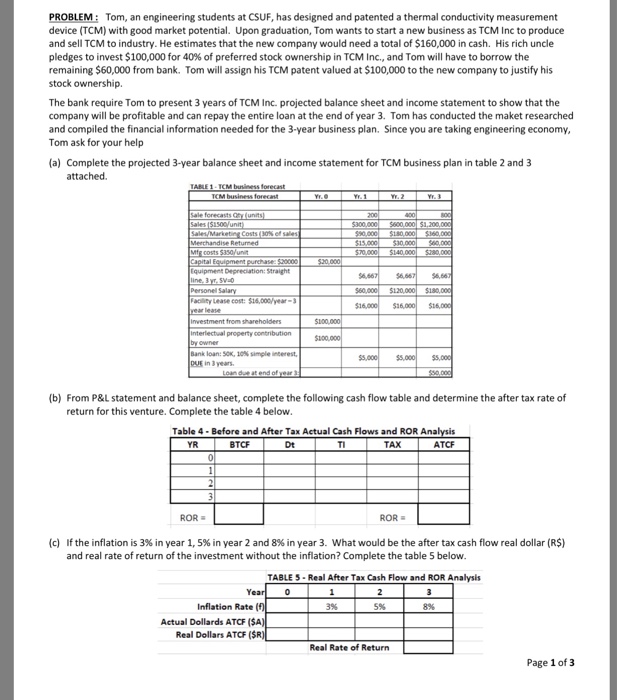

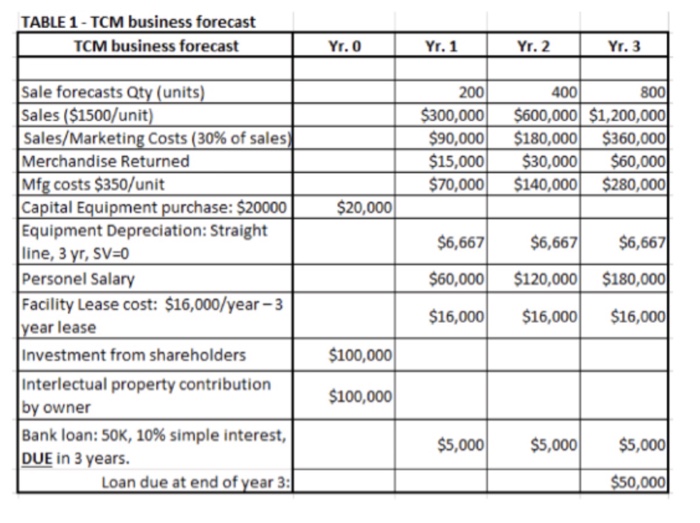

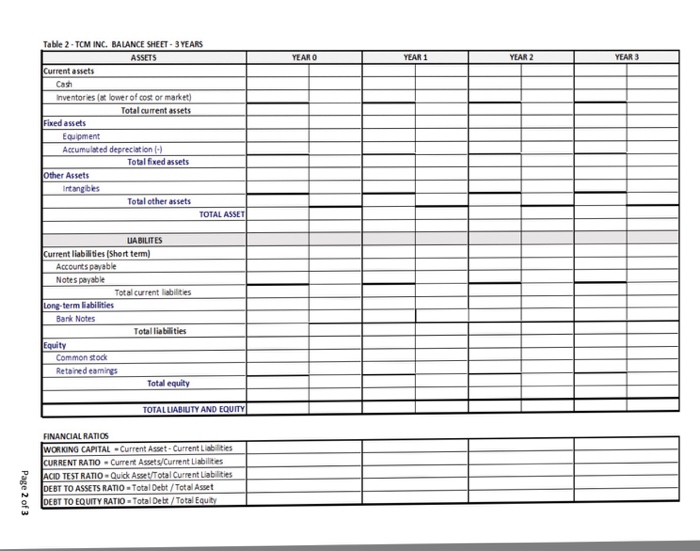

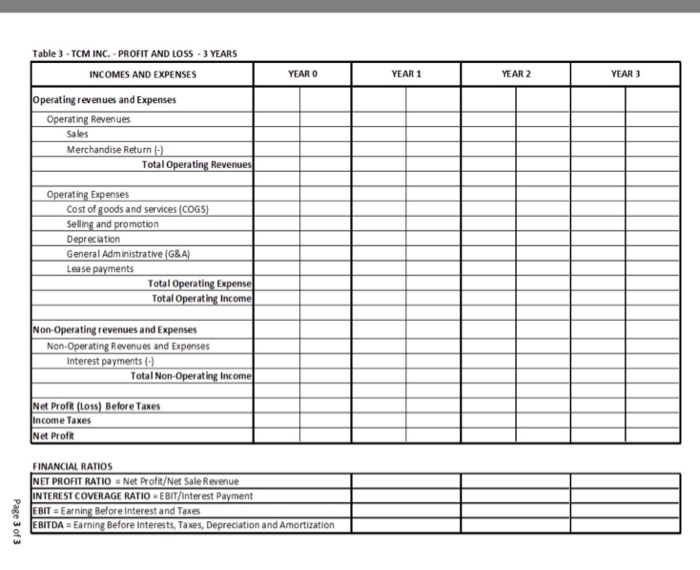

PROBLEM: Tom, an engineering students at CSUF, has designed and patented a thermal conductivity measurement device (TCM) with good market potential. Upon graduation, Tom wants to start a new business as TCM Inc to produce and sell TCM to industry. He estimates that the new company would need a total of $160,000 in cash. His rich uncle pledges to invest $100,000 for 40% of preferred stock ownership in TCM Inc., and Tom will have to borrow the remaining $60,000 from bank. Tom will assign his TCM patent valued at $100,000 to the new company to justify his stock ownership. The bank require Tom to present 3 years of TCM Inc. projected balance sheet and income statement to show that the company will be profitable and can repay the entire loan at the end of year 3. Tom has conducted the maket researched and compiled the financial information needed for the 3-year business plan. Since you are taking engineering economy Tom ask for your help Complete the projected 3-year balance sheet and income statement for TCM business plan in table 2 and 3 attached. (a) Costs 00% 6,66 Personel Salary Faolity Lease cost: $16,000year- $180, from shareholders Bank loan: 50K, 10% simple interest, in 3 years (b) From P&L statement and balance sheet, complete the following cash flow table and determine the after tax rate of return for this venture. Complete the table 4 below Table 4- Before and After Tax Actual Cash Flows and ROR Ana YR BTCF Dt TI TAX ATCF ROR ROR (c) If the inflation is 3% in year 1,5% in year 2 and 8% in year 3. what would be the after tax cash flow real dollar (R$) and real rate of return of the investment without the inflation? Complete the table 5 below TABLE 5- Real After Tax Cash Flow and ROR Analysis Inflation Rate 3% 