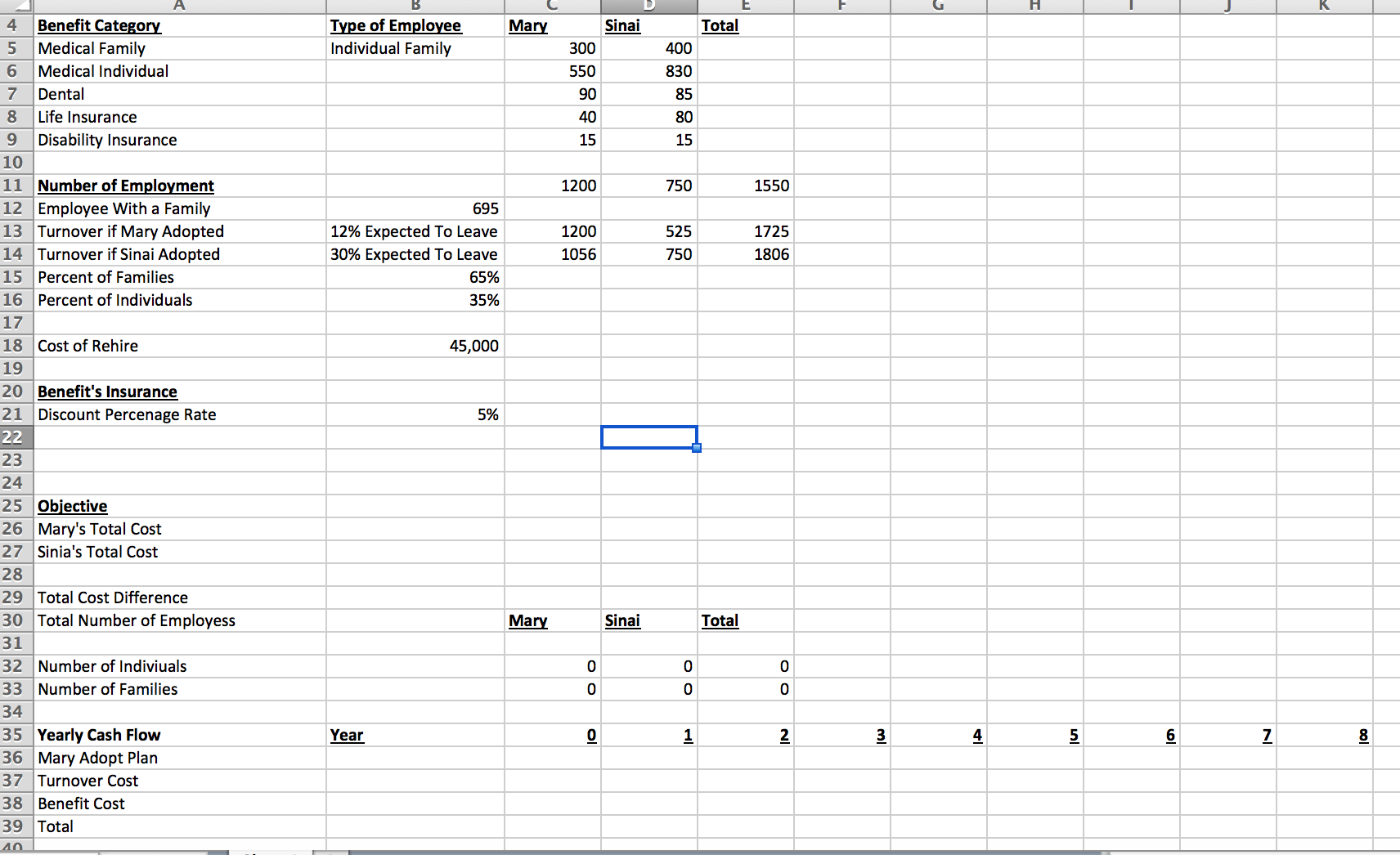

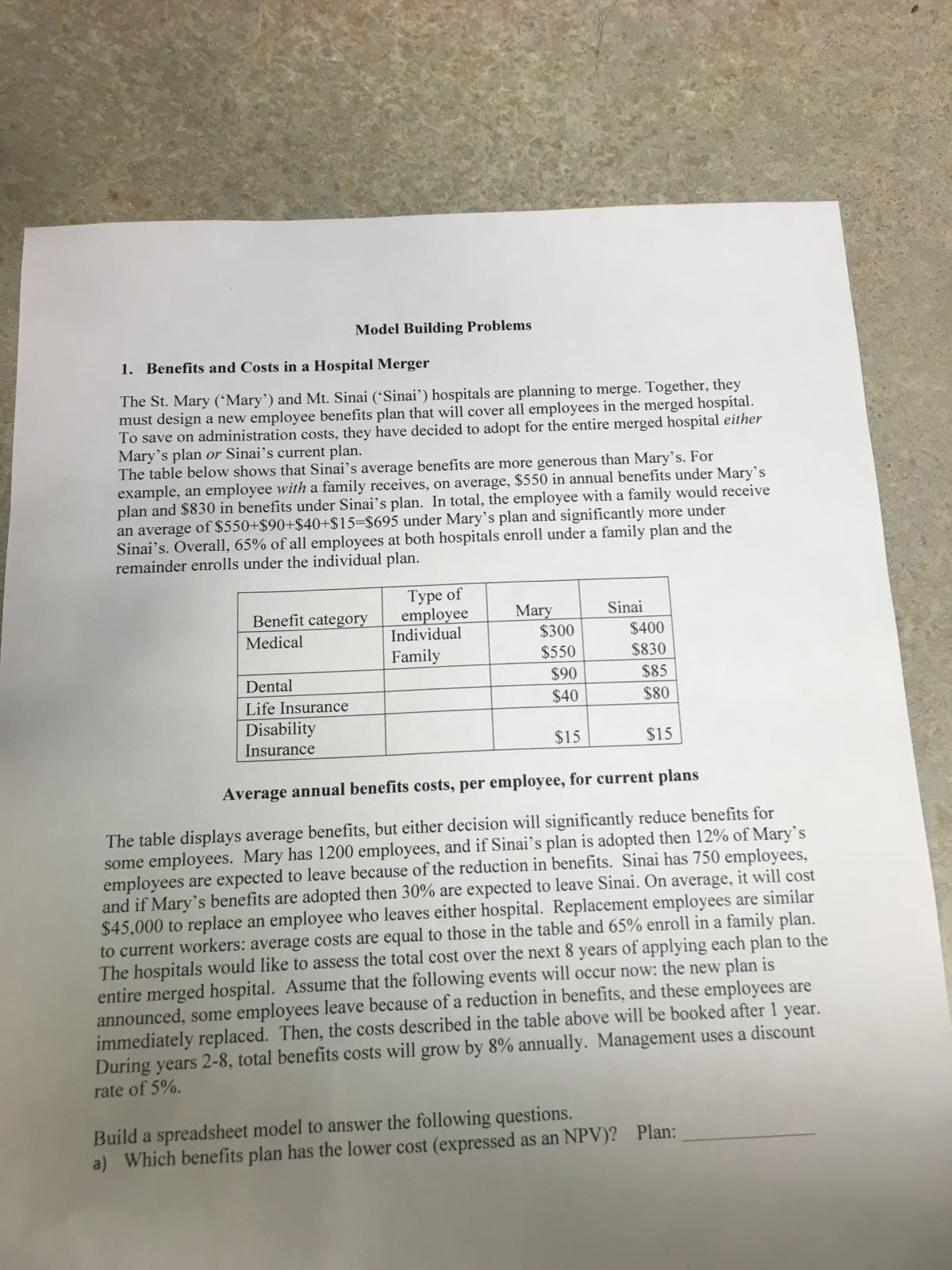

The St. Mary('May") and Mt. Sinai('Sinai') hospitals are planning to merge. Together, they must design a new employee benefits plan that will cover all employees in the merged hospital. To save on administration costs, they have decided to adopt for the entire merged hospital either Mary's plan or Sinai's current plan. The table below shows that Sinai's average benefits are more generous than Mary's. For example, and employee with a family received, on average, $550 in annual benefits under Mary's plan and $830 in benefits under Sinai's plan. In total, the employee with a family would receive an average of $550+$90+$40+$15=$695 under Mary's plan and significantly more under Sinai's. overall, 65% of all employees at both hospitals enroll under a family plan and the remainder enrolls under the individual plan. The table displays average benefits, but either decision will significantly reduce benefits for some employee. Mary has 1200 employees, and if Sinai's plan is adopted then 12% of Mary's employees are expected to leave because of the reduction in benefits. Sinai has 750 employees, and if Mary's benefits are adopted then 30% are expected to leave Sinai. On average, it will cost $45,000 to replace an employee who leaves either hospital. Replacement employees are similar to current workers: average costs are equal to those in the table and 65% enroll in a family plan. The hospitals would like to assess the total cost over the next 8 years of applying each plan to e=the entire merged hospital. Assume that the following events will occur now: the new plan is announce, some employees leave because of a reduction in benefits, and these employees are immediately replaces. Then, the costs described in the table above will be bookd after 1 year. During years 2-8, total benefits costs will grow by 8% annually. Management uses a discount rate of 5% Build a spreadsheet model to answer the following questions: Which benefits plan has the lower cost (expressed as an NPV)? Plan: The St. Mary('May") and Mt. Sinai('Sinai') hospitals are planning to merge. Together, they must design a new employee benefits plan that will cover all employees in the merged hospital. To save on administration costs, they have decided to adopt for the entire merged hospital either Mary's plan or Sinai's current plan. The table below shows that Sinai's average benefits are more generous than Mary's. For example, and employee with a family received, on average, $550 in annual benefits under Mary's plan and $830 in benefits under Sinai's plan. In total, the employee with a family would receive an average of $550+$90+$40+$15=$695 under Mary's plan and significantly more under Sinai's. overall, 65% of all employees at both hospitals enroll under a family plan and the remainder enrolls under the individual plan. The table displays average benefits, but either decision will significantly reduce benefits for some employee. Mary has 1200 employees, and if Sinai's plan is adopted then 12% of Mary's employees are expected to leave because of the reduction in benefits. Sinai has 750 employees, and if Mary's benefits are adopted then 30% are expected to leave Sinai. On average, it will cost $45,000 to replace an employee who leaves either hospital. Replacement employees are similar to current workers: average costs are equal to those in the table and 65% enroll in a family plan. The hospitals would like to assess the total cost over the next 8 years of applying each plan to e=the entire merged hospital. Assume that the following events will occur now: the new plan is announce, some employees leave because of a reduction in benefits, and these employees are immediately replaces. Then, the costs described in the table above will be bookd after 1 year. During years 2-8, total benefits costs will grow by 8% annually. Management uses a discount rate of 5% Build a spreadsheet model to answer the following questions: Which benefits plan has the lower cost (expressed as an NPV)? Plan

So Far Have:

So Far Have: