Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problems 1 1. Calculate the following: a. Receivables Turnover and the Average Collection Period; b. Inventory Turnover and Days Inventory on Hand; c. Payables Turnover

Problems 1

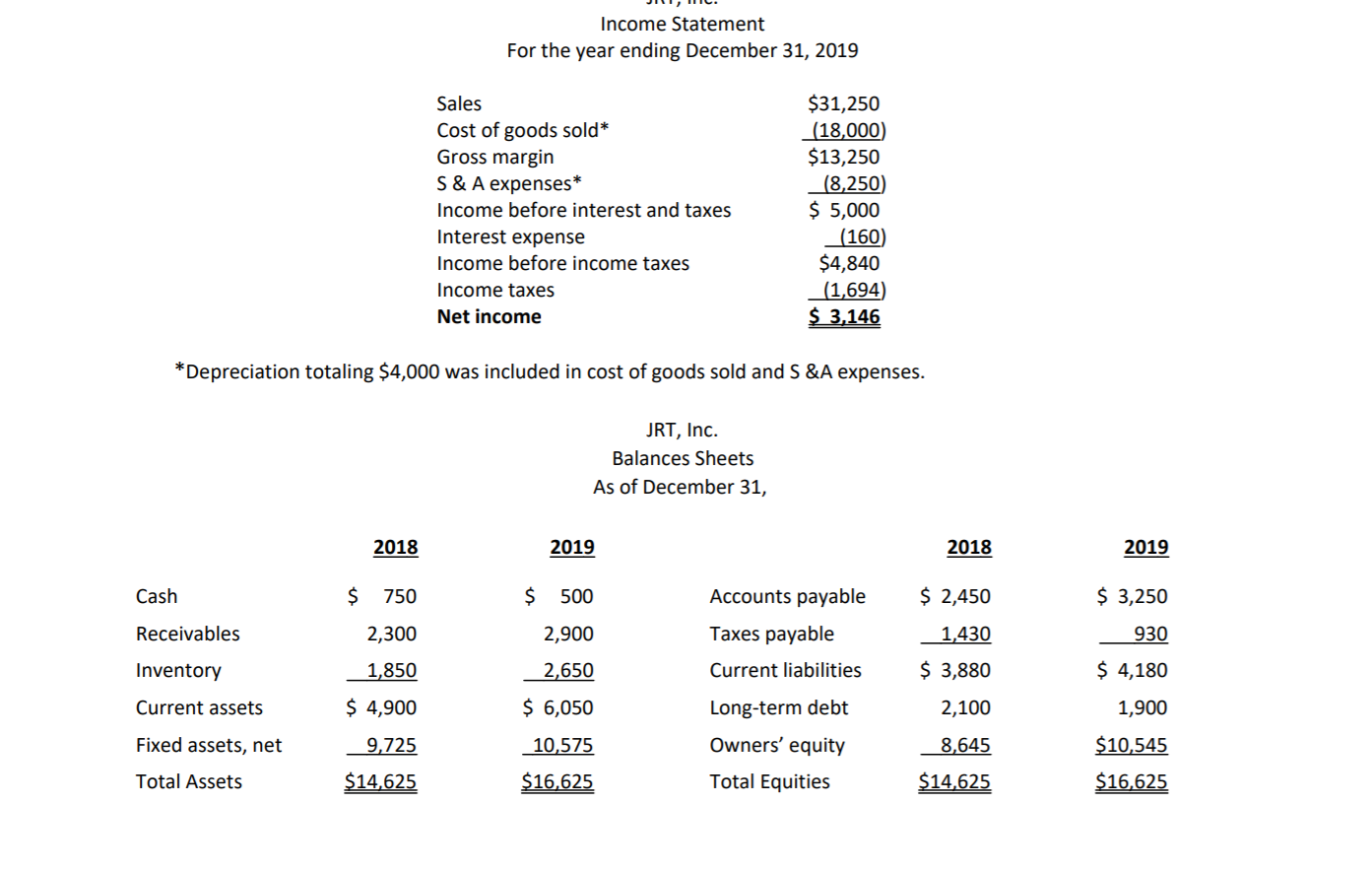

1. Calculate the following:

a. Receivables Turnover and the Average Collection Period;

b. Inventory Turnover and Days Inventory on Hand;

c. Payables Turnover and Days Payables (use purchases rather than cost of goods sold);

d. Profit Margin;

e. Return on Assets; and

f. Return on Equity;

JIIIIC. Income Statement For the year ending December 31, 2019 Sales Cost of goods sold* Gross margin S&A expenses* Income before interest and taxes Interest expense Income before income taxes Income taxes Net income $31,250 (18,000) $13,250 _(8,250) $ 5,000 (160) $4,840 (1,694) $ 3,146 *Depreciation totaling $4,000 was included in cost of goods sold and S &A expenses. JRT, Inc. Balances Sheets As of December 31, 2018 2019 2018 2019 Cash Receivables $ 750 2,300 1,850 $ 4,900 9,725 $14,625 $ 3,250 930 $ 4,180 Inventory Current assets $ 500 2,900 2,650 $ 6,050 10,575 $16,625 Accounts payable Taxes payable Current liabilities Long-term debt Owners' equity $ 2,450 1,430 $ 3,880 2,100 1,900 Fixed assets, net 8,645 $10,545 $16,625 Total Assets Total Equities $14,625Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started