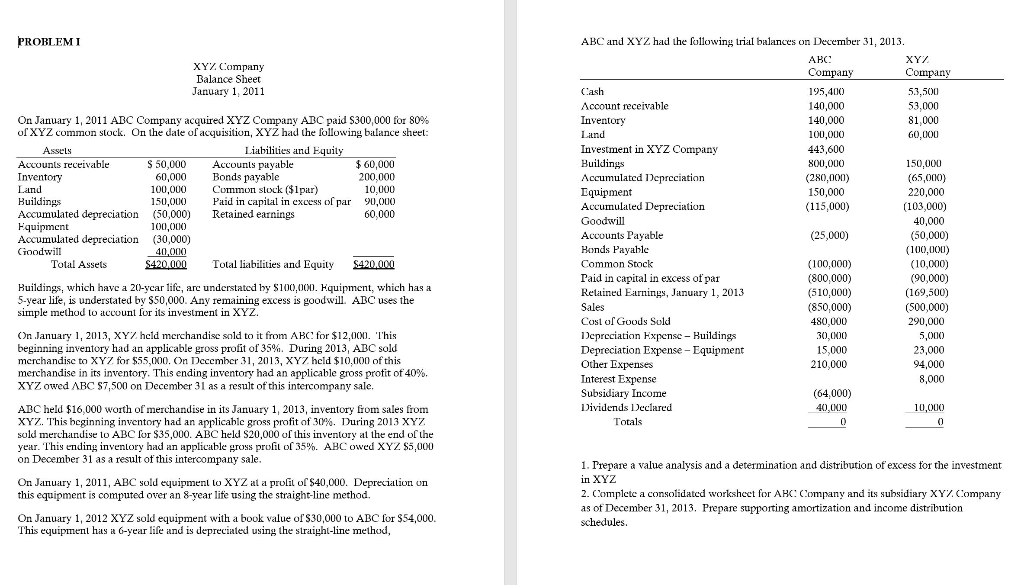

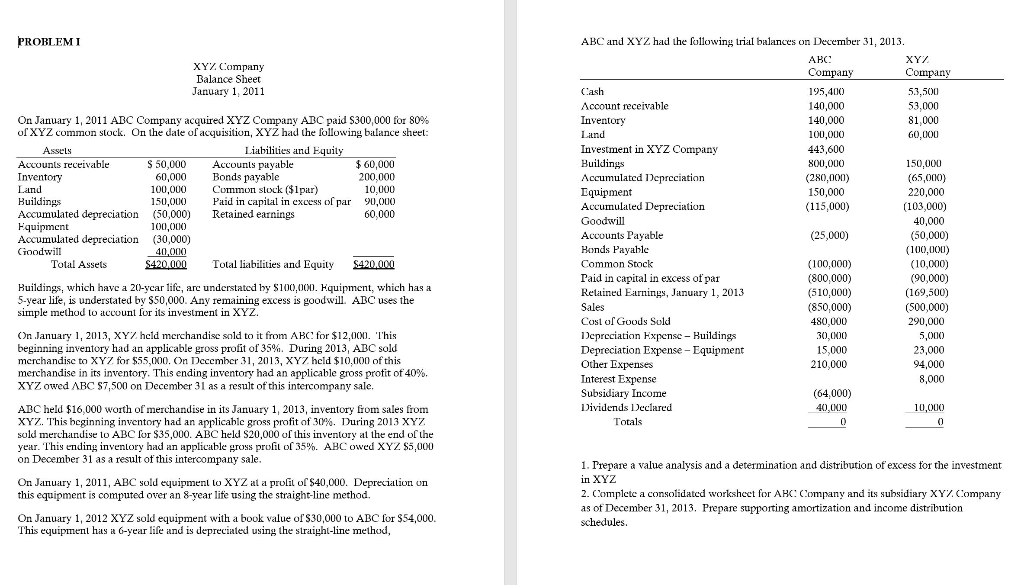

PROBLEMI XYZ Company Balance Sheet January 1, 2011 On January 1, 2011 ABC Company acquired XYZ Company ABC paid $300,000 for 80% of XYZ common stock. On the date of acquisition, XYZ had the following balance sheet: Assels Liabilities and Equity Accounts receivable Accounts payable $ 60,000 Inventory 60,000 Bonds payable 200.000 Land 100,000 Cummon stock ($1par) 10,000 Buildings 150,000 Paid in capital in excess of par 90,000 Accumulated depreciation (50,000) Retained earnings Equipment 100,000 Accumulated depreciation (30,000) Goodwill 40.000 Total Assets $420,000 Total liabilities and Equity S420.000 60,000 ABC and XYZ had the following trial balances on December 31, 2013. ABC XYZ Company Company Cash 195,400 53,500 Account receivable 140,000 53,000 Inventory 140,000 81,000 Land 100,000 60,000 Investment in XYZ Company 443,600 Buildings 800,000 150,000 Accumulated Depreciation (280,000) (65,000) Equipment 150,000 220,000 Accumulated Depreciation (115,000) (103,000) Goodwill 40,000 Accounts Payable (25,000) (50,000) Bonds Payable (100,000) Common Stock (100,000) (10,000) Paid in capital in excess of par (800,000) (90,000) Retained Earnings, January 1, 2013 (510,000) (169,500) Sales (850,000) (500,000) Cost of Goods Sold 480,000 290,000 Depreciation Expense - Buildings 30,00C) 5,000 Depreciation Expense - Equipment 15,000 23,000 Other Expenses 210,000 94,000 Interest Expense 8,000 Subsidiary Income (64,000) Dividends Declared 40.000 10,000 Totals 0 Buildings, which have a 20-year lifc, arc understated lyy $100,000. Equipment, which has a 5-year life, is understated by $50,000. Any remaining excess is goodwill. ABC uses the simple method to account for its investment in XYZ. On January 1, 2013, XYZ held merchandise sold to it from ABC for $12,000. This beginning inventory had an applicable gross profit of 35%. During 2013, ABC sold merchandisc to XYZ for $55,000. On December 31, 2013, XYZ held $10,000 of this merchandise in its inventory. This ending inventory had an applicable gross profit of 40%. XYZ owed ABC $7,500 on December 31 as a result of this intercompany sale. ABC held $16,000 worth of merchandise in its January 1, 2013, inventory from sales from XYZ. This beginning inventory had an applicable gross profit of 30%. During 2013 XYZ sold merchandise lo ABC for $35,000. ABC held $20,000 of this inventory at the end of the year. This ending inventory had an applicable gross profil of 35%. ABC owed XYZ $5,000 on December 31 as a result of this intercompany sale. On January 1, 2011, ABC sold equipment lo XYZ at a prolil of $40,000. Depreciation un this equipment is computed over an 8-year life using the straight-line method 1. Prepare a value analysis and a determination and distribution of excess for the investment in XYZ 2. Complete a consolidated worksheet for AHC Company and its subsidiary XYZ Company as of December 31, 2013. Prepare supporting amortization and income distribution schedules. On January 1, 2012 XYZ sold equipment with a book value of $30,000 to ABC for $54,000. This equipment has a 6-year life and is