Question

Problem09. Effective-Interest Rate Method: Bonds Issued at Premium & Discount (4.2 content area) 9.1 On Jan. 1, 2023, Moby, Inc. issued $600,000, of 10% bonds,

Problem09. Effective-Interest Rate Method: Bonds Issued at Premium & Discount (4.2 content area)

9.1 On Jan. 1, 2023, Moby, Inc. issued $600,000, of 10% bonds, due in 5 years. The bonds pay interest semi-annually on July 1 and January 1. The bonds effective yield 8%. Moby uses the effective-interest method (see PV Tables next page). Prepare Moby's journal entries for a thru c.

- 1. The January 1 issuance

- 2. The July 1 interest payment

- 3. The December 31 adjusting journal entry

- 4. Prepare a full Bond Amortization Schedule

9.2 On Jan. 1, 2023, Moby, Inc. issued $600,000 of 10% bonds, due in 5 years. The bonds pay interest semi-annually on July 1 and January 1. The bonds effective yield 12%. Moby uses the effective-interest method (see PV Tables next page). Prepare Moby's journal entries for a thru c.

- 1. The January 1 issuance

- 2. The July 1 interest payment

- 3. The December 31 adjusting journal entry

- 4. Prepare a full Bond Amortization Schedule

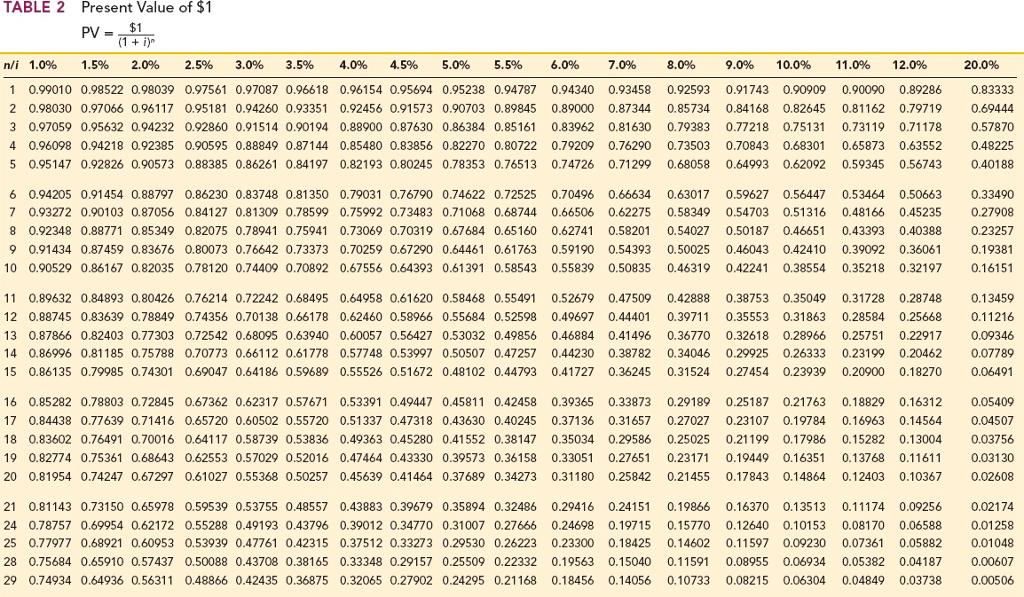

Present Value of a Single Sum

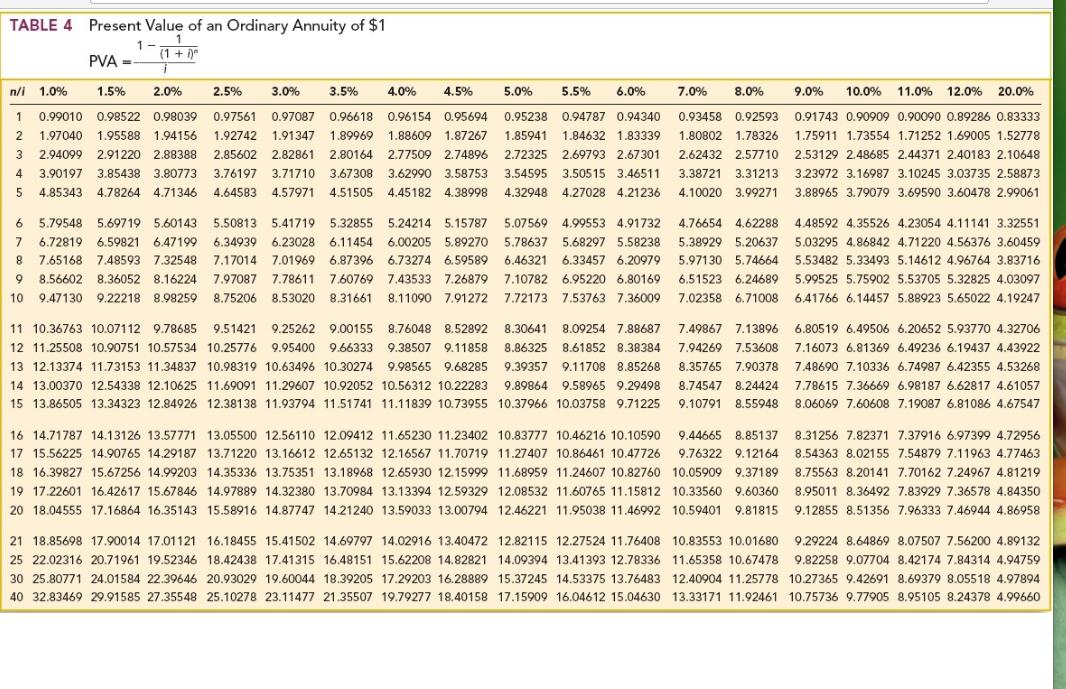

Present Value of an Ordinary Annuity (interest) of 1

TABLE 2 Present Value of $1 PV- $1 n/i 1.0% 1.5% (1 + i)" 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 6 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 8 0.92348 0.88771 0.85349 0.82075 0.78941 0.75941 9 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.79031 0.76790 0.74622 0.72525 0.75992 0.73483 0.71068 0.68744 