Answered step by step

Verified Expert Solution

Question

1 Approved Answer

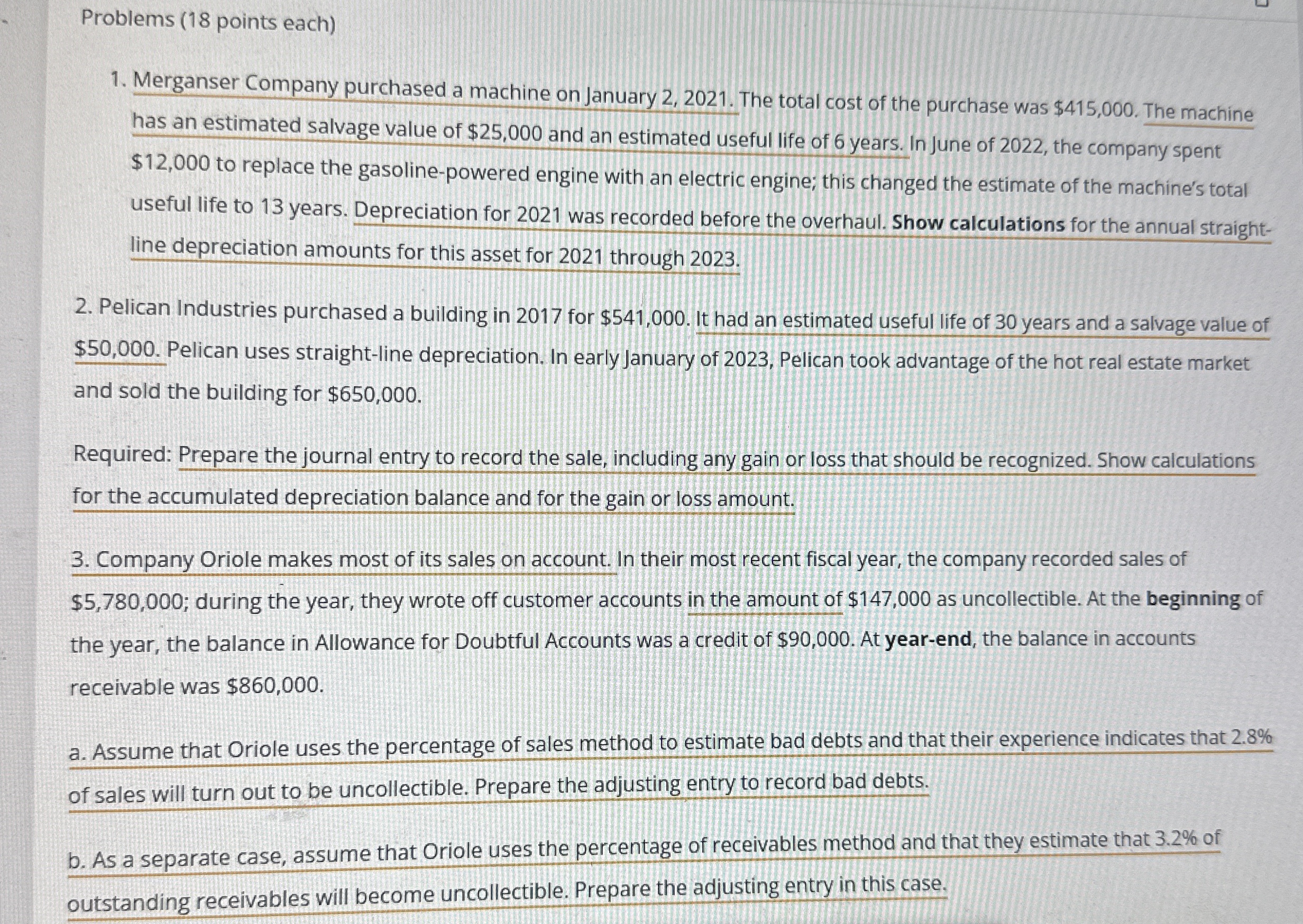

Problems ( 1 8 points each ) Merganser Company purchased a machine on January 2 , 2 0 2 1 . The total cost of

Problems points each

Merganser Company purchased a machine on January The total cost of the purchase was $ The machine has an estimated salvage value of $ and an estimated useful life of years. In June of the company spent $ to replace the gasolinepowered engine with an electric engine; this changed the estimate of the machine's total useful life to years. Depreciation for was recorded before the overhaul. Show calculations for the annual straightline depreciation amounts for this asset for through

Pelican Industries purchased a building in for $ It had an estimated useful life of years and a salvage value of $ Pelican uses straightline depreciation. In early January of Pelican took advantage of the hot real estate market and sold the building for $

Required: Prepare the journal entry to record the sale, including any gain or loss that should be recognized. Show calculations for the accumulated depreciation balance and for the gain or loss amount.

Company Oriole makes most of its sales on account. In their most recent fiscal year, the company recorded sales of $; during the year, they wrote off customer accounts in the amount of $ as uncollectible. At the beginning of the year, the balance in Allowance for Doubtful Accounts was a credit of $ At yearend, the balance in accounts receivable was $

a Assume that Oriole uses the percentage of sales method to estimate bad debts and that their experience indicates that of sales will turn out to be uncollectible. Prepare the adjusting entry to record bad debts.

b As a separate case, assume that Oriole uses the percentage of receivables method and that they estimate that of outstanding receivables will become uncollectible. Prepare the adjusting entry in this case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started