Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem-1: ANTM Lease and BHP Ltd. sign a lease agreement dated 1 January 2019, that calls for ANTM to lease a backhoe to BHP beginning

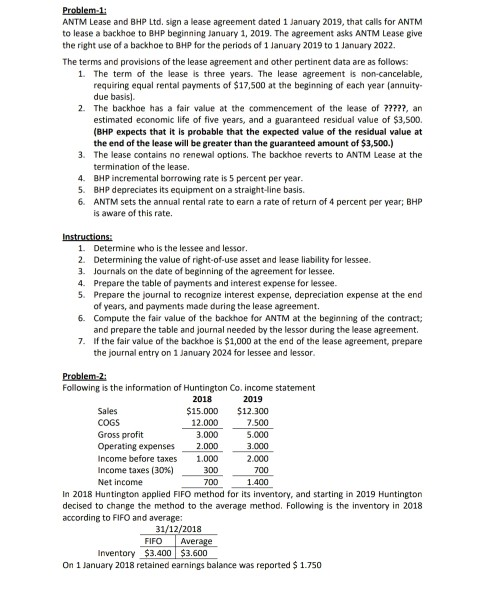

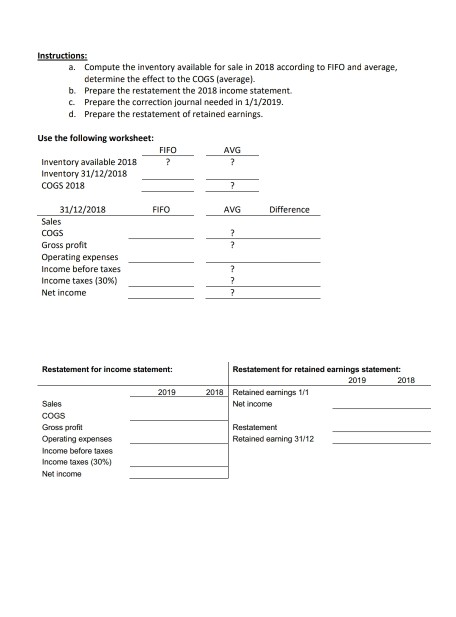

Problem-1: ANTM Lease and BHP Ltd. sign a lease agreement dated 1 January 2019, that calls for ANTM to lease a backhoe to BHP beginning January 1, 2019. The agreement asks ANTM Lease give the right use of a backhoe to BHP for the periods of 1 January 2019 to 1 January 2022. The terms and provisions of the lease agreement and other pertinent data are as follows: 1. The term of the lease is three years. The lease agreement is non-cancelable, requiring equal rental payments of $17,500 at the beginning of each year (annuity due basis). 2. The backhoe has a fair value at the commencement of the lease of ?????, an estimated economic life of five years, and a guaranteed residual value of $3,500. (BHP expects that it is probable that the expected value of the residual value at the end of the lease will be greater than the guaranteed amount of $3,500.) 3. The lease contains no renewal options. The backhoe reverts to ANTM Lease at the termination of the lease. 4. BHP incremental borrowing rate is 5 percent per year. 5. BHP depreciates its equipment on a straight-line basis. 6. ANTM sets the annual rental rate to earn a rate of return of 4 percent per year; BHP is aware of this rate. Instructions: 1. Determine who is the lessee and lessor. 2. Determining the value of right-of-use asset and lease liability for lessee. 3. Journals on the date of beginning of the agreement for lessee. 4. Prepare the table of payments and interest expense for lessee. 5. Prepare the journal to recognize interest expense depreciation expense at the end of years, and payments made during the lease agreement. 6. Compute the fair value of the backhoe for ANTM at the beginning of the contract; and prepare the table and journal needed by the lessor during the lease agreement. 7. If the fair value of the backhoe is $1,000 at the end of the lease agreement, prepare the journal entry on 1 January 2024 for lessee and lessor Problem-2: Following is the information of Huntington Co. Income statement 2018 2019 Sales $15.000 $12.300 COGS 12.000 7.500 Gross profit 3.000 5.000 Operating expenses 2.000 3.000 Income before taxes 1.000 2.000 Income taxes (30%) 300 700 Net income 700 1.400 In 2018 Huntington applied FIFO method for its inventory, and starting in 2019 Huntington decised to change the method to the average method. Following is the inventory in 2018 according to FIFO and average: 31/12/2018 FIFO Average Inventory $3.400 $3.600 On 1 January 2018 retained earnings balance was reported $ 1.750 Instructions: a. Compute the inventory available for sale in 2018 according to FIFO and average, determine the effect to the COGS (average). b. Prepare the restatement the 2018 income statement C. Prepare the correction journal needed in 1/1/2019. d. Prepare the restatement of retained earnings. Use the following worksheet: AVG FIFO ? ? Inventory available 2018 Inventory 31/12/2018 COGS 2018 ? FIFO AVG Difference ? ? 