Answered step by step

Verified Expert Solution

Question

1 Approved Answer

problem two parts a,b and c thank you! Problem Two Cuylits Company owned processing equipment that had a cost of $100,000. it had an expected

problem two parts a,b and c

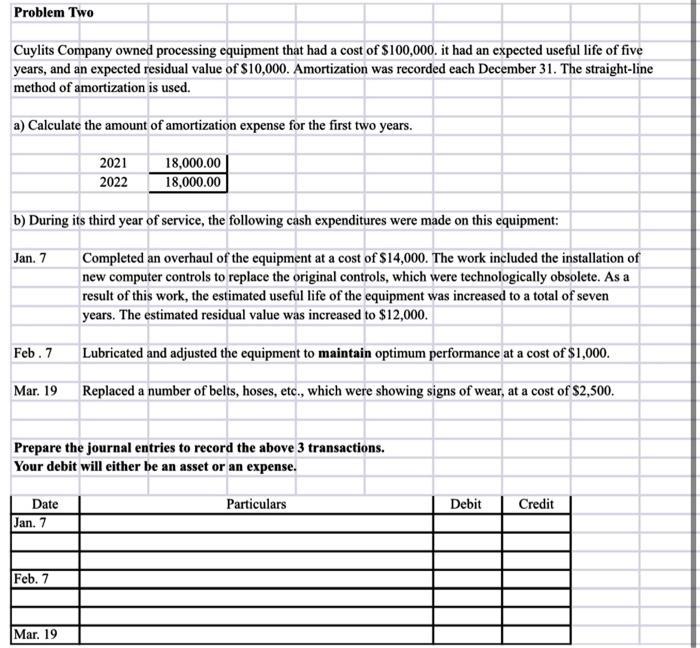

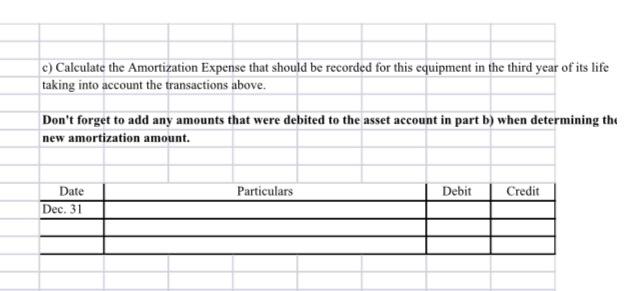

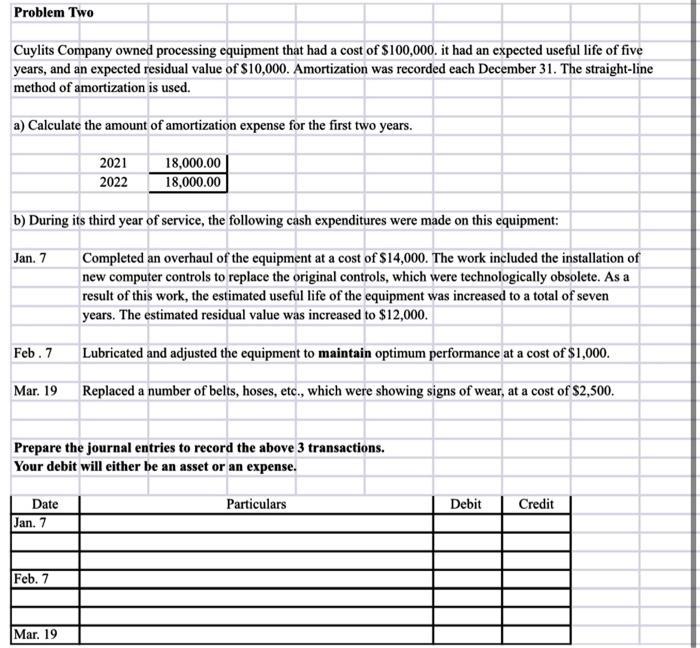

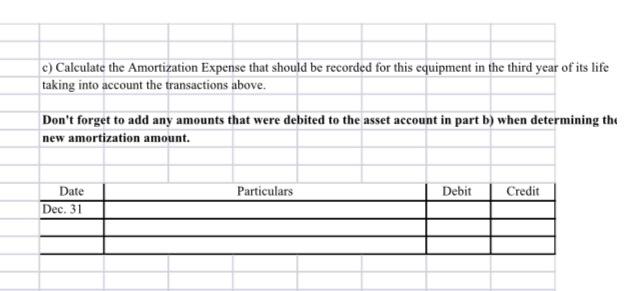

Problem Two Cuylits Company owned processing equipment that had a cost of $100,000. it had an expected useful life of five years, and an expected residual value of $10,000. Amortization was recorded each December 31. The straight-line method of amortization is used. a) Calculate the amount of amortization expense for the first two years. 2021 2022 18,000.00 18,000.00 b) During its third year of service, the following cash expenditures were made on this equipment: Jan. 7 Completed an overhaul of the equipment at a cost of $14,000. The work included the installation of new computer controls to replace the original controls, which were technologically obsolete. As a result of this work, the estimated useful life of the equipment was increased to a total of seven years. The estimated residual value was increased to $12,000. Feb. 7 Lubricated and adjusted the equipment to maintain optimum performance at a cost of $1,000. Mar. 19 Replaced a number of belts, hoses, etc., which were showing signs of wear, at a cost of $2,500. Prepare the journal entries to record the above 3 transactions. Your debit will either be an asset or an expense. Particulars Debit Credit Date Jan. 7 Feb. 7 Mar. 19 c) Calculate the Amortization Expense that should be recorded for this equipment in the third year of its life taking into account the transactions above. Don't forget to add any amounts that were debited to the asset account in part b) when determining the new amortization amount. Particulars Debit Credit Date Dec. 31 thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started