Answered step by step

Verified Expert Solution

Question

1 Approved Answer

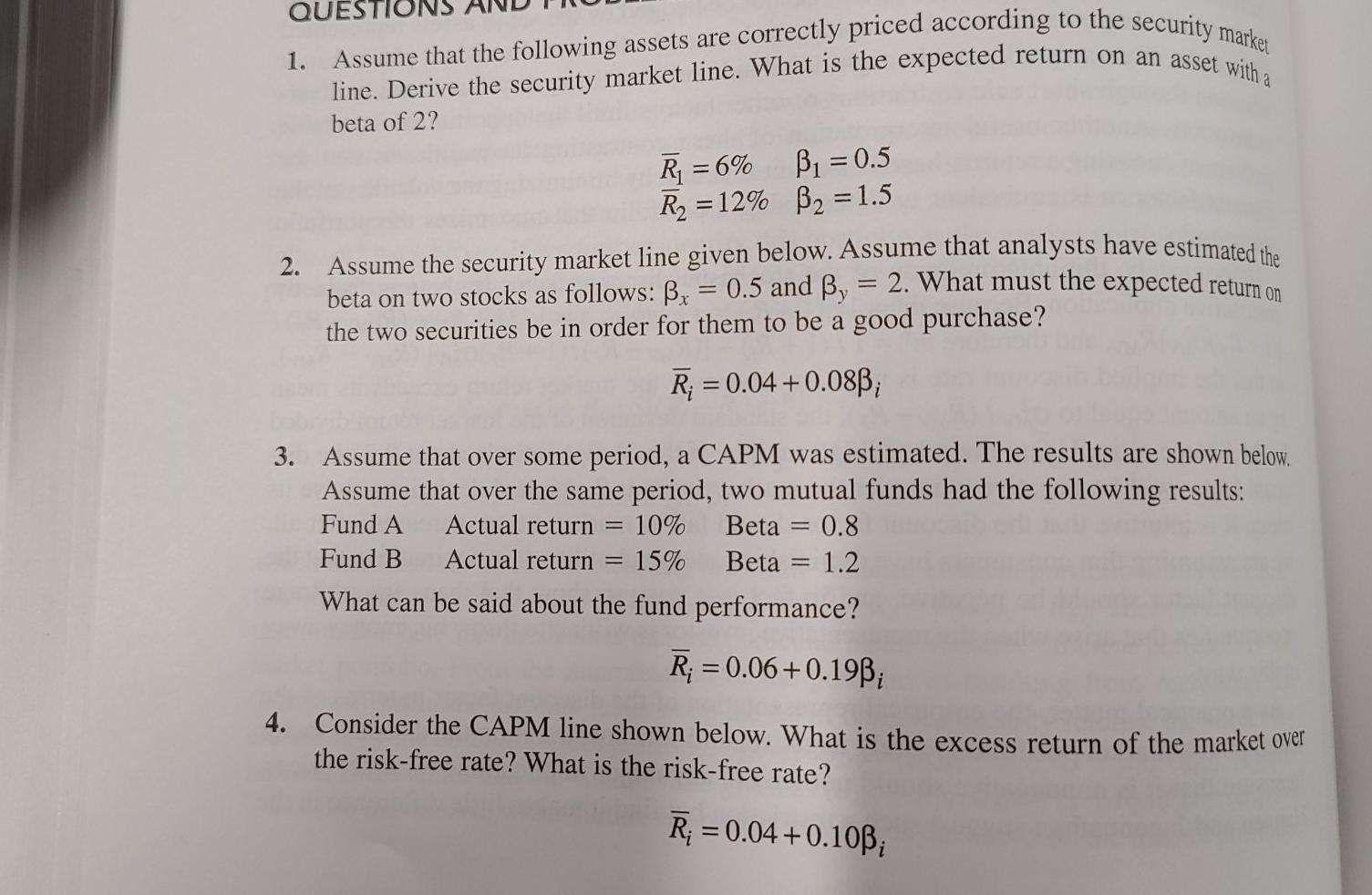

problem4) what is the risk free rate? problem4) what is the market risk premium? QUESTION marker 1. line. Derive the security market line. What is

problem4) what is the risk free rate? problem4) what is the market risk premium?

QUESTION marker 1. line. Derive the security market line. What is the expected return on an asset with a beta of 2? 2. R1 = 6% B1 = 0.5 R2 = 12% B2 = 1.5 Assume the security market line given below. Assume that analysts have estimated the beta on two stocks as follows: Bx = 0.5 and By = 2. What must the expected return on the two securities be in order for them to be a good purchase? R; = 0.04 +0.08B; = 3. Assume that over some period, a CAPM was estimated. The results are shown below. Assume that over the same period, two mutual funds had the following results: Fund A Actual return 10% Beta = 0.8 Fund B Actual return 15% Beta = 1.2 What can be said about the fund performance? - = R; = 0.06+0.19B; 4. Consider the CAPM line shown below. What is the excess return of the market over the risk-free rate? What is the risk-free rate? R;=0.04 +0.103Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started