Answered step by step

Verified Expert Solution

Question

1 Approved Answer

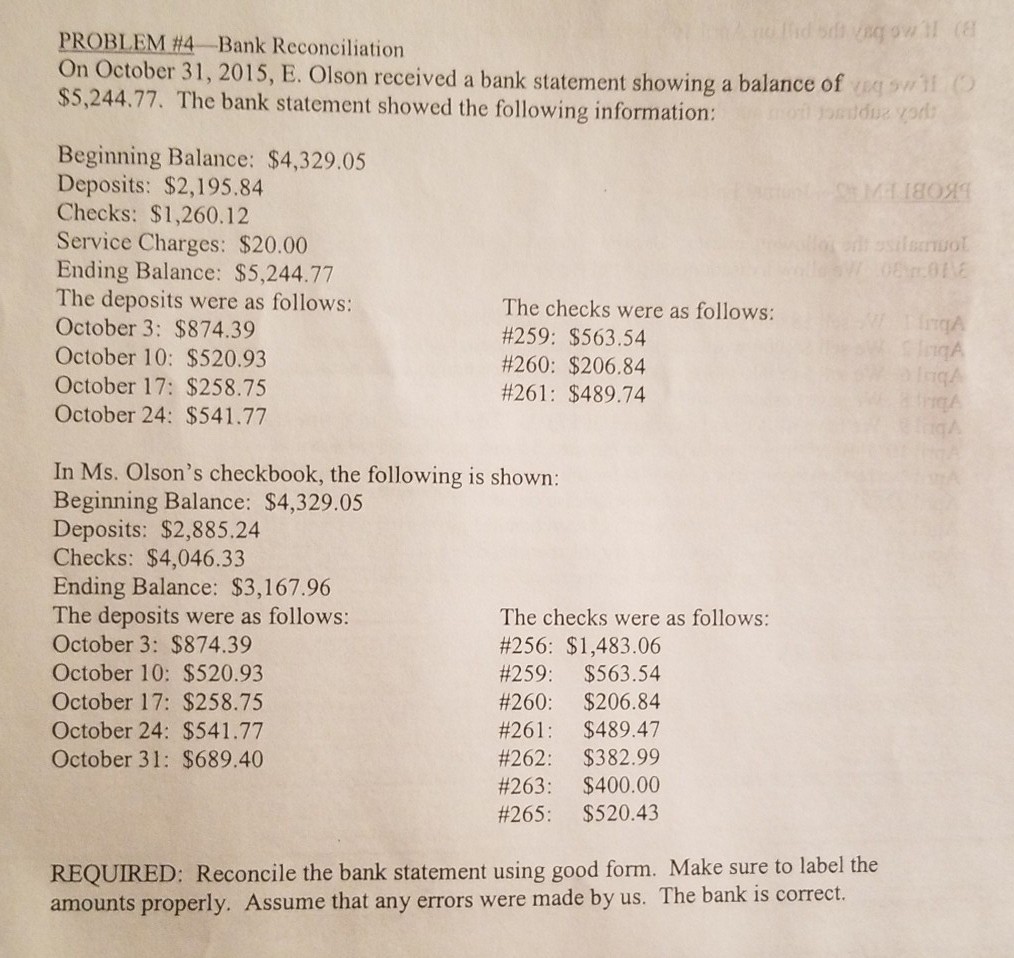

PROBLEM#4-Bank Reconciliation On October 31, 2015, E. Olson received a bank statement showing a balance of $5,244.77. The bank statement showed the following information: Beginning

PROBLEM#4-Bank Reconciliation On October 31, 2015, E. Olson received a bank statement showing a balance of $5,244.77. The bank statement showed the following information: Beginning Balance: $4,329.05 Deposits: $2,195.84 Checks: $1,260.12 Service Charges: $20.00 Ending Balance: $5,244.77 The deposits were as follows: October 3: $874.39 October 10: $520.93 October 17: $258.75 October 24: $541.77 The checks were as follows: #259: $563.54 #260: $206.84 #261: $489.74 In Ms. Olson's checkbook, the following is shown: Beginning Balance: $4,329.05 Deposits: $2,885.24 Checks: $4,046.33 Ending Balance: $3,167.96 The deposits were as follows: October 3: $874.39 October 10: $520.93 October 17: $258.75 October 24: $541.77 October 31: $689.40 The checks were as follows: #256: $1,483.06 #259: $563.54 #260: $206.84 #261: $489.47 #262: $382.99 #263: $400.00 #265: $520.43 REQUIRED: Reconcile the bank statement using good form. Make sure to label the amounts properly. Assume that any errors were made by us. The bank is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started