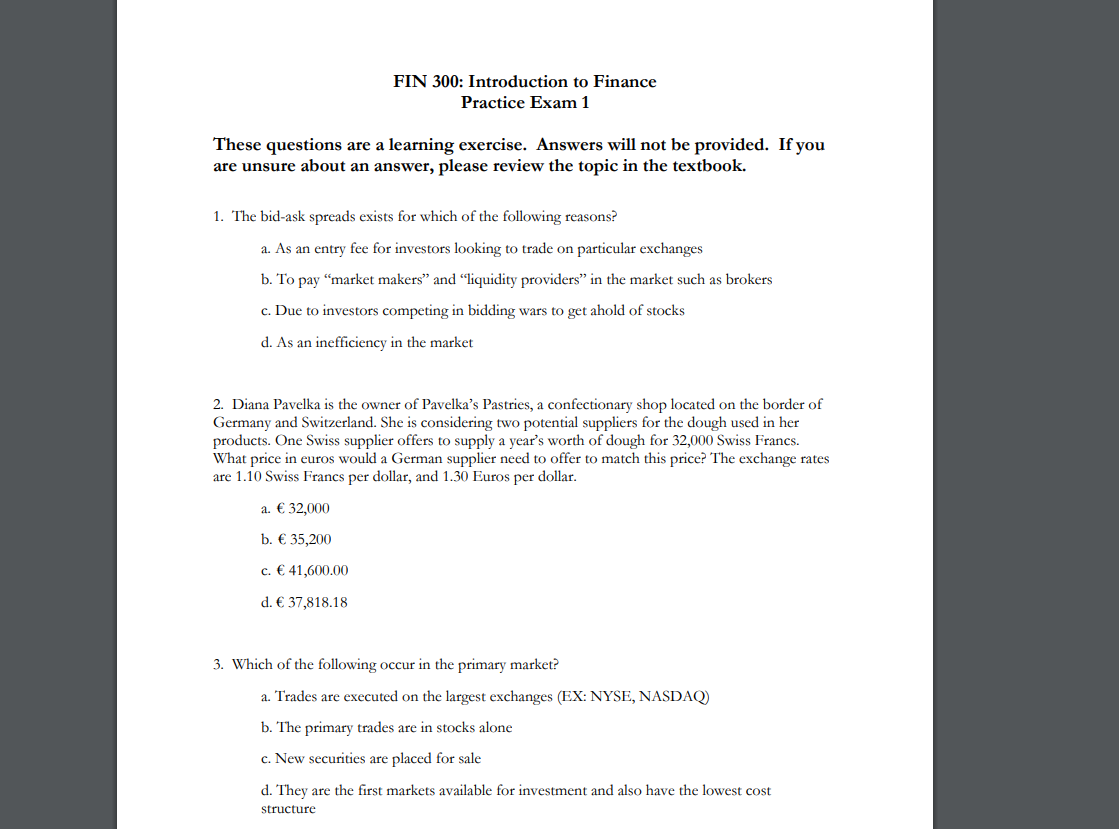

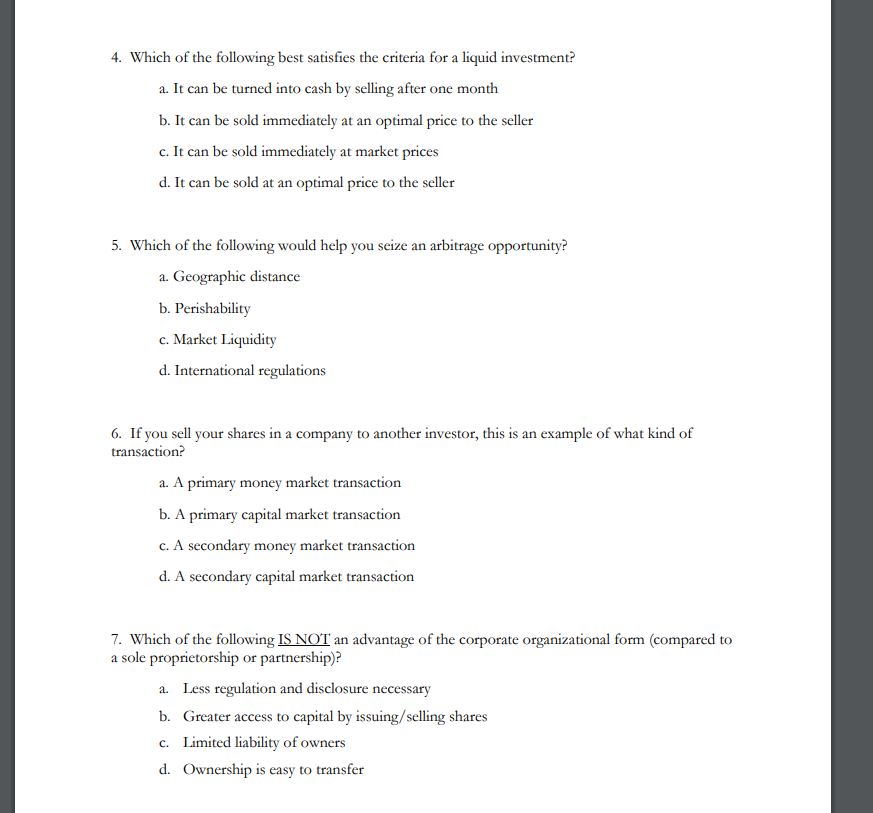

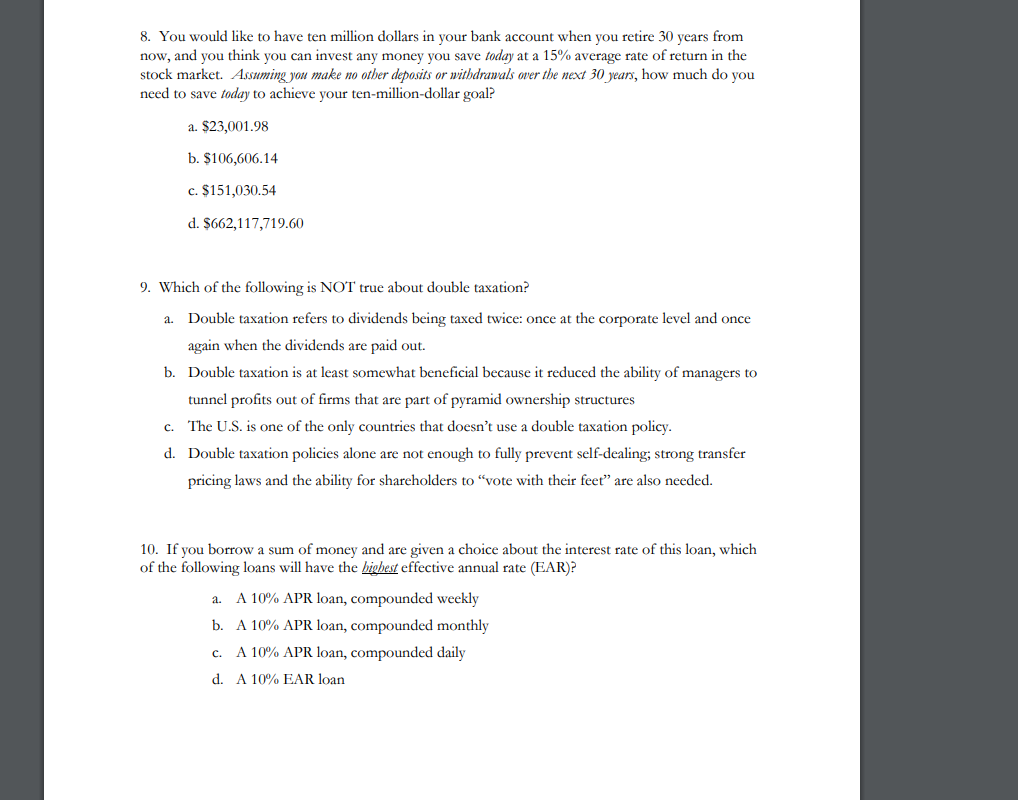

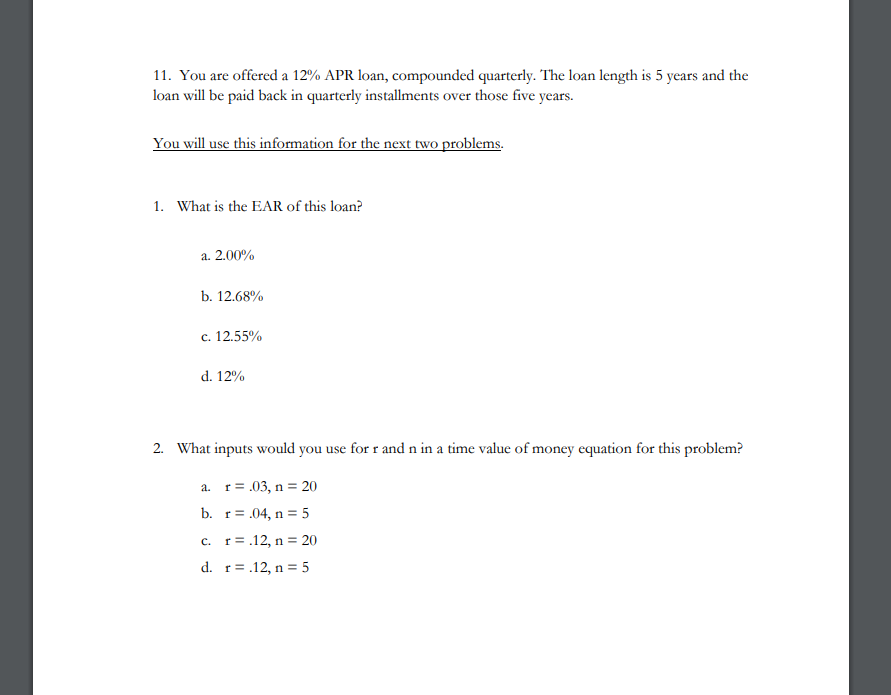

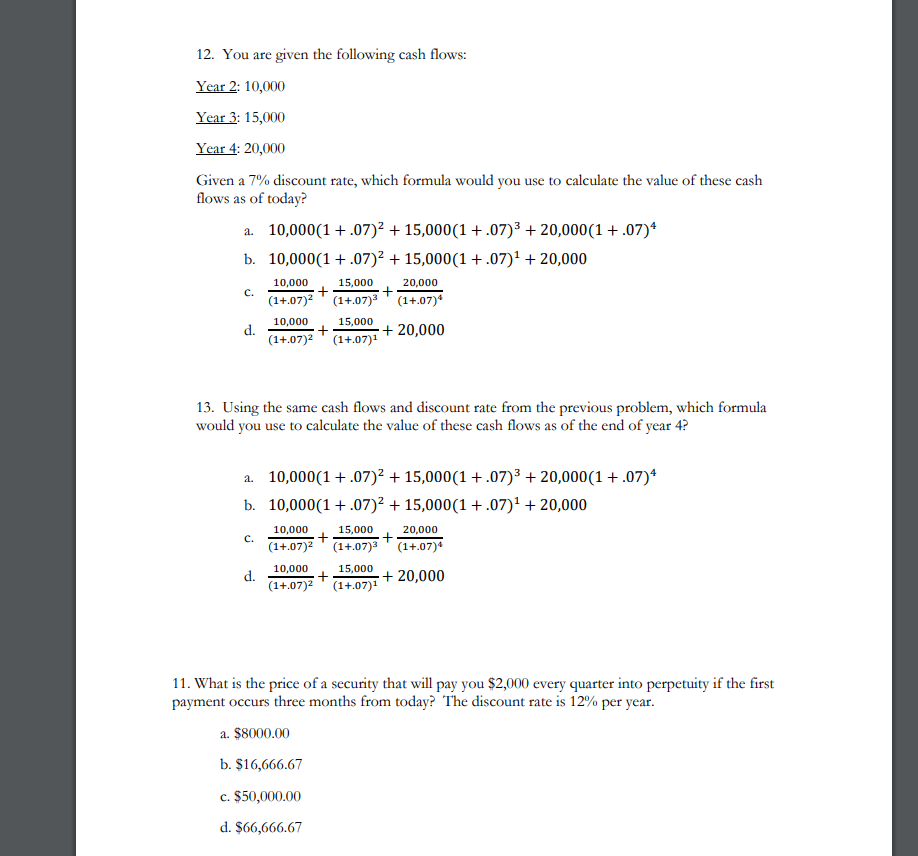

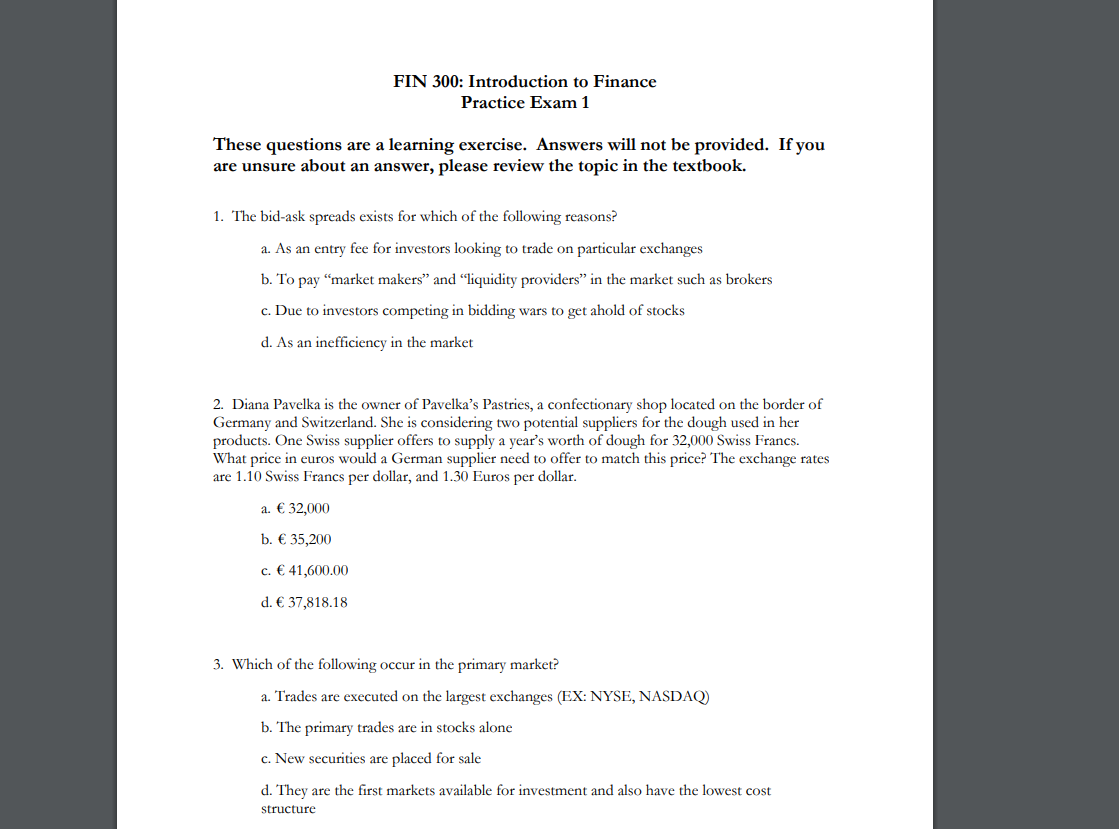

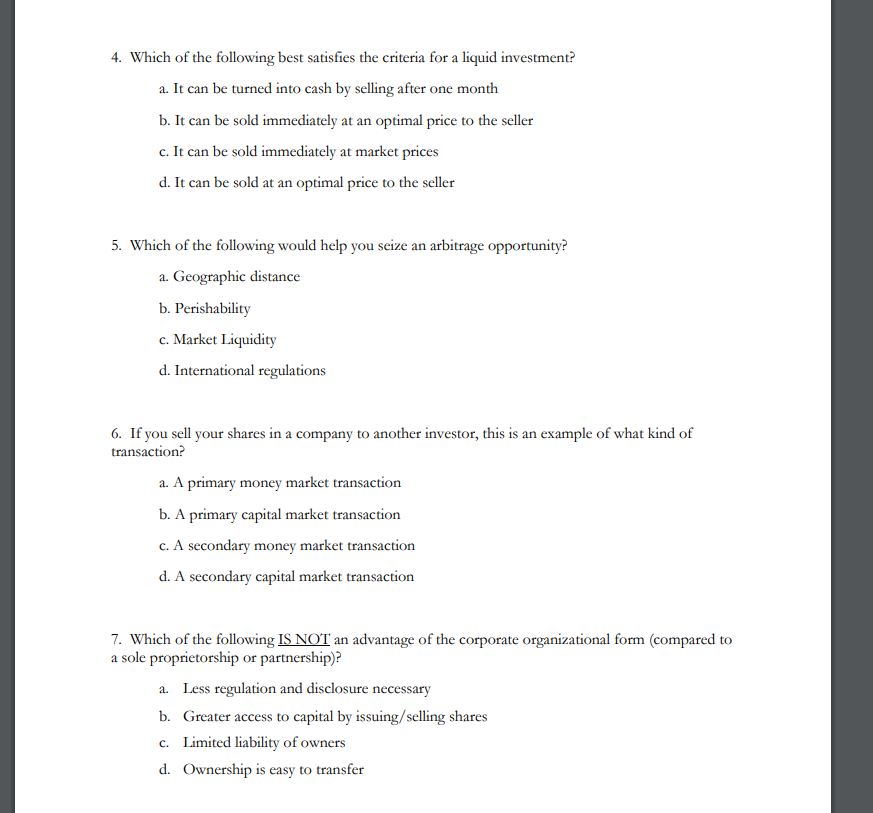

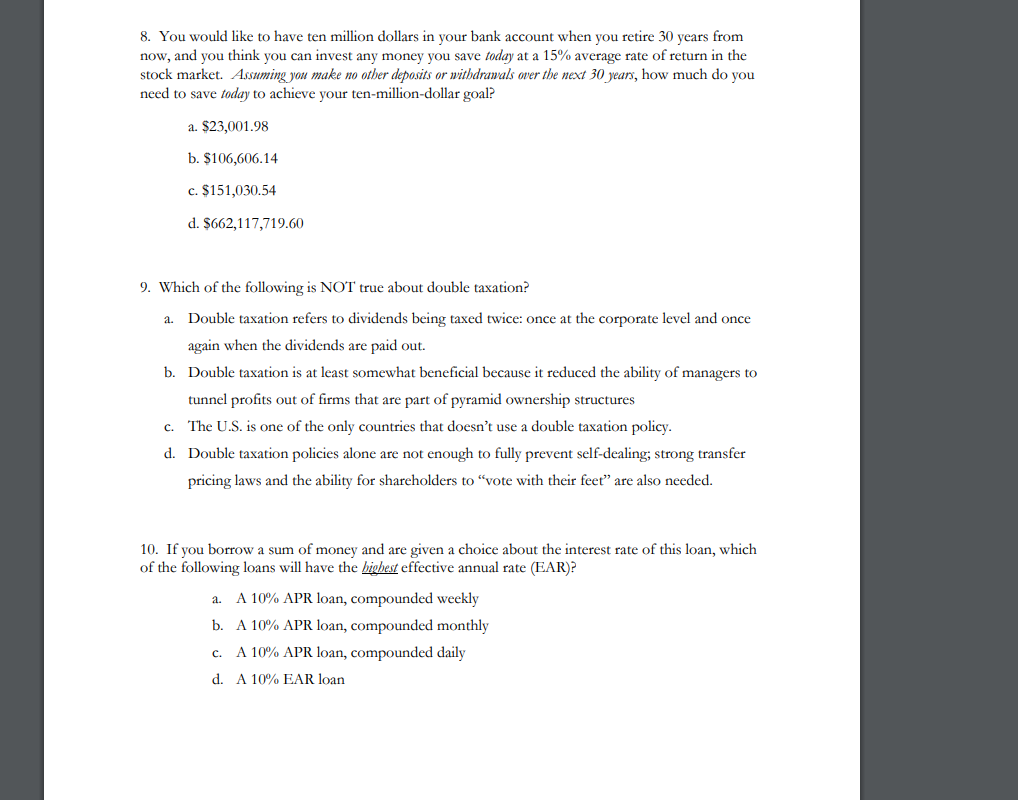

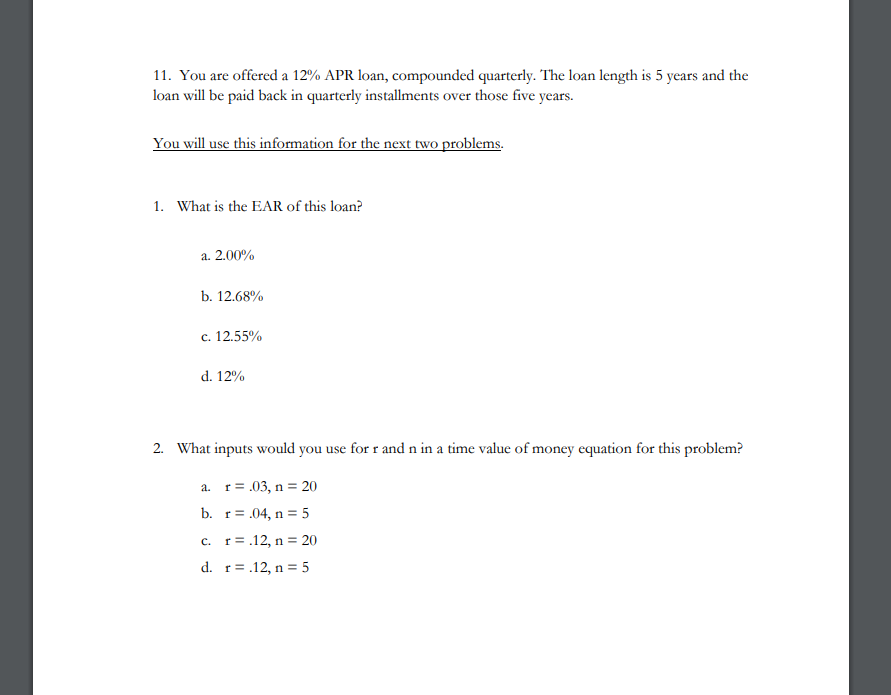

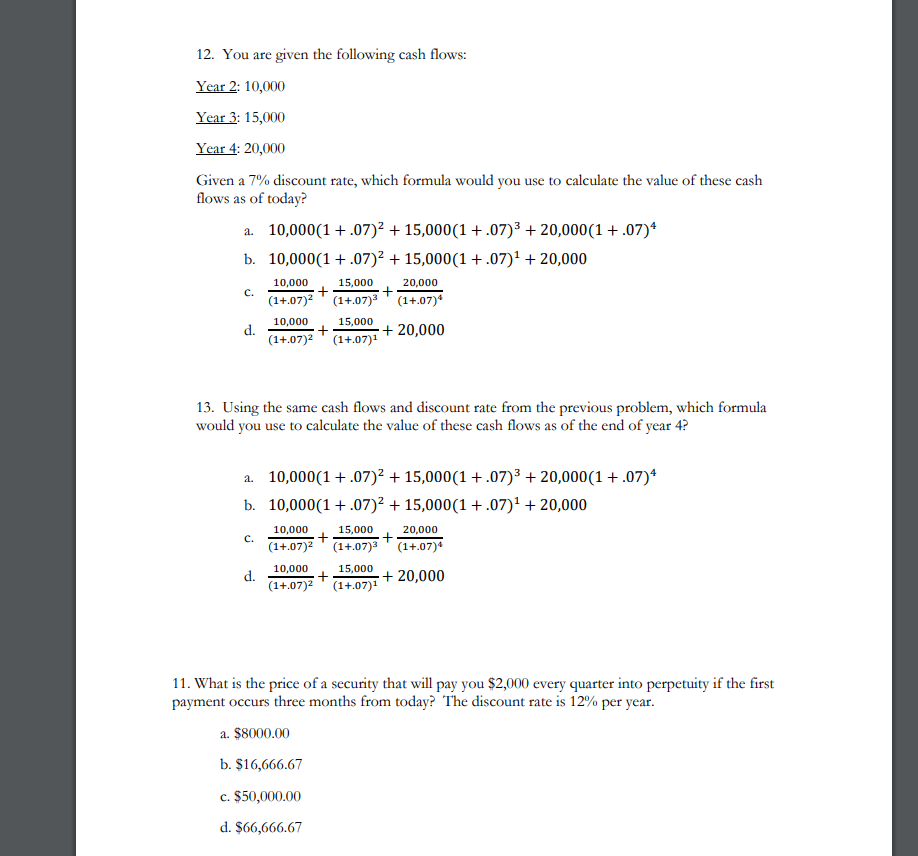

These questions are a learning exercise. Answers will not be provided. If you are unsure about an answer, please review the topic in the textbook. 1. The bid-ask spreads exists for which of the following reasons? a. As an entry fee for investors looking to trade on particular exchanges b. To pay "market makers" and "liquidity providers" in the