depreciated using the straight-line method, PROBLEMI XYZ Company Balance Sheet January 1, 2011 On January 1, 2011 ABC Company acquired XYZ Company ABC paid $300,000 for 80% of XYZ common stock. On the date of acquisition, XYZ had the following balance sheet: Assels Liabilities and Equity Accounts receivable Accounts payable $ 60,000 Inventory 60,000 Bonds payable 200.000 Land 100,000 Cummon stock ($1par) 10,000 Buildings 150,000 Paid in capital in excess of par 90,000 Accumulated depreciation (50,000) Retained earnings Equipment 100,000 Accumulated depreciation (30,000) Goodwill 40.000 Total Assets $420,000 Total liabilities and Equity S420.000 60,000 ABC and XYZ had the following trial balances on December 31, 2013. ABC XYZ Company Company Cash 195,400 53,500 Account receivable 140,000 53,000 Inventory 140,000 81,000 Land 100,000 60,000 Investment in XYZ Company 443,600 Buildings 800,000 150,000 Accumulated Depreciation (280,000) (65,000) Equipment 150,000 220,000 Accumulated Depreciation (115,000) (103,000) Goodwill 40,000 Accounts Payable (25,000) (50,000) Bonds Payable (100,000) Common Stock (100,000) (10,000) Paid in capital in excess of par (800,000) (90,000) Retained Earnings, January 1, 2013 (510,000) (169,500) Sales (850,000) (500,000) Cost of Goods Sold 480,000 290,000 Depreciation Expense - Buildings 30,00C) 5,000 Depreciation Expense - Equipment 15,000 23,000 Other Expenses 210,000 94,000 Interest Expense 8,000 Subsidiary Income (64,000) Dividends Declared 40.000 10,000 Totals 0 Buildings, which have a 20-year lifc, arc understated lyy $100,000. Equipment, which has a 5-year life, is understated by $50,000. Any remaining excess is goodwill. ABC uses the simple method to account for its investment in XYZ. On January 1, 2013, XYZ held merchandise sold to it from ABC for $12,000. This beginning inventory had an applicable gross profit of 35%. During 2013, ABC sold merchandisc to XYZ for $55,000. On December 31, 2013, XYZ held $10,000 of this merchandise in its inventory. This ending inventory had an applicable gross profit of 40%. XYZ owed ABC $7,500 on December 31 as a result of this intercompany sale. ABC held $16,000 worth of merchandise in its January 1, 2013, inventory from sales from XYZ. This beginning inventory had an applicable gross profit of 30%. During 2013 XYZ sold merchandise lo ABC for $35,000. ABC held $20,000 of this inventory at the end of the year. This ending inventory had an applicable gross profil of 35%. ABC owed XYZ $5,000 on December 31 as a result of this intercompany sale. On January 1, 2011, ABC sold equipment lo XYZ at a prolil of $40,000. Depreciation un this equipment is computed over an 8-year life using the straight-line method 1. Prepare a value analysis and a determination and distribution of excess for the investment in XYZ 2. Complete a consolidated worksheet for AHC Company and its subsidiary XYZ Company as of December 31, 2013. Prepare supporting amortization and income distribution schedules. On January 1, 2012 XYZ sold equipment with a book value of $30,000 to ABC for $54,000. This equipment has a 6-year life and is depreciated using the straight-line method