Question: Problems 6 & 8 Suppose a company has a preferred stock issue and a common stock issue. Both have just paid a $2 dividend. Which

Problems 6 & 8

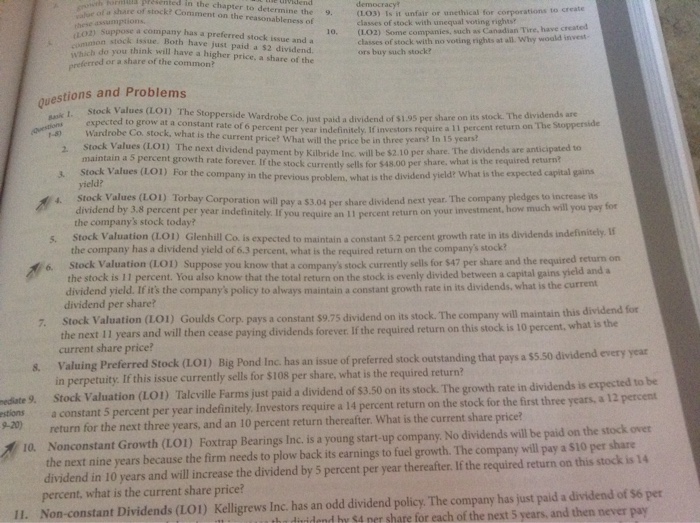

Problems 6 & 8 Suppose a company has a preferred stock issue and a common stock issue. Both have just paid a $2 dividend. Which do you think will have a higher price, a share of the preferred or a share of the common? Is it unfair or unethical for corporations to create classes of stock with unequal voting rights? Some companies, such as Canadian Tire, have created classes of stock with no voting eights at all. Why would investors buy such stock? The Stopperside Wardobe Co. just paid a dividend of $1.95 per share on its stock. The dividends are expected to grow at a constant rate of 6 percent per year indefinitely. If investors require a 11 percent on The Stopperside Wardrobe C. stock, what is the current price? What will the price bi in three years? In 15 years? The next dividend payment by Kilbride Inc, will be $2.10 per share. The dividends are anticipated to maintain a 5 percent growth rate forever. If the stock currently sells for $48.00 per share, what is the required return? For the company in the previous problem, what is the dividend yield? What is the expected capital gains yield? Torbay Corporation will pay a $3.04 per share dividend next year. The company pledges to increases its dividend by 3.8 percent per year indefinitely. If you require an 11 percent return on your investment, how much will you pay for the company's stock today? Glenhill Co. is expected to maintain a constant 5.2 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 6.3 percent, what is the required return on the company's stock? Suppose you know that a company's stock currently sells for $47 per share and the required return on the stock is 11 percent. You also know that the total return on the stock is evenly divided between a capital gains yield and a dividend yield. If it's the company's policy to always maintain a constant growth rate in the dividends, what is the current dividend per share? Goulds Corp. pays a constant $9.75 dividend on its stock. The company will maintain this dividend for the next 11 years and will then cease paying dividends forever. If the required return on this stock is 10 percent, what is the current share price? Big Pond Inc. has an issue of preferred stock outstanding that pays a $5.50 dividend every year in perpetuity. If this issue currently sells for $108 per share, what is the required return? Talcville Farms just paid a dividend of $3.50 on its stock. The growth rate in dividends is expected to be a constant 5 percent per year indefinitely, Invested require a 14 percent return on the stock for the first three years, a 12 percent return for the next three years, and an 10 percent return thereafter. What is the current share price? Foxtrap Bearings Inc. is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $10 per share dividend in 10 years and will increase the dividend by 5 percent per year thereafter. If the required return on this stock is 14 percent, what is the current share price? Kelligrews Inc. has an old dividend policy. The company has just paid a dividend of $6 per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts