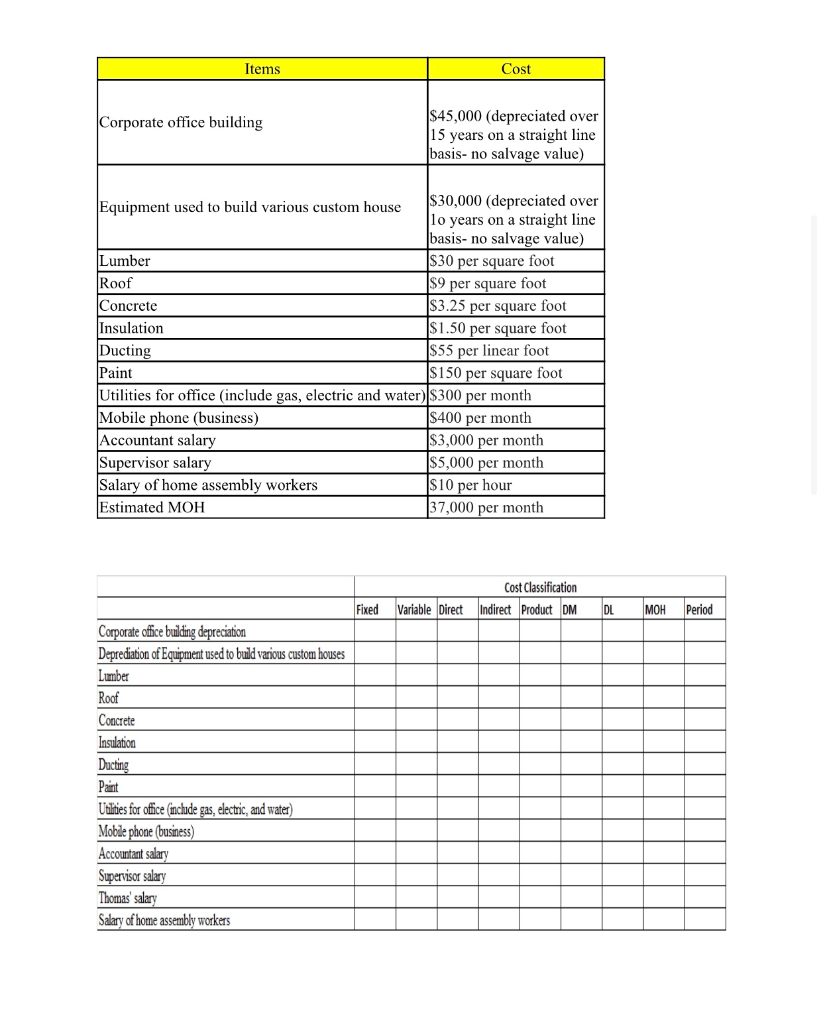

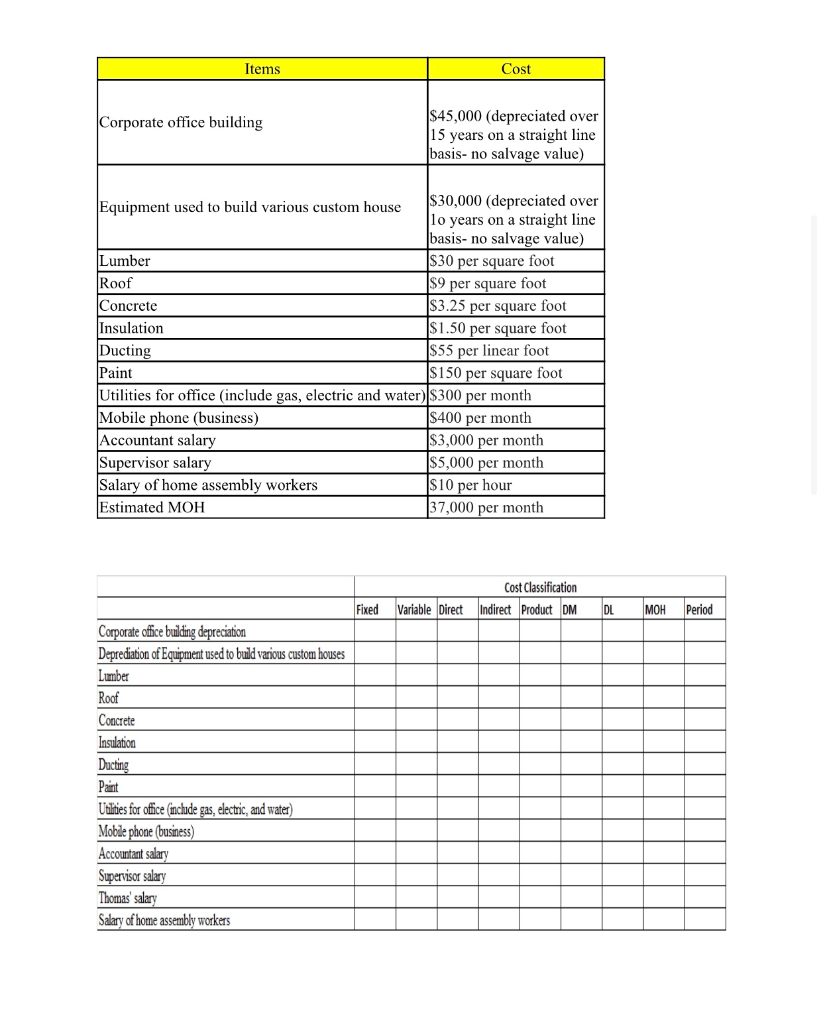

Problem Thomas plans to set up a business that build custom house for high net-worth customers in Upstate NY on January 1, 2018. He would borrow $1,500,000 from a bank to invest in the business as star-up capital and receive a minimum salary of $5,000/month. Cost Classification (Assignment #1) Here is the list of some related items or products that he would need to start the business: - Lumber - Roof - Concrete - Insulation - Ducting - Paint - Corporate office building He needs to hire you as an accountant to help his financial and accounting work, and one supervisor who is in charge of the supervision of building custom houses. His business' cost drivers are provided in Table 1. Required: Thomas needs your help in classifying the various costs. In order to manage these costs, he wants them identified using the information below. He asked that you use Table 2 (page 3) for your answers. a) Behavior: fixed or variable cost b) Traceability: direct or indirect c) Financial reporting: product or period d) If product cost, identify which items are direct materials, direct labor or manufacturing overhead. Costing Systems (Assignment #2) Thomas discussed the business plan with you. He was told that there are three different types of costing systems that exist in organizations - job order, process costing and activity based costing Required: Which type of costing system is his business most likely to use? Discuss? Items Cost Corporate office building $45,000 (depreciated over 15 years on a straight line basis- no salvage value) Roof Equipment used to build various custom house $30,000 (depreciated over lo years on a straight line basis- no salvage value) Lumber $30 per square foot $9 per square foot Concrete $3.25 per square foot Insulation $1.50 per square foot Ducting $55 per linear foot $150 per square foot Utilities for office (include gas, electric and water)|$300 per month Mobile phone (business) $400 per month Accountant salary $3,000 per month Supervisor salary $5,000 per month Salary of home assembly workers $10 per hour Estimated MOH 37,000 per month Paint Cost Classification Indirect Product DM Fixed Variable Direct D L MOH Period Corporate office building depreciation Deprediation of Equipment used to build various custom houses Lumber Roof Concrete Insulation Ducting Paint Utilities for office (include gas, electric, and water) Mobile phone business) Accountant salary Supervisor salary