Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Two - Requirements 1-10 Answer question for Consider the following situation PROBLEM TWO Mr. Madden, a master cabinetmaker, owns and operates a custom-made cabinetry

Problem Two - Requirements 1-10

Answer question for "Consider the following situation"

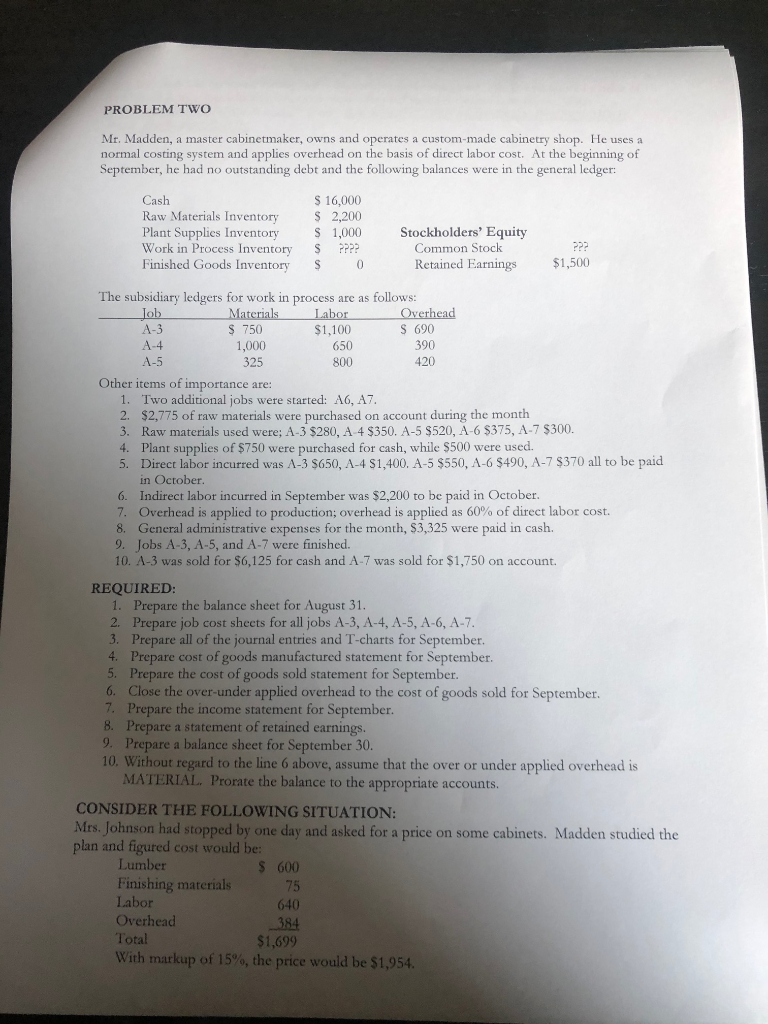

PROBLEM TWO Mr. Madden, a master cabinetmaker, owns and operates a custom-made cabinetry shop. He uses a normal costing system and applies overhead on the basis of direct labor cost. At the beginning of September, he had no outstanding debt and the following balances were in the general ledger: Cash Raw Materials Inventory Plant Supplies Inventory Work in Process Inventory Finished Goods Inventory $ 16,000 $ 2,200 $ 1,000 S ???? $ 0 Stockholders' Equity Common Stock Retained Earnings P $1,500 The subsidiary ledgers for work in process are as follows: Job Materials Labor Overhead A-3 $ 750 $1,100 S 690 A-4 1,000 650 390 A-5 325 800 420 Other items of importance are: 1. Two additional jobs were started: A6, A7. 2. $2,775 of raw materials were purchased on account during the month 3. Raw materials used were; A-3 $280, A 4 $350. A-5 $520, A-6 $375, A-7 $300. 4. Plant supplies of $750 were purchased for cash, while $500 were used. 5. Direct labor incurred was A-3 $650, A-4 $1,400. A-5 $550, A-6 $490, A-7 $370 all to be paid in October 6. Indirect labor incurred in September was $2,200 to be paid in October. 7. Overhead is applied to production; overhead is applied as 60% of direct labor cost. 8. General administrative expenses for the month, $3,325 were paid in cash. 9. Jobs A-3, A-5, and A-7 were finished. 10. A-3 was sold for $6,125 for cash and A-7 was sold for $1,750 on account. REQUIRED: 1. Prepare the balance sheet for August 31. 2. Prepare job cost sheets for all jobs A-3, A-4, A-5, A-6, A-7. 3. Prepare all of the journal entries and T-charts for September. 4. Prepare cost of goods manufactured statement for September. 5. Prepare the cost of goods sold statement for September. 6. Close the over-under applied overhead to the cost of goods sold for September. 7. Prepare the income statement for September. 8. Prepare a statement of retained earnings. 9. Prepare a balance sheet for September 30. 10. Without regard to the line 6 above, assume that the over or under applied overhead is MATERIAL. Prorate the balance to the appropriate accounts. CONSIDER THE FOLLOWING SITUATION: Mrs. Johnson had stopped by one day and asked for a price on some cabinets. Madden studied the plan and figured cost would be: Lumber $ 600 Finishing materials 75 Labor 640 Overhead 384 Total $1,699 With markup of 15%, the price would be $1,954. Mrs. Johnson was incensed stating that a competitor down the