Question

Problem Type: NPV Profiles: Timing Differences An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outlay at t

Problem Type: NPV Profiles: Timing Differences

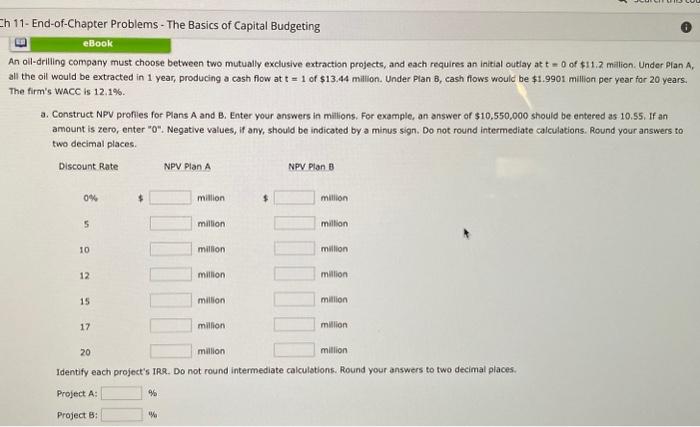

An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outlay at t = 0 of

all the oil would be extracted in 1 year, producing a cash flow at t = 1 of $13.44 million. Under Plan B, cash flows would be $1.9901 mill.on

The firm's WACC is 12.1%.

on. Under Plan A, year for 20 years.

a. Construct NPV profiles for Plans A and B. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. If an amount is zero, enter "O". Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to two decimal places.

Discount Rate NPV Plan A. NPV Plan B

0%. _____million. ______million

5 _____million. _______million

10 _____million. ______million

12 _____million. _______million

15 _______ million _______million

17 ______million. _______million

20 _____million. ______million

Identify each project's IRR. Do not round intermediate calculations. Round your answers to two decimal places.

Project A:_____%

Project B:____%

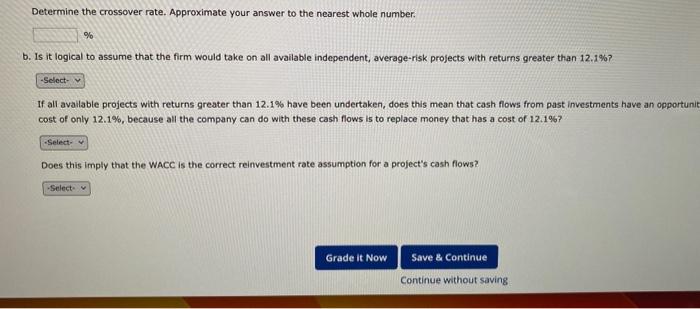

Determine the crossover rate. Approximate your answer to the nearest whole number.

______%

Part 2 of Problem:

Is it logical to assume that the firm would take on all avilable independent, average-risk projects with returns greater than 12.1%? Answer Yes or No?

If all available projects returns greater than 12.1% have been undertaken, does this mean that cash flows from past investments have an opportunity cost of only 12.1%, because all the company can do with these cash flows is to replace money that has a cost of 12.1%? Answer Yes or No?

Does this imply that the WACC is correct reinvestment rate assumption for a projects's cash flows? Answer Yes or No?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started