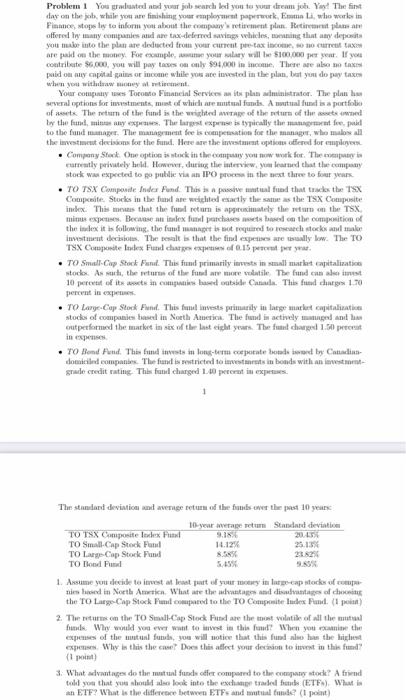

Problem! You graduated your job searched you to your dream job. Yol The first for on the while you are fishing your employment apork, Ein Li, who work in Finance, stogsly to inform you about the company retirement plan. Retired offered by many companies and to defend saving vehicles, ming that any deposit you make into the plan are deducted from your current pre-tax income, to current.com are paid on the money. For complete your ulary will be $100.000 eur. If you contribute $6.000, you will pay tres ou only $94.000 in income. There are also not paid on my capital gains or income while you are invested in the plan, but you do pay taxe when you with lent Your company es Toronto Financial Services wit plan ministrator. The plan several options for investments, must of which are usual funds. A tal fund is a portfolio of a The return of the fund is the weighted We of the return of the set wed Iw the fund, mitte any cases. The largest expenses typically the augment for puid to the fund manage the management fee is compensation for the manager, who malo all the investment decisions for the fund. Here are the mattis fered for employee Compony Stock Owe option is stock in the company you work for. The restly privately held. However, during the interview, you learned that the comes stock was expected to go publie via an IPO process in the next three to four years TO TSX Composite Inder Fund. This is a passive malfund that takes the TSX Compte. Stories in the date muilted exactly the same as the TSX Composite index. This means that the fram is appreciately them on the TSX mis expenses. Because an index fund purchases et bed on the composition of the index it is following the funge is not required to research stocks and more investment decisions. The seat is that the find expenses are ally low. The TO TSX Compte de ancho 0.15 per TO Small Cap Stock Firul. This fund primarily invests in small matkait capitalization stockey Assur, the per of the film wale The fund can be 10 percutit of its sin com based le. This fundarges 1.10 percent in expres TO Large-Cap Stock Funil. This fuel invests primarily in large market capitalistic stodes of companies based in North America. The fundin actively and la outperformed the market in six of the last eight years. The fuel charged 1.50 percent in expenses TO Bond Fund. This fund invest in long-term cepat bother by Catalan domiciled companies. The fund is restricted to investments in bonds with an investom grade credit rating This fun charged 10 prin exp. The stamani devintion und average return of the fisever the past 10 years 1 year at Standard deviation TO TSX Compositeudex SIN 20.53 TO Small Cap Stock Fund 14.12% TO LgCap Stock 23:25 TO Blood 1. Assume you decide to best at put your money inge-cap stocks of tied in North America. What we the advantand disadvantages of chocine the TO LargeCap Stock Fil.compared to the TO Composite lades und point 2. The return on the TO Small Cap Stock Find the most volatile of all the funds Why would you ever want to invest in this fil? When you canine the expenses of the fut, you will notice that this fund also has the highest expenses. Why is this the cel Does this affect your decision to invest in this fund (post) 3. What advantages do the mutual fund oder compared to the company tod? A friend told you that you should also look into the extradle (ETF). What is an ETF? What is the difference between ETFs and mutual fue (pont)