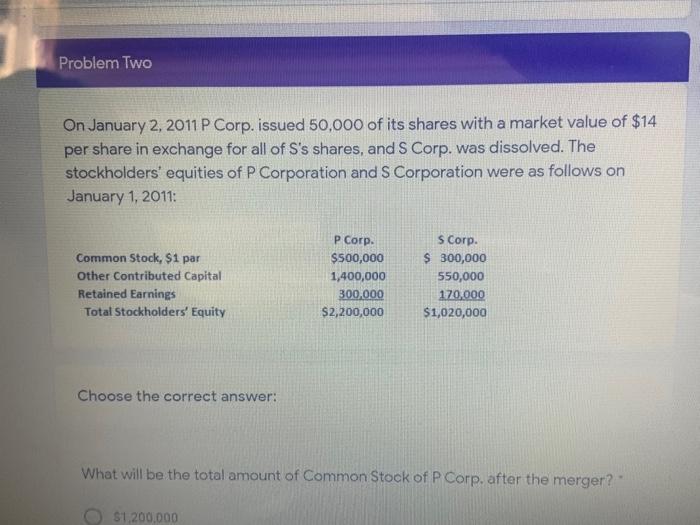

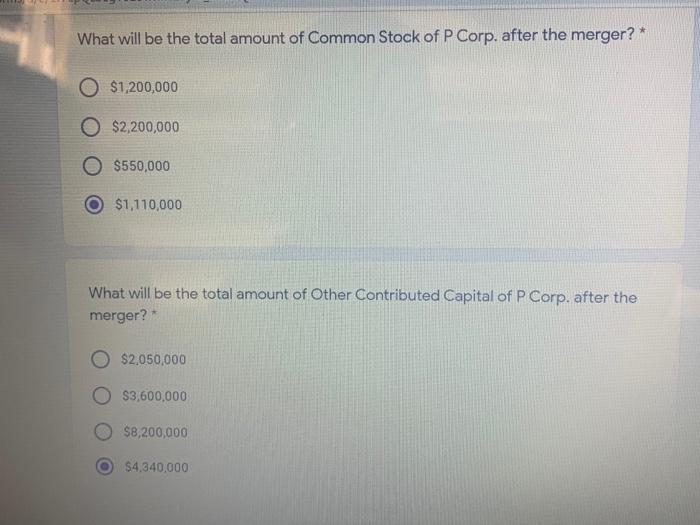

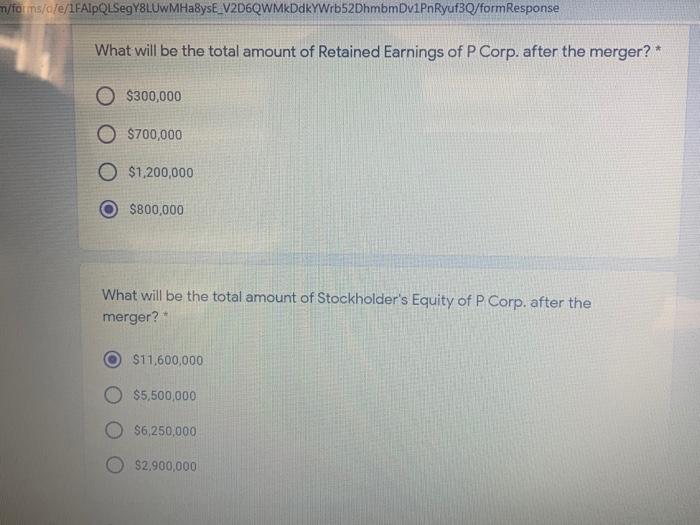

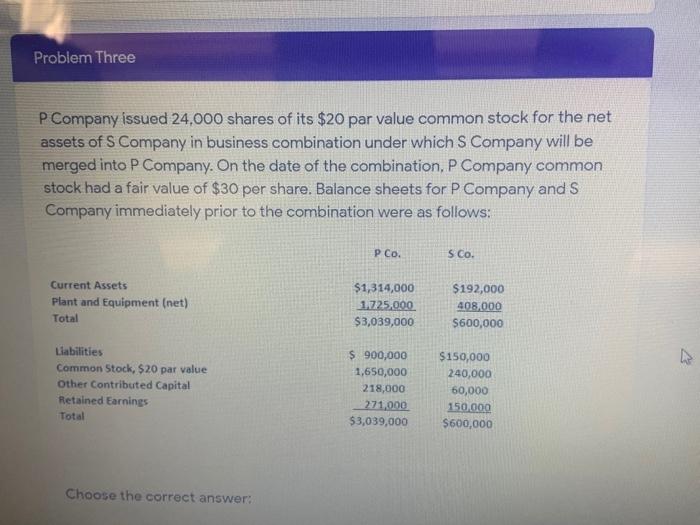

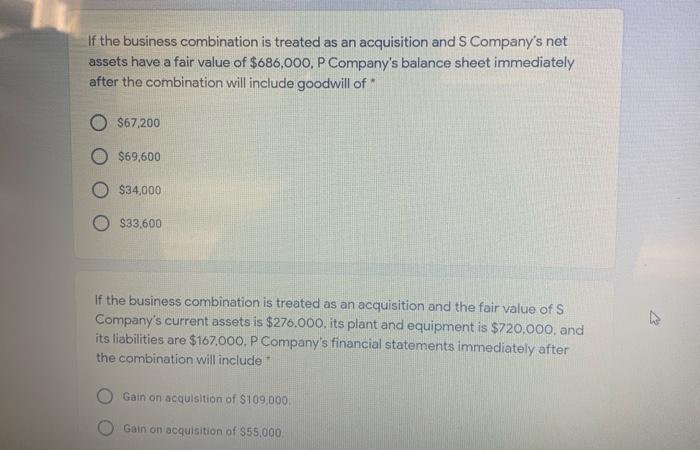

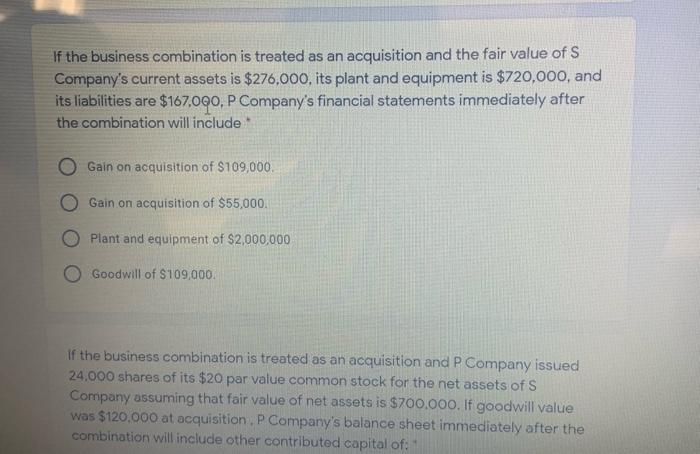

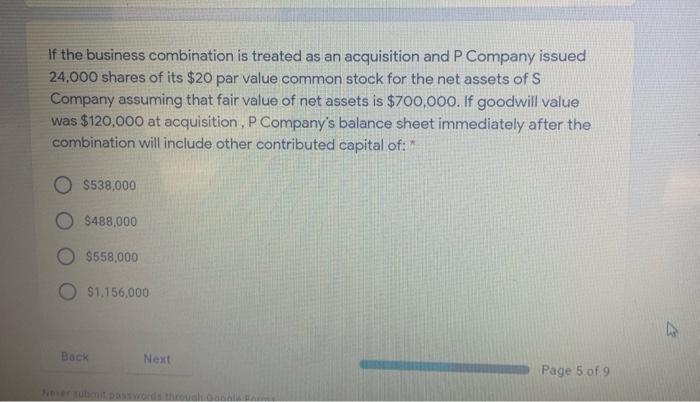

Problem Two On January 2, 2011 P Corp. issued 50,000 of its shares with a market value of $14 per share in exchange for all of S's shares, and S Corp. was dissolved. The stockholders' equities of P Corporation and S Corporation were as follows on January 1, 2011: Common Stock, $1 par Other Contributed Capital Retained Earnings Total Stockholders' Equity P Corp. $500,000 1,400,000 300,000 $2,200,000 s Corp. $ 300,000 550,000 170,000 $1,020,000 Choose the correct answer: What will be the total amount of Common Stock of P Corp. after the merger? $1.200.000 What will be the total amount of Common Stock of P Corp. after the merger?* O $1,200,000 O $2,200,000 O $550,000 $1,110,000 What will be the total amount of Other Contributed Capital of P Corp. after the merger? $2,050,000 O $3,600,000 $8,200,000 $4,340,000 m/forms/d/e/1FAIpQLSeg YSLUwMHa8ysE_V2D6QWMDdkYWrb52DhmbmDv1PnRyuf3Q/formResponse What will be the total amount of Retained Earnings of P Corp. after the merger?* $300,000 O $700,000 O $1,200,000 $800,000 What will be the total amount of Stockholder's Equity of P Corp. after the merger? $11,600,000 $5,500,000 $6,250,000 $2,900,000 Problem Three P Company issued 24,000 shares of its $20 par value common stock for the net assets of S Company in business combination under which S Company will be merged into P Company. On the date of the combination, P Company common stock had a fair value of $30 per share. Balance sheets for P Company and S Company immediately prior to the combination were as follows: P CO. s Co. Current Assets Plant and Equipment (net) Total $1,314,000 1.725,000 $3,039,000 $192,000 408,000 $600,000 