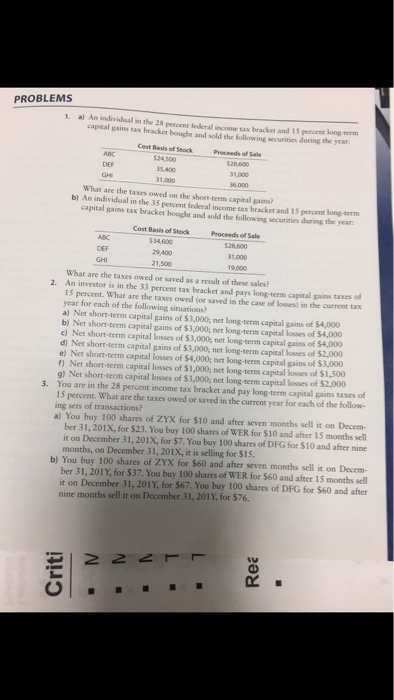

PROBLEMS 1. a) An individual in the 28 percent federal income tax capital gains tax bracket bought and sold the following securities bracket and 15 pencent long-term securities during the year Cost Basis of Stock $24,500 35,400 31,000 ABC DEF Proceeds of Saile 28,600 31,000 What are the taxes owed on the shoet-term capital gains in the 35 percent federal income tax beacket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year Cost Basis of Stock 534,600 29.400 21,500 Proceeds of Sale 528.600 31,000 9,000 What are the taxes owed or saved as a result of these sales An investor is in the 33 percent tax bracket and pays long-term capital gains tases of 15 percent. What are the taxes owed (or saved in the case of losses) in the current tax year for each of the following situations? a) Net short-term capital gains of $3,000; net long-term capital gains of $4,000 b) Net short-term capital gains of $3,000; net long-term capital losses of $4,000 c) Net short-term capital losses of $3,000; net long-term capital gains of $4,000 d) Net short-term capital gains of $3,000, net long-term capital losses of $2,000 e) Net shont-term capital losses of $4,000; net long-term capital gains of $3,000 f) Net short-term capital losses of $1,000; net long-term capital losses of $1,500 g) Net short-term capital losses of $3,000; net long-term capital losses of $2,000 You are in the 28 percent income tax bracket and pay long-term capital gains taxes of 15 percent. What are the taxes owed or saved in the current year for each of the follow- ing sets of transactionsi? a) You buy 100 shares of ZYX for $10 and after seven months sell it on Decem 2. 3. ber 31, 201X, for $23. You buy 100 shares of WER for $10 and after 15 months sell it on December 31, 201X, for $7. You buy 100 shares of DFG for $10 and after nine months, on December 31, 201X, it is selling for SIS b) You buy 100 shares of ZYX for $60 and after seven months sell it on Decem- ber 31, 201Y, for $37. You buy 100 shares of WER for $60 and after 15 months sell it on December 31, 201Y, for $67. You buy 100 shares of DFG for $60 and after nine months sell it on December 31, 201Y, for $76. PROBLEMS 1. a) An individual in the 28 percent federal income tax capital gains tax bracket bought and sold the following securities bracket and 15 pencent long-term securities during the year Cost Basis of Stock $24,500 35,400 31,000 ABC DEF Proceeds of Saile 28,600 31,000 What are the taxes owed on the shoet-term capital gains in the 35 percent federal income tax beacket and 15 percent long-term capital gains tax bracket bought and sold the following securities during the year Cost Basis of Stock 534,600 29.400 21,500 Proceeds of Sale 528.600 31,000 9,000 What are the taxes owed or saved as a result of these sales An investor is in the 33 percent tax bracket and pays long-term capital gains tases of 15 percent. What are the taxes owed (or saved in the case of losses) in the current tax year for each of the following situations? a) Net short-term capital gains of $3,000; net long-term capital gains of $4,000 b) Net short-term capital gains of $3,000; net long-term capital losses of $4,000 c) Net short-term capital losses of $3,000; net long-term capital gains of $4,000 d) Net short-term capital gains of $3,000, net long-term capital losses of $2,000 e) Net shont-term capital losses of $4,000; net long-term capital gains of $3,000 f) Net short-term capital losses of $1,000; net long-term capital losses of $1,500 g) Net short-term capital losses of $3,000; net long-term capital losses of $2,000 You are in the 28 percent income tax bracket and pay long-term capital gains taxes of 15 percent. What are the taxes owed or saved in the current year for each of the follow- ing sets of transactionsi? a) You buy 100 shares of ZYX for $10 and after seven months sell it on Decem 2. 3. ber 31, 201X, for $23. You buy 100 shares of WER for $10 and after 15 months sell it on December 31, 201X, for $7. You buy 100 shares of DFG for $10 and after nine months, on December 31, 201X, it is selling for SIS b) You buy 100 shares of ZYX for $60 and after seven months sell it on Decem- ber 31, 201Y, for $37. You buy 100 shares of WER for $60 and after 15 months sell it on December 31, 201Y, for $67. You buy 100 shares of DFG for $60 and after nine months sell it on December 31, 201Y, for $76