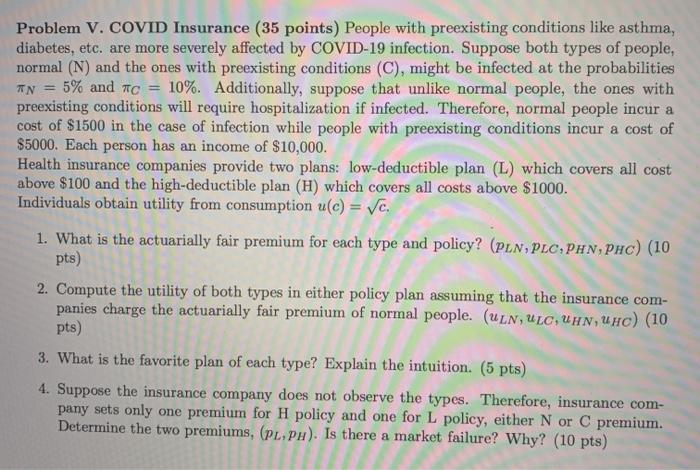

Problem V. COVID Insurance (35 points) People with preexisting conditions like asthma, diabetes, etc. are more severely affected by COVID-19 infection. Suppose both types of people, normal (N) and the ones with preexisting conditions (C), might be infected at the probabilities TIN 5% and C = 10%. Additionally, suppose that unlike normal people, the ones with preexisting conditions will require hospitalization if infected. Therefore, normal people incur a cost of $1500 in the case of infection while people with preexisting conditions incur a cost of $5000. Each person has an income of $10,000. Health insurance companies provide two plans: low-deductible plan (L) which covers all cost above $100 and the high-deductible plan (H) which covers all costs above $1000. Individuals obtain utility from consumption u(c) = Vc. 1. What is the actuarially fair premium for each type and policy? (PLN, PLC, PHN, Phc) (10 pts) 2. Compute the utility of both types in either policy plan assuming that the insurance com- panies charge the actuarially fair premium of normal people. (ULN, ULC, UHN, uc) (10 pts) 3. What is the favorite plan of each type? Explain the intuition. (5 pts) 4. Suppose the insurance company does not observe the types. Therefore, insurance com- pany sets only one premium for H policy and one for L policy, either N or C premium. Determine the two premiums, (PL,PH). Is there a market failure? Why? (10 pts) Problem V. COVID Insurance (35 points) People with preexisting conditions like asthma, diabetes, etc. are more severely affected by COVID-19 infection. Suppose both types of people, normal (N) and the ones with preexisting conditions (C), might be infected at the probabilities TIN 5% and C = 10%. Additionally, suppose that unlike normal people, the ones with preexisting conditions will require hospitalization if infected. Therefore, normal people incur a cost of $1500 in the case of infection while people with preexisting conditions incur a cost of $5000. Each person has an income of $10,000. Health insurance companies provide two plans: low-deductible plan (L) which covers all cost above $100 and the high-deductible plan (H) which covers all costs above $1000. Individuals obtain utility from consumption u(c) = Vc. 1. What is the actuarially fair premium for each type and policy? (PLN, PLC, PHN, Phc) (10 pts) 2. Compute the utility of both types in either policy plan assuming that the insurance com- panies charge the actuarially fair premium of normal people. (ULN, ULC, UHN, uc) (10 pts) 3. What is the favorite plan of each type? Explain the intuition. (5 pts) 4. Suppose the insurance company does not observe the types. Therefore, insurance com- pany sets only one premium for H policy and one for L policy, either N or C premium. Determine the two premiums, (PL,PH). Is there a market failure? Why? (10 pts)