Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEMI TRUE OR FALSE The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary cost to get the asset in

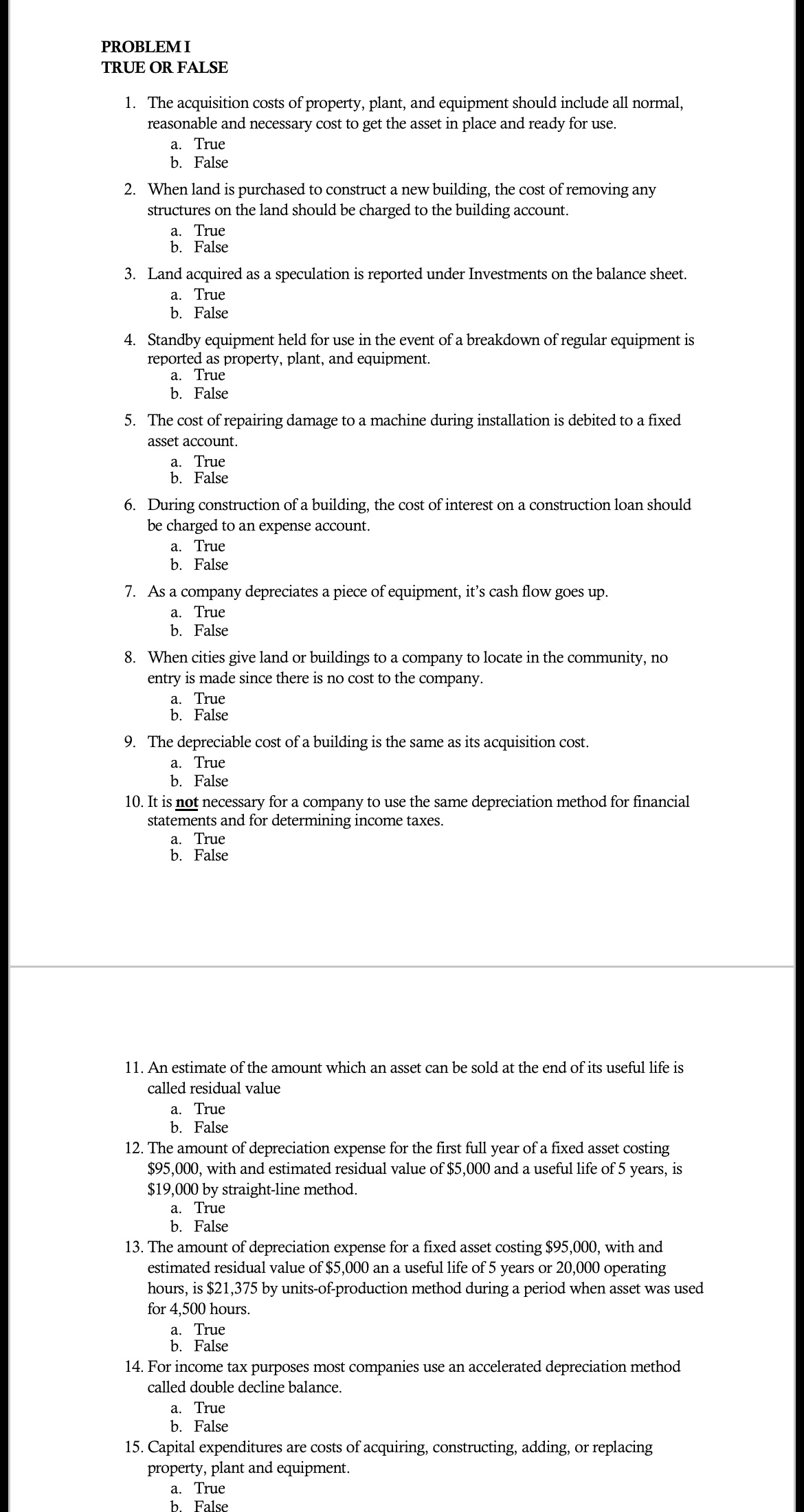

PROBLEMI

TRUE OR FALSE

The acquisition costs of property, plant, and equipment should include all normal,

reasonable and necessary cost to get the asset in place and ready for use.

a True

b False

When land is purchased to construct a new building, the cost of removing any

structures on the land should be charged to the building account.

a True

b False

Land acquired as a speculation is reported under Investments on the balance sheet.

a True

b False

Standby equipment held for use in the event of a breakdown of regular equipment is

reported as property, plant, and equipment.

a True

b False

The cost of repairing damage to a machine during installation is debited to a fixed

asset account.

a True

b False

During construction of a building, the cost of interest on a construction loan should

be charged to an expense account.

a True

b False

As a company depreciates a piece of equipment, it's cash flow goes up

a True

b False

When cities give land or buildings to a company to locate in the community, no

entry is made since there is no cost to the company.

a True

b False

The depreciable cost of a building is the same as its acquisition cost.

a True

b False

It is not necessary for a company to use the same depreciation method for financial

statements and for determining income taxes.

a True

b False

An estimate of the amount which an asset can be sold at the end of its useful life is

called residual value

a True

b False

The amount of depreciation expense for the first full year of a fixed asset costing

$ with and estimated residual value of $ and a useful life of years, is

$ by straightline method.

a True

b False

The amount of depreciation expense for a fixed asset costing $ with and

estimated residual value of $ an a useful life of years or operating

hours, is $ by unitsofproduction method during a period when asset was used

for hours.

a True

b False

For income tax purposes most companies use an accelerated depreciation method

called double decline balance.

a True

b False

Capital expenditures are costs of acquiring, constructing, adding, or replacing

property, plant and equipment.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started