0.73069 0.70319 0.67684 0.65160 0.70259 0.67290 0.64461 0.61763 0.67556 0.64393 0.61391 0.58543 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.59190 0.54393 0.50025 0.46043 0.42410 0.55839 0.50835 0.46319 0.42241 0.38554 2.0% 2.5% 3.0% 3.5% 6.0% 7.0% 0.94340 4.0% 4.5% 5.0% 5.5% 8.0% 9.0% 10.0% 11.0% 12.0% 0.96154 0.95694 0.95238 0.94787 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.85480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 20.0% 0.83333 0.69444 0.57870 0.48225 0.40188 0.33490 0.27908 0.23257 0.39092 0.36061 0.35218 0.32197 0.19381 0.16151 0.42888 0.38753 0.35049 0.31728 0.28748 0.39711 0.35553 0.31863 0.28584 0.25668 0.36770 0.32618 0.28966 0.25751 0.22917 0.34046 0.29925 0.26333 0.23199 0.20462 0.31524 0.27454 0.23939 0.20900 0.18270 0.13459 0.11216 0.09346 0.07789 0.06491 0.05409 0.04507 0.03756 0.03130 0.02608 0.02174 0.01258 0.01048 0.00607 11 0.89632 0.84893 0.80426 0.76214 0.72242 0.68495 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 0.62460 0.58966 0.55684 0.52598 0.49697 0.44401 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.55526 0.51672 0.48102 0.44793. 0.41727 0.36245 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 18 0.83602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.38165 0.33348 0.29157 0.25509 0.22332 0.19563 0.15040 0.11591 0.08955 0.06934 0.05382 0.04187 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.18456 0.14056 0.10733 0.08215 0.06304 0.04849 0.03738 0.00506

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we will first calculate the bond price interest payments and bond discountprem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started