Thomas' salary Salary of home assembly workers Problem Thomas plans to set up a business that build custom house for high net-worth customers in Upstate NY on January 1, 2018. He would borrow $1,500,000 from a bank to invest in the business as star-up capital and receive a minimum salary of $5,000/month. Cost Classification (Assignment #1) Here is the list of some related items or products that he would need to start the business: - Lumber - Roof - Concrete - Insulation - Ducting - Paint - Corporate office building He needs to hire you as an accountant to help his financial and accounting work, and one supervisor who is in charge of the supervision of building custom houses. His business' cost drivers are provided in Table 1. Required: Thomas needs your help in classifying the various costs. In order to manage these costs, he wants them identified using the information below. He asked that you use Table 2 (page 3) for your answers. a) Behavior: fixed or variable cost b) Traceability: direct or indirect c) Financial reporting: product or period d) If product cost, identify which items are direct materials, direct labor or manufacturing overhead. Costing Systems (Assignment #2) Thomas discussed the business plan with you. He was told that there are three different types of costing systems that exist in organizations - job order, process costing and activity based costing Required: Which type of costing system is his business most likely to use? Discuss? Items Cost Corporate office building $45,000 (depreciated over 15 years on a straight line basis- no salvage value) Roof Equipment used to build various custom house $30,000 (depreciated over lo years on a straight line basis- no salvage value) Lumber $30 per square foot $9 per square foot Concrete $3.25 per square foot Insulation $1.50 per square foot Ducting $55 per linear foot $150 per square foot Utilities for office (include gas, electric and water)|$300 per month Mobile phone (business) $400 per month Accountant salary $3,000 per month Supervisor salary $5,000 per month Salary of home assembly workers $10 per hour Estimated MOH 37,000 per month Paint Cost Classification Indirect Product DM Fixed Variable Direct D L MOH Period Corporate office building depreciation Deprediation of Equipment used to build various custom houses Lumber Roof Concrete Insulation Ducting Paint Utilities for office (include gas, electric, and water) Mobile phone business) Accountant salary Supervisor salary Thomas' salary Salary of home assembly workers