Liabilities Common Stock, $20 par value Other Contributed Capital Retained Earnings Total $ 900,000 1,650,000 218,000 271,000 $3,039,000 $150,000 240,000 60,000 150.000 $600,000 Choose the correct answer: If the business combination is treated as an acquisition and Company's net assets have a fair value of $686,000, P Company's balance sheet immediately after the combination will include goodwill of $67,200 $69,600 $34,000 $33,600 If the business combination is treated as an acquisition and the fair value of S Company's current assets is $276.000. its plant and equipment is $720.000. and its liabilities are $167.000. P Company's financial statements immediately after the combination will include Gain on acquisition of $109,000 Gain on acquisition of S55,000 If the business combination is treated as an acquisition and the fair value of S Company's current assets is $276.000. its plant and equipment is $720,000, and its liabilities are $167,090, P Company's financial statements immediately after the combination will include O Gain on acquisition of S109,000 O Gain on acquisition of $55,000 Plant and equipment of $2,000,000 Goodwill of $109,000 If the business combination is treated as an acquisition and P Company issued 24,000 shares of its $20 par value common stock for the net assets of S Company assuming that fair value of net assets is $700.000. If goodwill value was $120,000 at acquisition . P Company's balance sheet immediately after the combination will include other contributed capital of: If the business combination is treated as an acquisition and P Company issued 24,000 shares of its $20 par value common stock for the net assets of S Company assuming that fair value of net assets is $700,000. If goodwill value was $120,000 at acquisition, P Company's balance sheet immediately after the combination will include other contributed capital of: $538,000 S488,000 $558,000 O $1.156,000 7 Back Next Page 5 of 9