Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem- Worksheets Discuss at least four deficiencies that you find on this worksheet in light of what was discussed in class. Be specific. Do not

Problem- Worksheets

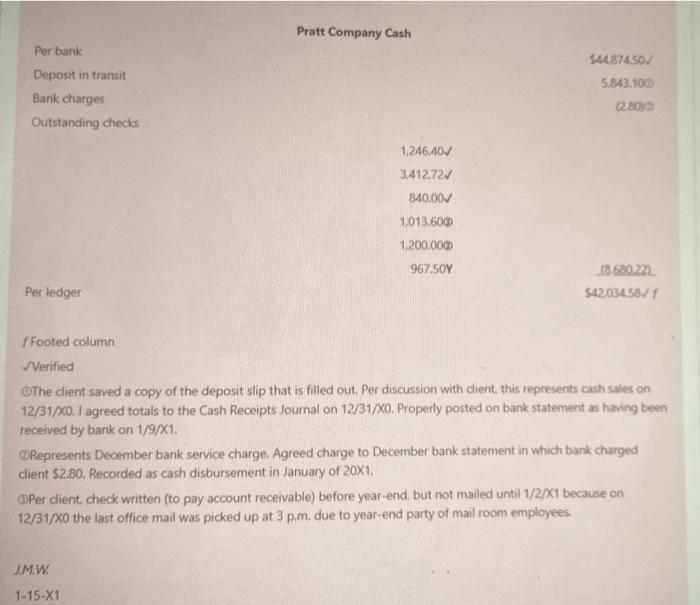

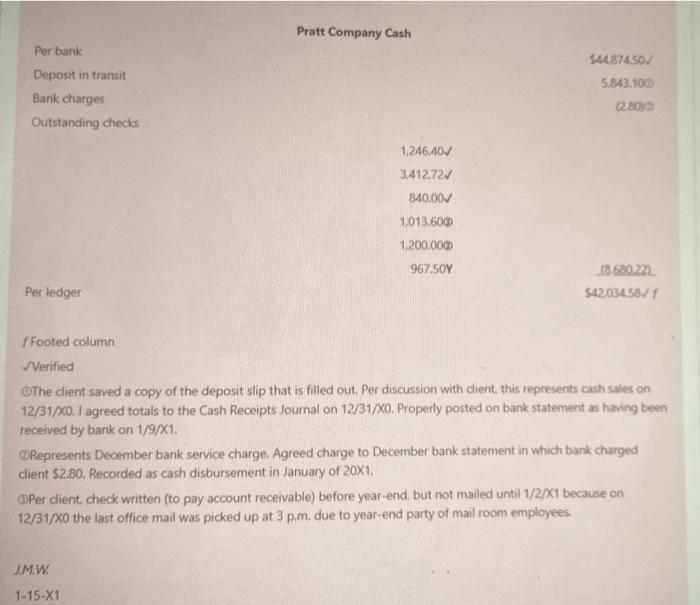

Pratt Company Cash Per bank $44,874.50/ Deposit in transit 5.843.100 (280) Bank charges Outstanding checks 1.246.40/ 3,412.72 840,00 1.013.600 1.200.000 967.50Y (8.680.22) Per ledger $42.034.58// f Footed column Verified The client saved a copy of the deposit slip that is filled out. Per discussion with client, this represents cash sales on 12/31/X0. I agreed totals to the Cash Receipts Journal on 12/31/X0. Properly posted on bank statement as having been received by bank on 1/9/X1. Represents December bank service charge. Agreed charge to December bank statement in which bank charged client $2.80. Recorded as cash disbursement in January of 20X1. Per client, check written (to pay account receivable) before year-end, but not mailed until 1/2/X1 because on 12/31/X0 the last office mail was picked up at 3 p.m. due to year-end party of mail room employees. J.M.W. 1-15-X1 Pratt Company Cash Per bank $44,874.50/ Deposit in transit 5.843.100 (280) Bank charges Outstanding checks 1.246.40/ 3,412.72 840,00 1.013.600 1.200.000 967.50Y (8.680.22) Per ledger $42.034.58// f Footed column Verified The client saved a copy of the deposit slip that is filled out. Per discussion with client, this represents cash sales on 12/31/X0. I agreed totals to the Cash Receipts Journal on 12/31/X0. Properly posted on bank statement as having been received by bank on 1/9/X1. Represents December bank service charge. Agreed charge to December bank statement in which bank charged client $2.80. Recorded as cash disbursement in January of 20X1. Per client, check written (to pay account receivable) before year-end, but not mailed until 1/2/X1 because on 12/31/X0 the last office mail was picked up at 3 p.m. due to year-end party of mail room employees. J.M.W. 1-15-X1 Discuss at least four deficiencies that you find on this worksheet in light of what was discussed in class. Be specific. Do not repeat details related to the same point.

@The client saved a copy of the deposit slip that is filled out. Per discussion with client, this represents cash sales on 12/31/X0. I agreed totals to the Cash Receipts Journal on 12/31/X0. Properly posted on bank statement as having been received by bank on 1/9/X1. Represents December bank service charge. Agreed charge to December bank statement in which bank charged client $2.80. Recorded as cash disbursement in January of 20X1. Per client, check written (to pay account receivable) before year-end, but not mailed until 1/2/X1 because on 12/31/X0 the last office mail was picked up at 3 p.m. due to year-end party of mail room employees.

J.M.W.

1-15-X1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started