Answered step by step

Verified Expert Solution

Question

1 Approved Answer

problems #8,11,12 9.8. What is the present value of a perpetuity of $100 per year if the appropriate discount rate is 7 percent? Suppose that

problems #8,11,12

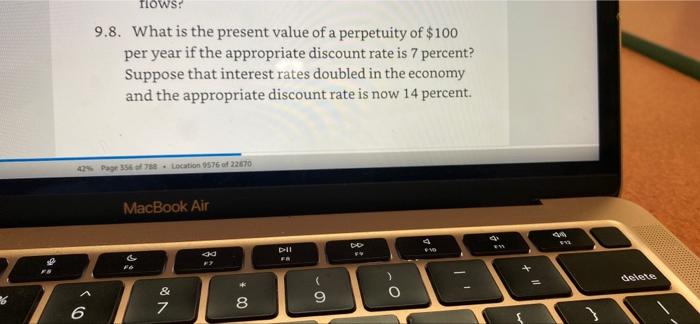

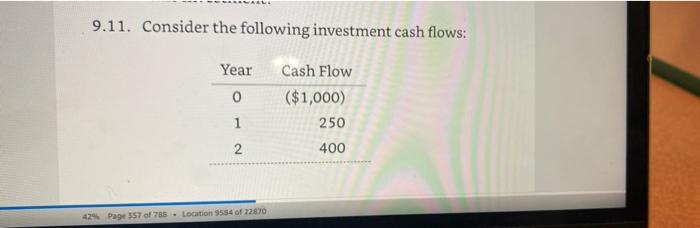

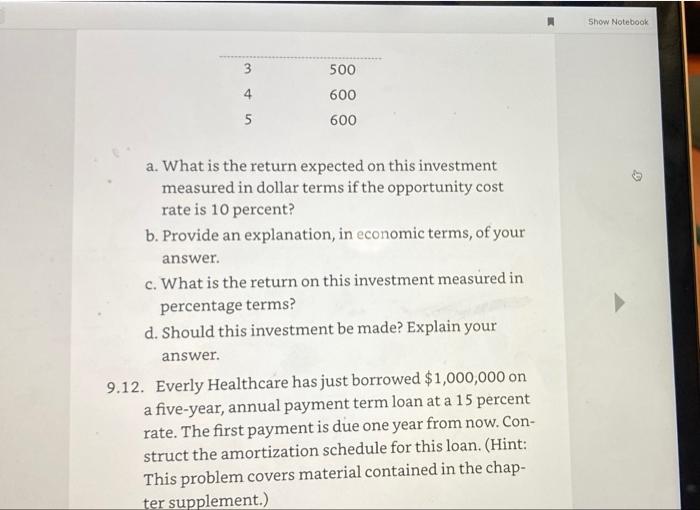

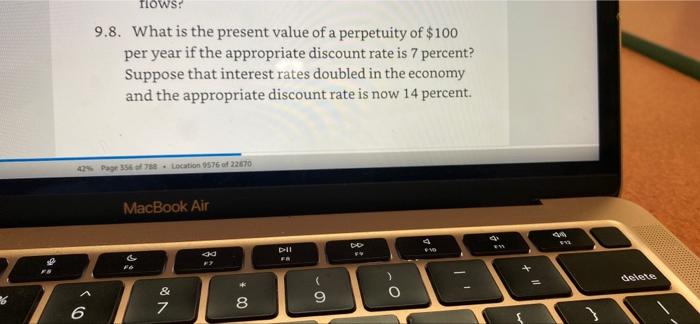

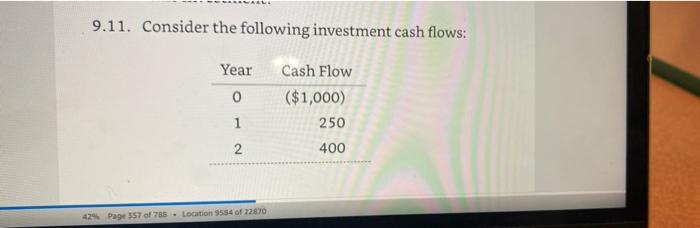

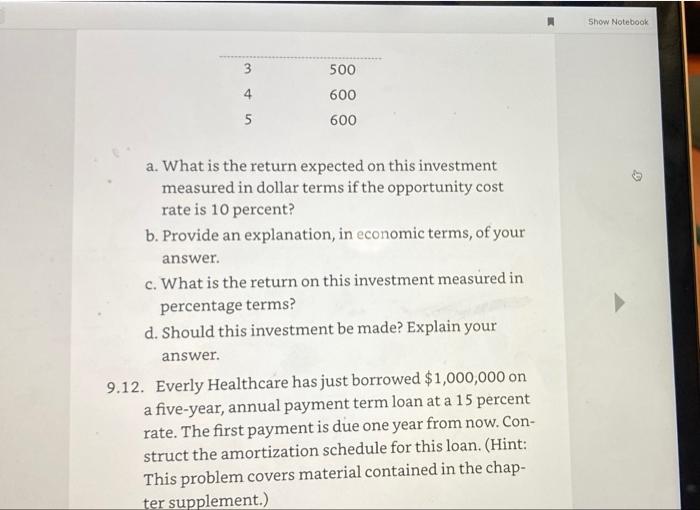

9.8. What is the present value of a perpetuity of $100 per year if the appropriate discount rate is 7 percent? Suppose that interest rates doubled in the economy and the appropriate discount rate is now 14 percent. What would happen to the present value of the perpetuity? 9.11. Consider the following investment cash flows: a. What is the return expected on this investment measured in dollar terms if the opportunity cost rate is 10 percent? b. Provide an explanation, in economic terms, of your answer. c. What is the return on this investment measured in percentage terms? d. Should this investment be made? Explain your answer. 9.12. Everly Healthcare has just borrowed $1,000,000 on a five-year, annual payment term loan at a 15 percent rate. The first payment is due one year from now. Construct the amortization schedule for this loan. (Hint: This problem covers material contained in the chapter supplement.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started