5% 8% Actual Dollards ATCF (SA Real Dollars ATCF (SR) Real Rate of Return Page 1 of 3 PROBLEM: Tom, an engineering students at CSUF, has designed and patented a thermal conductivity measurement device (TCM) with good market potential. Upon graduation, Tom wants to start a new business as TCM Inc to produce and sell TCM to industry. He estimates that the new company would need a total of $160,000 in cash. His rich uncle pledges to invest $100,000 for 40% of preferred stock ownership in TCM Inc., and Tom will have to borrow the remaining $60,000 from bank. Tom will assign his TCM patent valued at $100,000 to the new company to justify his stock ownership. The bank require Tom to present 3 years of TCM Inc. projected balance sheet and income statement to show that the company will be profitable and can repay the entire loan at the end of year 3. Tom has conducted the maket researched and compiled the financial information needed for the 3-year business plan. Since you are taking engineering economy Tom ask for your help Complete the projected 3-year balance sheet and income statement for TCM business plan in table 2 and 3 attached. (a) Costs 00% 6,66 Personel Salary Faolity Lease cost: $16,000year- $180, from shareholders Bank loan: 50K, 10% simple interest, in 3 years (b) From P&L statement and balance sheet, complete the following cash flow table and determine the after tax rate of return for this venture. Complete the table 4 below Table 4- Before and After Tax Actual Cash Flows and ROR Ana YR BTCF Dt TI TAX ATCF ROR ROR (c) If the inflation is 3% in year 1,5% in year 2 and 8% in year 3. what would be the after tax cash flow real dollar (R$) and real rate of return of the investment without the inflation? Complete the table 5 below TABLE 5- Real After Tax Cash Flow and ROR Analysis Inflation Rate 3% 5% 8% Actual Dollards ATCF (SA Real Dollars ATCF (SR) Real Rate of Return Page 1 of 3