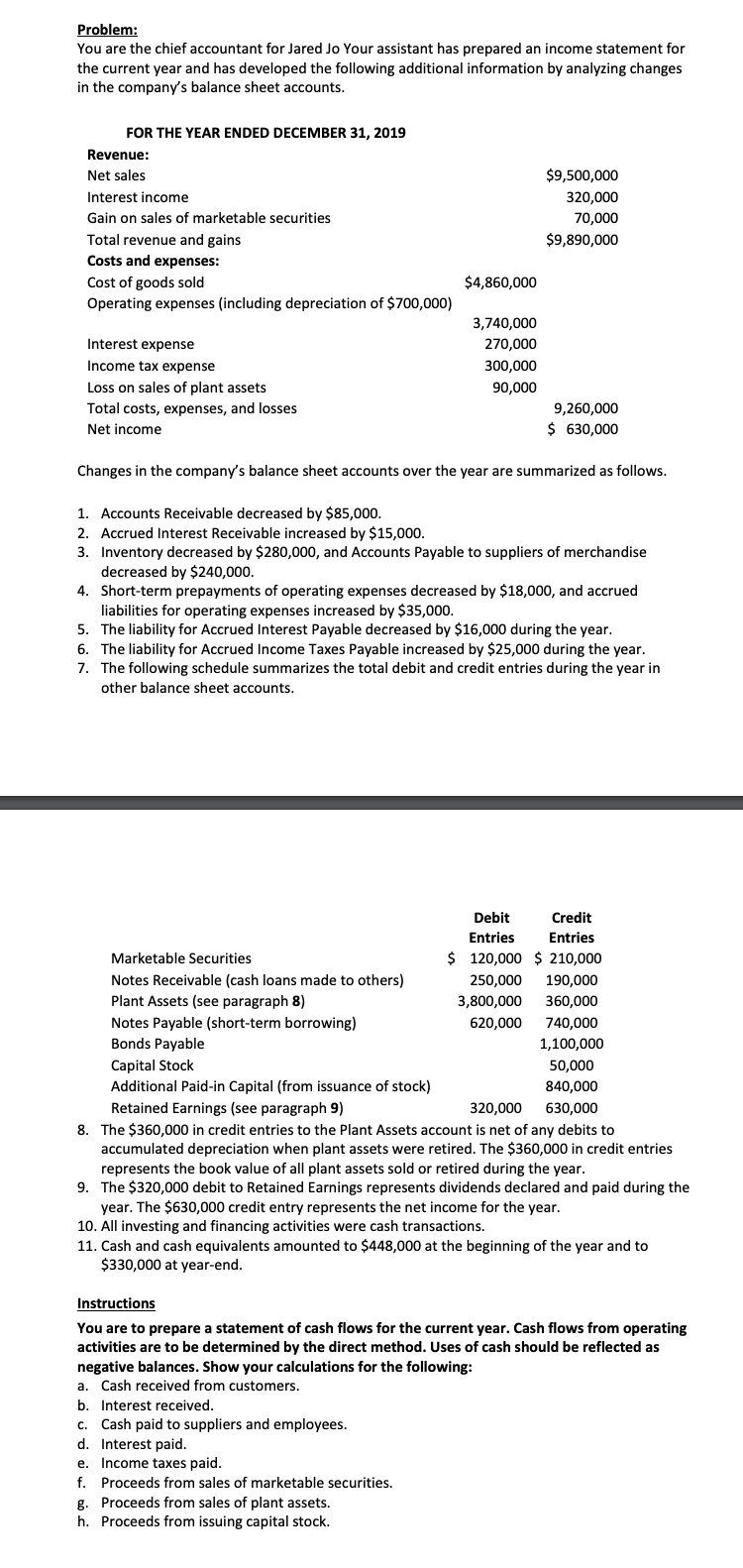

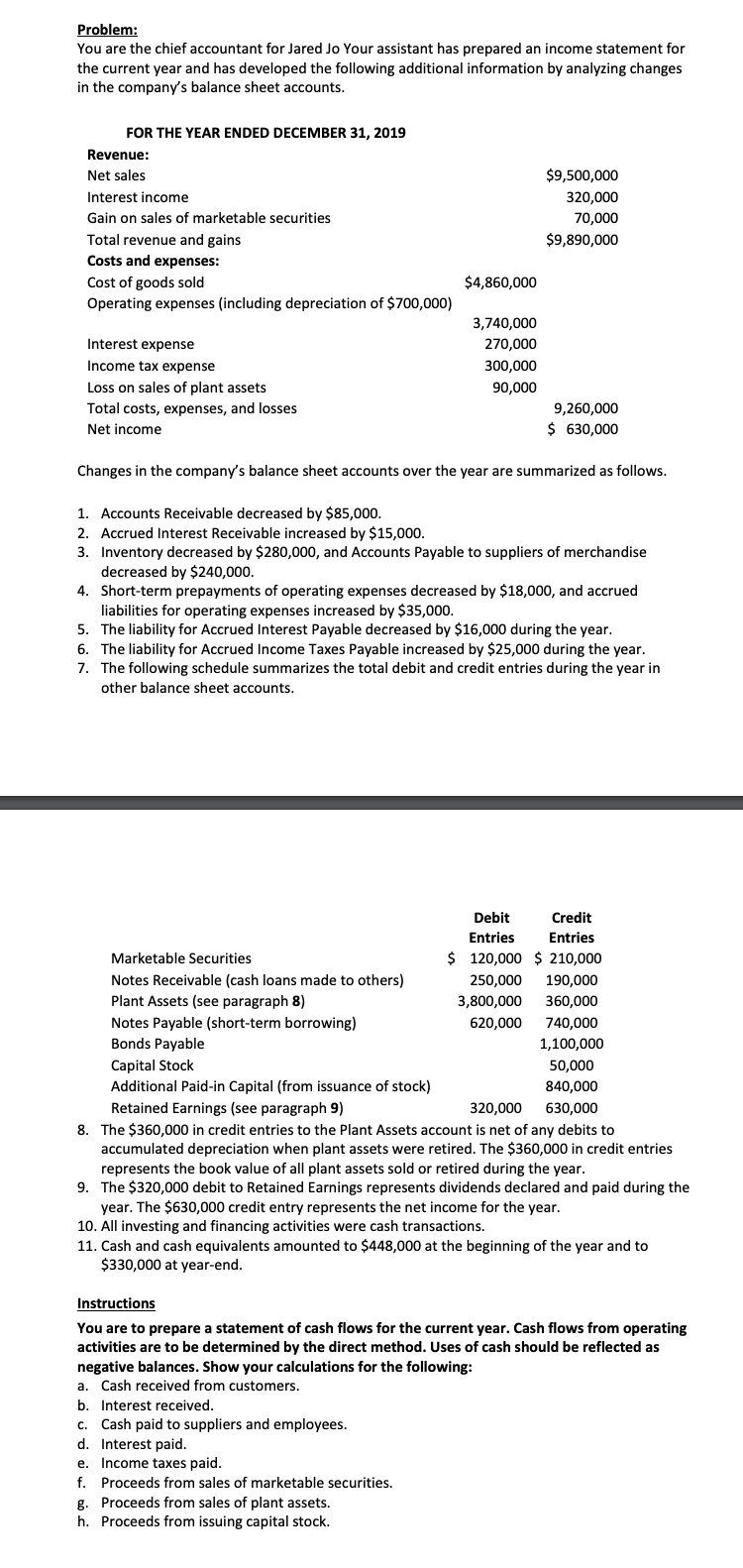

Problem: You are the chief accountant for Jared Jo Your assistant has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company's balance sheet accounts. FOR THE YEAR ENDED DECEMBER 31, 2019 Revenue: Net sales Interest income Gain on sales of marketable securities Total revenue and gains Costs and expenses: Cost of goods sold Operating expenses (including depreciation of $700,000) $9,500,000 320,000 70,000 $9,890,000 $4,860,000 Interest expense Income tax expense Loss on sales of plant assets Total costs, expenses, and losses Net income 3,740,000 270,000 300,000 90,000 9,260,000 $ 630,000 Changes in the company's balance sheet accounts over the year are summarized as follows. 1. Accounts Receivable decreased by $85,000. 2. Accrued Interest Receivable increased by $15,000. 3. Inventory decreased by $280,000, and Accounts Payable to suppliers of merchandise decreased by $240,000. 4. Short-term prepayments of operating expenses decreased by $18,000, and accrued liabilities for operating expenses increased by $35,000. 5. The liability for Accrued Interest Payable decreased by $16,000 during the year. 6. The liability for Accrued Income Taxes Payable increased by $25,000 during the year. 7. The following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts. Debit Credit Entries Entries Marketable Securities $ 120,000 $ 210,000 Notes Receivable (cash loans made to others) 250,000 190,000 Plant Assets (see paragraph 8) 3,800,000 360,000 Notes Payable (short-term borrowing) 620,000 740,000 Bonds Payable 1,100,000 Capital Stock 50,000 Additional Paid-in Capital (from issuance of stock) 840,000 Retained Earnings (see paragraph 9) 320,000 630,000 8. The $360,000 in credit entries to the Plant Assets account is net of any debits to accumulated depreciation when plant assets were retired. The $360,000 in credit entries represents the book value of all plant assets sold or retired during the year. 9. The $320,000 debit to Retained Earnings represents dividends declared and paid during the year. The $630,000 credit entry represents the net income for the year. 10. All investing and financing activities were cash transactions. 11. Cash and cash equivalents amounted to $448,000 at the beginning of the year and to $330,000 at year-end. a. Instructions You are to prepare a statement of cash flows for the current year. Cash flows from operating activities are to be determined by the direct method. Uses of cash should be reflected as negative balances. Show your calculations for the following: Cash received from customers. b. Interest received. C. Cash paid to suppliers and employees. d. Interest paid. e. Income taxes paid. f. Proceeds from sales of marketable securities. g. Proceeds from sales of plant assets. h. Proceeds from issuing capital stock