market such as brokers c. Due to investors competing in bidding wars to get ahold of stocks d. As an inefficiency in the market 2. Diana Pavelka is the owner of Pavelka's Pastries, a confectionary shop located on the border of Germany and Switzerland. She is considering two potential suppliers for the dough used in her products. One Swiss supplier offers to supply a year's worth of dough for 32,000 Swiss Francs. What price in euros would a German supplier need to offer to match this price? The exchange rates are 1.10 Swiss Francs per dollar, and 1.30 Euros per dollar. a. 32,000 b. 35,200 c. 41,600.00 d. 37,818.18 3. Which of the following occur in the primary market? a. Trades are executed on the largest exchanges (EX: NYSE, NASDAQ) b. The primary trades are in stocks alone c. New securities are placed for sale d. They are the first markets available for investment and also have the lowest cost structure 4. Which of the following best satisfies the criteria for a liquid investment? a. It can be turned into cash by selling after one month b. It can be sold immediately at an optimal price to the seller c. It can be sold immediately at market prices d. It can be sold at an optimal price to the seller 5. Which of the following would help you seize an arbitrage opportunity? a. Geographic distance b. Perishability c. Market Liquidity d. International regulations 6. If you sell your shares in a company to another investor, this is an example of what kind of transaction? a. A primary money market transaction b. A primary