street, Mr. James, quoted a price of $1,600. It is true that Madden does not want to lay off workers during slow times. What recommendation would you make? Why? PROBLEM TWO Mr. Madden, a master cabinetmaker, owns and operates a custom-made cabinetry shop. He uses a normal costing system and applies overhead on the basis of direct labor cost. At the beginning of September, he had no outstanding debt and the following balances were in the general ledger: Cash Raw Materials Inventory Plant Supplies Inventory Work in Process Inventory Finished Goods Inventory $ 16,000 $ 2,200 $ 1,000 S ???? $ 0 Stockholders' Equity Common Stock Retained Earnings P $1,500 The subsidiary ledgers for work in process are as follows: Job Materials Labor Overhead A-3 $ 750 $1,100 S 690 A-4 1,000 650 390 A-5 325 800 420 Other items of importance are: 1. Two additional jobs were started: A6, A7. 2. $2,775 of raw materials were purchased on account during the month 3. Raw materials used were; A-3 $280, A 4 $350. A-5 $520, A-6 $375, A-7 $300. 4. Plant supplies of $750 were purchased for cash, while $500 were used. 5. Direct labor incurred was A-3 $650, A-4 $1,400. A-5 $550, A-6 $490, A-7 $370 all to be paid in October 6. Indirect labor incurred in September was $2,200 to be paid in October. 7. Overhead is applied to production; overhead is applied as 60% of direct labor cost. 8. General administrative expenses for the month, $3,325 were paid in cash. 9. Jobs A-3, A-5, and A-7 were finished. 10. A-3 was sold for $6,125 for cash and A-7 was sold for $1,750 on account. REQUIRED: 1. Prepare the balance sheet for August 31. 2. Prepare job cost sheets for all jobs A-3, A-4, A-5, A-6, A-7. 3. Prepare all of the journal entries and T-charts for September. 4. Prepare cost of goods manufactured statement for September. 5. Prepare the cost of goods sold statement for September. 6. Close the over-under applied overhead to the cost of goods sold for September. 7. Prepare the income statement for September. 8. Prepare a statement of retained earnings. 9. Prepare a balance sheet for September 30. 10. Without regard to the line 6 above, assume that the over or under applied overhead is MATERIAL. Prorate the balance to the appropriate accounts. CONSIDER THE FOLLOWING SITUATION: Mrs. Johnson had stopped by one day and asked for a price on some cabinets. Madden studied the plan and figured cost would be: Lumber $ 600 Finishing materials 75 Labor 640 Overhead 384 Total $1,699 With markup of 15%, the price would be $1,954. Mrs. Johnson was incensed stating that a competitor down the street, Mr. James, quoted a price of $1,600. It is true that Madden does not want to lay off workers during slow times. What recommendation would you make? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started