31/12/2018 Sales COGS Gross profit Operating expenses Income before taxes Income taxes (30%) Net income ? ? Restatement for income statement: Restatement for retained earnings statement: 2019 2018 2018 Retained earnings 1/1 Net income 2019 Sales COGS Gross profit Operating expenses Income before taxes Income taxes (30%) Net income Restatement Retained earning 31/12 Problem-1: ANTM Lease and BHP Ltd. sign a lease agreement dated 1 January 2019, that calls for ANTM to lease a backhoe to BHP beginning January 1, 2019. The agreement asks ANTM Lease give the right use of a backhoe to BHP for the periods of 1 January 2019 to 1 January 2022. The terms and provisions of the lease agreement and other pertinent data are as follows: 1. The term of the lease is three years. The lease agreement is non-cancelable, requiring equal rental payments of $17,500 at the beginning of each year (annuity due basis). 2. The backhoe has a fair value at the commencement of the lease of ?????, an estimated economic life of five years, and a guaranteed residual value of $3,500. (BHP expects that it is probable that the expected value of the residual value at the end of the lease will be greater than the guaranteed amount of $3,500.) 3. The lease contains no renewal options. The backhoe reverts to ANTM Lease at the termination of the lease. 4. BHP incremental borrowing rate is 5 percent per year. 5. BHP depreciates its equipment on a straight-line basis. 6. ANTM sets the annual rental rate to earn a rate of return of 4 percent per year; BHP is aware of this rate. Instructions: 1. Determine who is the lessee and lessor. 2. Determining the value of right-of-use asset and lease liability for lessee. 3. Journals on the date of beginning of the agreement for lessee. 4. Prepare the table of payments and interest expense for lessee. 5. Prepare the journal to recognize interest expense depreciation expense at the end of years, and payments made during the lease agreement. 6. Compute the fair value of the backhoe for ANTM at the beginning of the contract; and prepare the table and journal needed by the lessor during the lease agreement. 7. If the fair value of the backhoe is $1,000 at the end of the lease agreement, prepare the journal entry on 1 January 2024 for lessee and lessor Problem-2: Following is the information of Huntington Co. Income statement 2018 2019 Sales $15.000 $12.300 COGS 12.000 7.500 Gross profit 3.000 5.000 Operating expenses 2.000 3.000 Income before taxes 1.000 2.000 Income taxes (30%) 300 700 Net income 700 1.400 In 2018 Huntington applied FIFO method for its inventory, and starting in 2019 Huntington decised to change the method to the average method. Following is the inventory in 2018 according to FIFO and average: 31/12/2018 FIFO Average Inventory $3.400 $3.600 On 1 January 2018 retained earnings balance was reported $ 1.750 Instructions: a. Compute the inventory available for sale in 2018 according to FIFO and average, determine the effect to the COGS (average). b. Prepare the restatement the 2018 income statement C. Prepare the correction journal needed in 1/1/2019. d. Prepare the restatement of retained earnings. Use the following worksheet: AVG FIFO ? ? Inventory available 2018 Inventory 31/12/2018 COGS 2018 ? FIFO AVG Difference ? ? 31/12/2018 Sales COGS Gross profit Operating expenses Income before taxes Income taxes (30%) Net income ? ? Restatement for income statement: Restatement for retained earnings statement: 2019 2018 2018 Retained earnings 1/1 Net income 2019 Sales COGS Gross profit Operating expenses Income before taxes Income taxes (30%) Net income Restatement Retained earning 31/12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started