capital market transaction c. A secondary money market transaction d. A secondary capital market transaction 7. Which of the following IS NOT an advantage of the corporate organizational form (compared to a sole proprietorship or partnership)? a. Less regulation and disclosure necessary b. Greater access to capital by issuing/selling shares c. Limited liability of owners d. Ownership is easy to transfer 8. You would like to have ten million dollars in your bank account when you retire 30 years from now, and you think you can invest any money you save today at a 15% average rate of return in the stock market. Assuming you make no otber deposits or withdravals over the next 30 years, how much do you need to save today to achieve your ten-million-dollar goal? a. $23,001.98 b. $106,606.14 c. $151,030.54 d. $662,117,719.60 9. Which of the following is NOT true about double taxation? a. Double taxation refers to dividends being taxed twice: once at the corporate level and once again when the dividends are paid out. b. Double taxation is at least somewhat beneficial because it reduced the ability of managers to tunnel profits out of firms that are part of pyramid ownership structures c. 'The U.S. is one of the only countries that doesn't use a double taxation policy. d. Double taxation policies alone are not enough to fully prevent self-dealing; strong transfer pricing laws and the ability for shareholders to "vote with their feet" are also needed. 10. If you borrow a sum of money and are given a choice about the interest rate of this loan, which of the following loans will have the highest effective annual rate (EAR)? a. A 10% APR loan, compounded weekly b. A 10% APR loan, compounded monthly c. A 10% APR loan, compounded daily d. A 10% EAR loan 11. You are offered a 12% APR loan, compounded quarterly. The loan length is 5 years and the loan will be paid back in quarterly installments over those five years. You will use this information for the next two problems. 1. What is the EAR of this loan? a. 2.00% b. 12.68% c. 12.55% d. 12% 2. What inputs would you use for r and n in a time value of money equation for this problem? a. r=.03,n=20 b. r=.04,n=5 c. r=.12,n=20 d. r=.12,n=5 Given a 7% discount rate, which formula would you use to calculate the value of these cash flows as of today? a. 10,000(1+.07)2+15,000(1+.07)3+20,000(1+.07)4 b. 10,000(1+.07)2+15,000(1+.07)1+20,000 c. (1+.07)210,000+(1+.07)315,000+(1+.07)420,000 d. (1+.07)210,000+(1+.07)115,000+20,000 13. Using the same cash flows and discount rate from the previous problem, which formula would you use to calculate the value of these cash flows as of the end of year 4 ? a. 10,000(1+.07)2+15,000(1+.07)3+20,000(1+.07)4 b. 10,000(1+.07)2+15,000(1+.07)1+20,000 c. (1+.07)210,000+(1+.07)315,000+(1+.07)420,000 d. (1+.07)210,000+(1+.07)115,000+20,000 11. What is the price of a security that will pay you $2,000 every quarter into perpetuity if the first payment occurs three months from today? The discount rate is 12% per year. a. $8000.00 b. $16,666.67 c. $50,000.00 d. $66,666.67