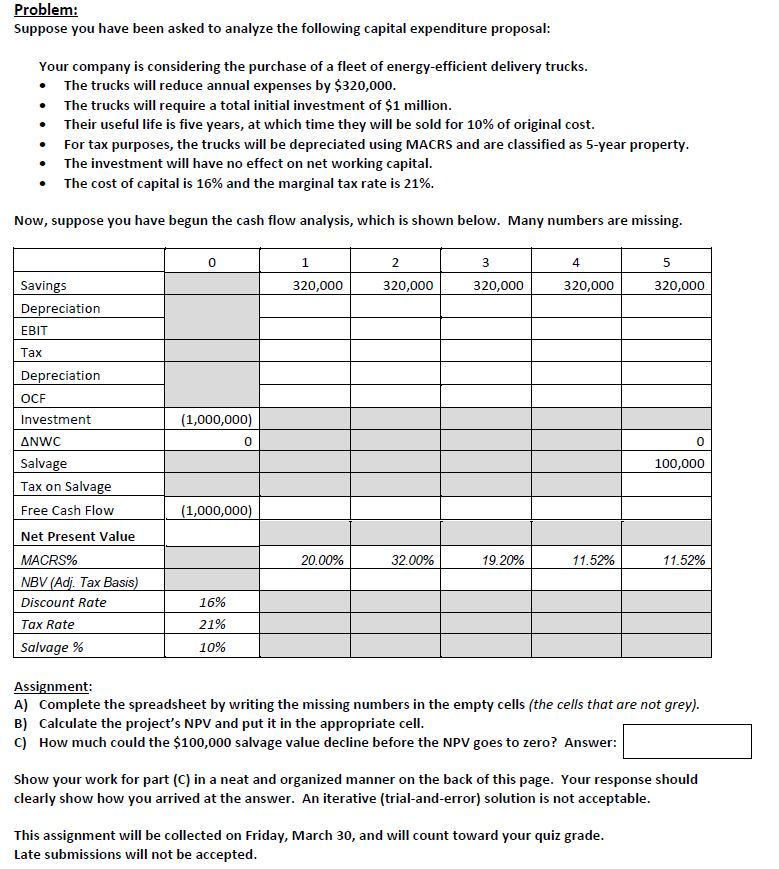

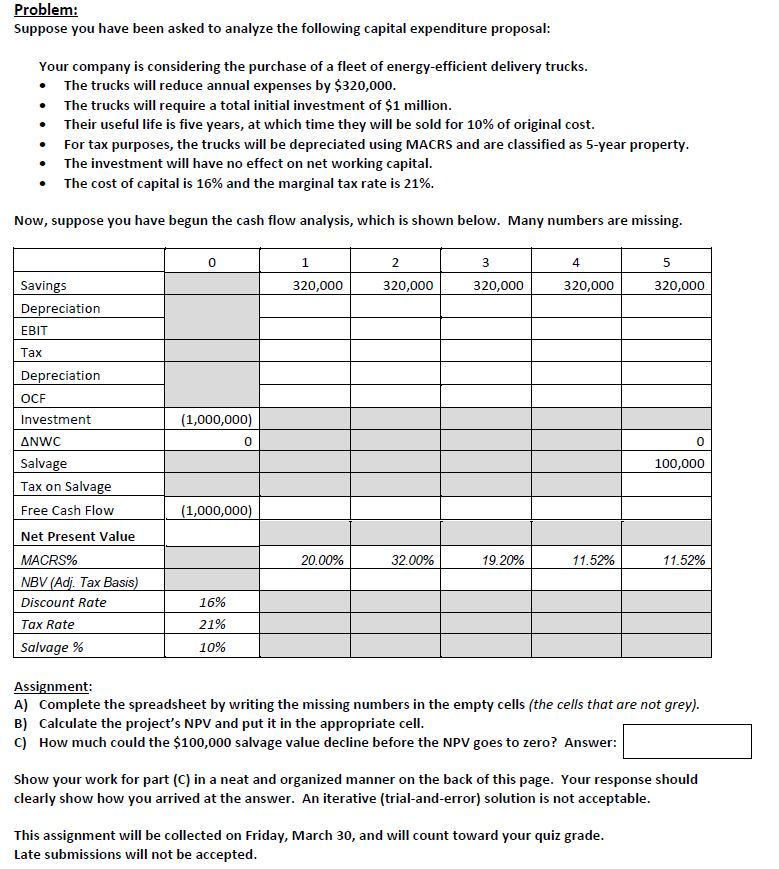

Problem: Suppose you have been asked to analyze the following capital expenditure proposal: Your company is considering the purchase of a fleet of energy-efficient delivery trucks . The trucks will reduce annual expenses by $320,000 . The trucks will require a total initial investment of $1 million . Their useful life is five years, at which time they will be sold for 10% of original cost .For tax purposes, the trucks will be depreciated using MACRS and are classified as 5-year property The investment will have no effect on net working capital The cost of capital is 16% and the marginal tax rate is 21%. Now, suppose you have begun the cash flow analysis, which is shown below. Many numbers are missing 0 2 4 5 Saving Depreciation EBIT 320,000 320,000 320,000 320,000 320,000 Depreciation OCF Investment (1,000,000) 0 0 Salvage Tax on Salvage Free Cash Flow Net Present Value MACRS% NBV (Adi. Tax Basis Discount Rate Tax Rate Salvage % 100,000 1,000,000 20.00% 32 0096 19.20% 11.52% 11.52% 16% 21% 10% Assignment A) Complete the spreadsheet by writing the missing numbers in the empty cells (the cells that are not grey). B) Calculate the project's NPV and put it in the appropriate cell C) How much could the $100,000 salvage value decline before the NPV goes to zero? Answer: Show your work for part (C) in a neat and organized manner on the back of this page. Your response should clearly show how you arrived at the answer. An iterative (trial-and-error) solution is not acceptable This assignment will be collected on Friday, March 30, and will count toward your quiz grade Late submissions will not be accepted Problem: Suppose you have been asked to analyze the following capital expenditure proposal: Your company is considering the purchase of a fleet of energy-efficient delivery trucks . The trucks will reduce annual expenses by $320,000 . The trucks will require a total initial investment of $1 million . Their useful life is five years, at which time they will be sold for 10% of original cost .For tax purposes, the trucks will be depreciated using MACRS and are classified as 5-year property The investment will have no effect on net working capital The cost of capital is 16% and the marginal tax rate is 21%. Now, suppose you have begun the cash flow analysis, which is shown below. Many numbers are missing 0 2 4 5 Saving Depreciation EBIT 320,000 320,000 320,000 320,000 320,000 Depreciation OCF Investment (1,000,000) 0 0 Salvage Tax on Salvage Free Cash Flow Net Present Value MACRS% NBV (Adi. Tax Basis Discount Rate Tax Rate Salvage % 100,000 1,000,000 20.00% 32 0096 19.20% 11.52% 11.52% 16% 21% 10% Assignment A) Complete the spreadsheet by writing the missing numbers in the empty cells (the cells that are not grey). B) Calculate the project's NPV and put it in the appropriate cell C) How much could the $100,000 salvage value decline before the NPV goes to zero? Answer: Show your work for part (C) in a neat and organized manner on the back of this page. Your response should clearly show how you arrived at the answer. An iterative (trial-and-error) solution is not acceptable This assignment will be collected on Friday, March 30, and will count toward your quiz grade Late submissions will not be accepted