Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cavuto makes bulk purchases of men's and women's shoes, stocks them in conveniently located warehouses, and ships them to its chain of retail stores.

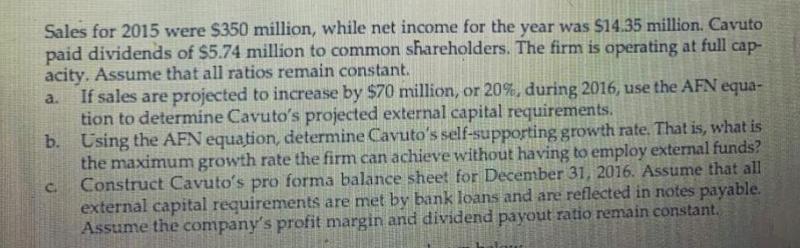

Cavuto makes bulk purchases of men's and women's shoes, stocks them in conveniently located warehouses, and ships them to its chain of retail stores. Cavuto's balance sheet as at December 31, 2015, is shown here (millions of dollars). Cash $ 3.5 Accounts payable Notes payable $ 9.0 Receivables 26.0 18.0 Inventories 58.0 Accruals 8.5 Total current assets 87.5 Total current liabilities 35.5 Net fixed assets 35.0 Mortgage loan 6.0 Common stock 15.0 Retained earnings Total liabilities and equity 66.0 Total assets $122.5 $122.5 Sales for 2015 were $350 million, while net income for the year was $14.35 million. Cavuto paid dividends of $5.74 million to common shareholders. The firm is operating at full cap- acity. Assume that all ratios remain constant. If sales are projected to increase by $70 million, or 20%, during 2016, use the AFN equa- tion to determine Cavuto's projected external capital requirements. b. Using the AFN equation, determine Cavuto's self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ external funds? Construct Cavuto's pro forma balance sheet for December 31, 2016. Assume that all external capital requirements are met by bank loans and are reflected in notes payable. Assume the company's profit margin and dividend payout ratio remain constant. a.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Please see attached pictures one of the attached pics ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started