Answered step by step

Verified Expert Solution

Question

1 Approved Answer

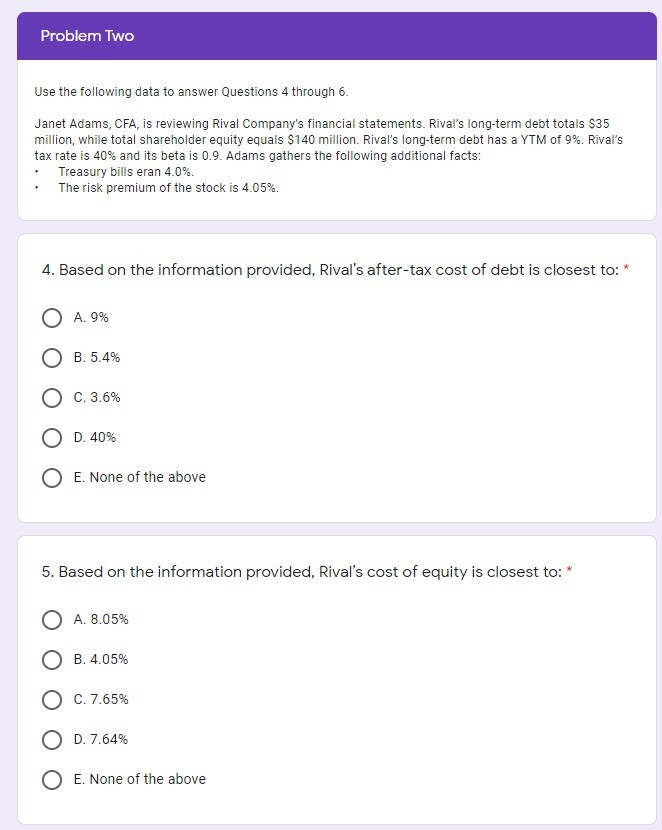

Problem Two Use the following data to answer Questions 4 through 6. Janet Adams, CFA, is reviewing Rival Company's financial statements. Rival's long-term debt totals

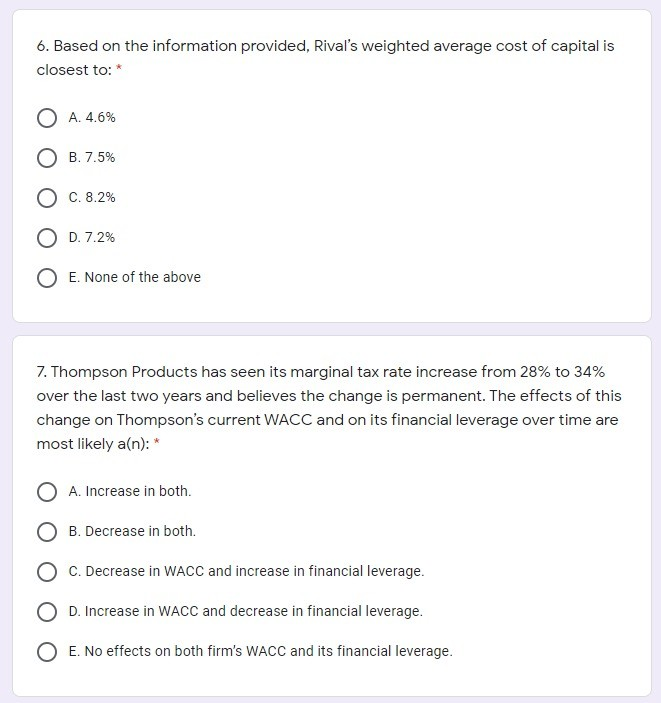

Problem Two Use the following data to answer Questions 4 through 6. Janet Adams, CFA, is reviewing Rival Company's financial statements. Rival's long-term debt totals $35 million, while total shareholder equity equals $140 million. Rival's long-term debt has a YTM of 9%. Rival's tax rate is 40% and its beta is 0.9. Adams gathers the following additional facts: Treasury bills eran 4.0%. The risk premium of the stock is 4.05%. 4. Based on the information provided, Rival's after-tax cost of debt is closest to: A. 9% B. 5.4% C. 3.6% 10% E. None of the above 5. Based on the information provided, Rival's cost of equity is closest to: * A. 8.05% O B. 4.05% O C. 7.65% O D. 7.64% O E. None of the above 6. Based on the information provided, Rival's weighted average cost of capital is closest to: * O A. 4.6% O B.7.5% O C. 8.2% D. 7.2% E. None of the above 7. Thompson Products has seen its marginal tax rate increase from 28% to 34% over the last two years and believes the change is permanent. The effects of this change on Thompson's current WACC and on its financial leverage over time are most likely a(n): * A. Increase in both. B. Decrease in both. C. Decrease in WACC and increase in financial leverage. D. Increase in WACC and decrease in financial leverage. O E. No effects on both firm's WACC and its financial leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started