Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Statement: Suggest your choice of leasing vs. owning to the business owner supported by calculations. Also answer the following questions: a) What is the

Problem Statement: Suggest your choice of leasing vs. owning to the business owner supported by calculations. Also answer the following questions: a) What is the net present value cost of owing? b) What is the net present value cost of leasing? c) What is the net advantage of Leasing?

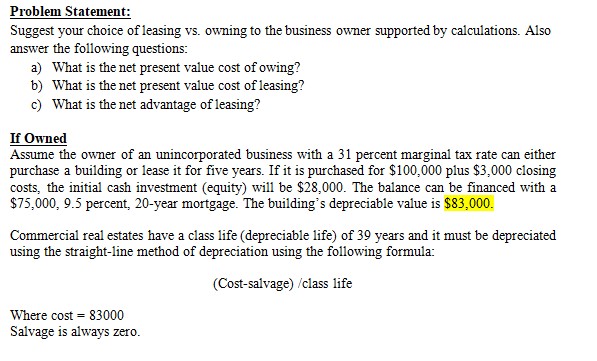

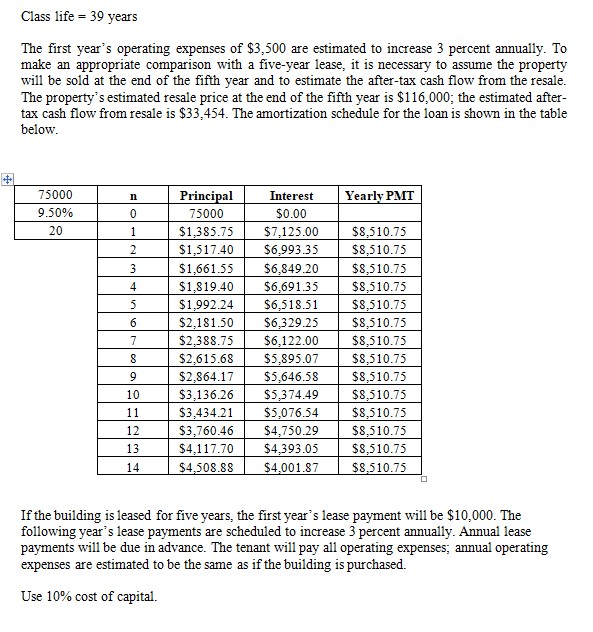

Problem Statement: Suggest your choice of leasing vs. owning to the business owner supported by calculations. Also answer the following questions: a) What is the net present value cost of owing? b) What is the net present value cost of leasing? c) What is the net advantage of leasing? If Owned Assume the owner of an unincorporated business with a 31 percent marginal tax rate can either purchase a building or lease it for five years. If it is purchased for $100,000 plus $3,000 closing costs, the initial cash investment (equity) will be $28,000. The balance can be financed with a $75,000,9.5 percent, 20 -year mortgage. The building's depreciable value is $83,000. Commercial real estates have a class life (depreciable life) of 39 years and it must be depreciated using the straight-line method of depreciation using the following formula: (Cost-salvage)/class life Where cost =83000 Salvage is always zero. Class life =39 years The first year's operating expenses of $3,500 are estimated to increase 3 percent annually. To make an appropriate comparison with a five-year lease, it is necessary to assume the property will be sold at the end of the fifth year and to estimate the after-tax cash flow from the resale. The property's estimated resale price at the end of the fifth year is $116,000; the estimated aftertax cash flow from resale is $33,454. The amortization schedule for the loan is shown in the table below. 55 If the building is leased for five years, the first year's lease payment will be $10,000. The following year's lease payments are scheduled to increase 3 percent annually. Annual lease payments will be due in advance. The tenant will pay all operating expenses; annual operating expenses are estimated to be the same as if the building is purchased. Use 10% cost of capital

Problem Statement: Suggest your choice of leasing vs. owning to the business owner supported by calculations. Also answer the following questions: a) What is the net present value cost of owing? b) What is the net present value cost of leasing? c) What is the net advantage of leasing? If Owned Assume the owner of an unincorporated business with a 31 percent marginal tax rate can either purchase a building or lease it for five years. If it is purchased for $100,000 plus $3,000 closing costs, the initial cash investment (equity) will be $28,000. The balance can be financed with a $75,000,9.5 percent, 20 -year mortgage. The building's depreciable value is $83,000. Commercial real estates have a class life (depreciable life) of 39 years and it must be depreciated using the straight-line method of depreciation using the following formula: (Cost-salvage)/class life Where cost =83000 Salvage is always zero. Class life =39 years The first year's operating expenses of $3,500 are estimated to increase 3 percent annually. To make an appropriate comparison with a five-year lease, it is necessary to assume the property will be sold at the end of the fifth year and to estimate the after-tax cash flow from the resale. The property's estimated resale price at the end of the fifth year is $116,000; the estimated aftertax cash flow from resale is $33,454. The amortization schedule for the loan is shown in the table below. 55 If the building is leased for five years, the first year's lease payment will be $10,000. The following year's lease payments are scheduled to increase 3 percent annually. Annual lease payments will be due in advance. The tenant will pay all operating expenses; annual operating expenses are estimated to be the same as if the building is purchased. Use 10% cost of capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started